- Canada

- /

- Metals and Mining

- /

- TSX:OGC

What OceanaGold (TSX:OGC)'s Surging Sales and Net Income Could Mean for Shareholders

Reviewed by Sasha Jovanovic

- OceanaGold Corporation recently reported its third quarter and nine-month results for 2025, with sales rising to US$448.5 million and net income increasing to US$87.2 million for the quarter, both significantly higher than the same period last year.

- The company’s year-to-date net income more than tripled from the previous year, signaling marked operational improvements and highlighting enhanced profitability.

- We'll explore how the sharp rise in both sales and net income this quarter may reshape OceanaGold's investment narrative going forward.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

OceanaGold Investment Narrative Recap

For an OceanaGold shareholder, the core belief centers on the company sustaining its operational gains, translating higher production and profitability into long-term value. The recent leap in both revenue and net income supports sentiment around improved margins, but in the short term, key catalysts such as planned production growth may be influenced by persistent operational hurdles at sites like Haile, where harder ore could pressure costs if not managed successfully. However, these earnings don't appear to meaningfully reduce the primary risks around cost inflation or weather-related disruptions, leaving the investment case relatively unchanged for now.

Among recent company announcements, OceanaGold’s August 2025 dividend declaration stands out as most relevant to this strong quarter. Ongoing dividend payments highlight management’s confidence in cash flow alongside profit growth, which aligns with the positive sales momentum reported. For shareholders, this is a tangible example of capital returns, a central catalyst if the company continues to convert earnings gains into rewards for investors.

But while margins and efficiency have improved, keep in mind that exposure to ore quality issues at Haile remains a significant risk investors should be aware of, especially if...

Read the full narrative on OceanaGold (it's free!)

OceanaGold's narrative projects $2.2 billion revenue and $764.2 million earnings by 2028. This requires 12.7% yearly revenue growth and a $388.4 million increase in earnings from $375.8 million today.

Uncover how OceanaGold's forecasts yield a CA$36.83 fair value, a 16% upside to its current price.

Exploring Other Perspectives

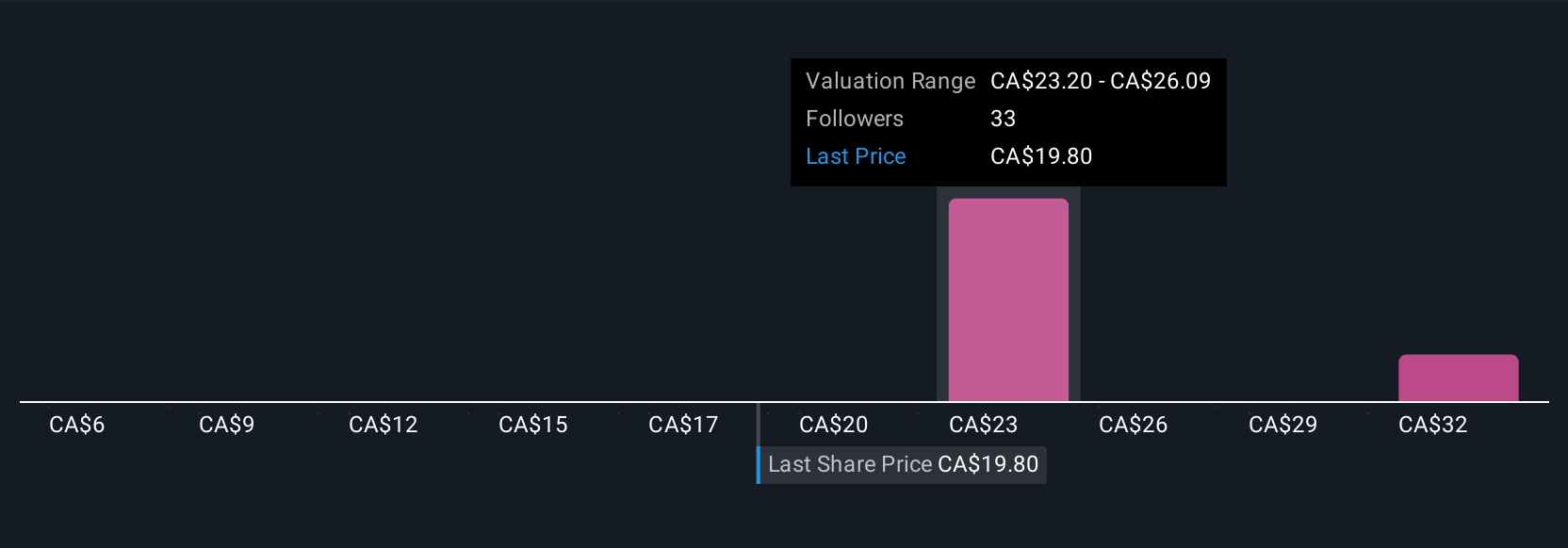

Six members of the Simply Wall St Community set OceanaGold’s fair value between US$5.87 and US$47.77 per share. With operational risks at Haile still in focus, consider the full range of opinions before making decisions.

Explore 6 other fair value estimates on OceanaGold - why the stock might be worth as much as 51% more than the current price!

Build Your Own OceanaGold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OceanaGold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free OceanaGold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OceanaGold's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OGC

OceanaGold

A gold and copper producer, engages in exploration, development, and operation of mineral properties in the United States, the Philippines, and New Zealand.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives