How New Supply Chain Pressures Could Impact Nutrien’s Share Price in 2025

Reviewed by Bailey Pemberton

- Wondering if Nutrien might be a hidden value gem or an overrated pick? You are not alone, especially if you're looking for smart ways to spot opportunities in today's market.

- Despite a 17.5% gain year-to-date and a solid 13.3% return over the past year, Nutrien's shares have dipped 4.8% in the last week and are down 7.4% over the past month. This hints at shifting market sentiment and potential changes in risk or reward.

- Recent news has brought renewed attention to Nutrien as the global agricultural sector faces supply chain pressures and shifting commodity prices. Government discussions about food security and sustainability have also added volatility and opportunity for sector leaders like Nutrien.

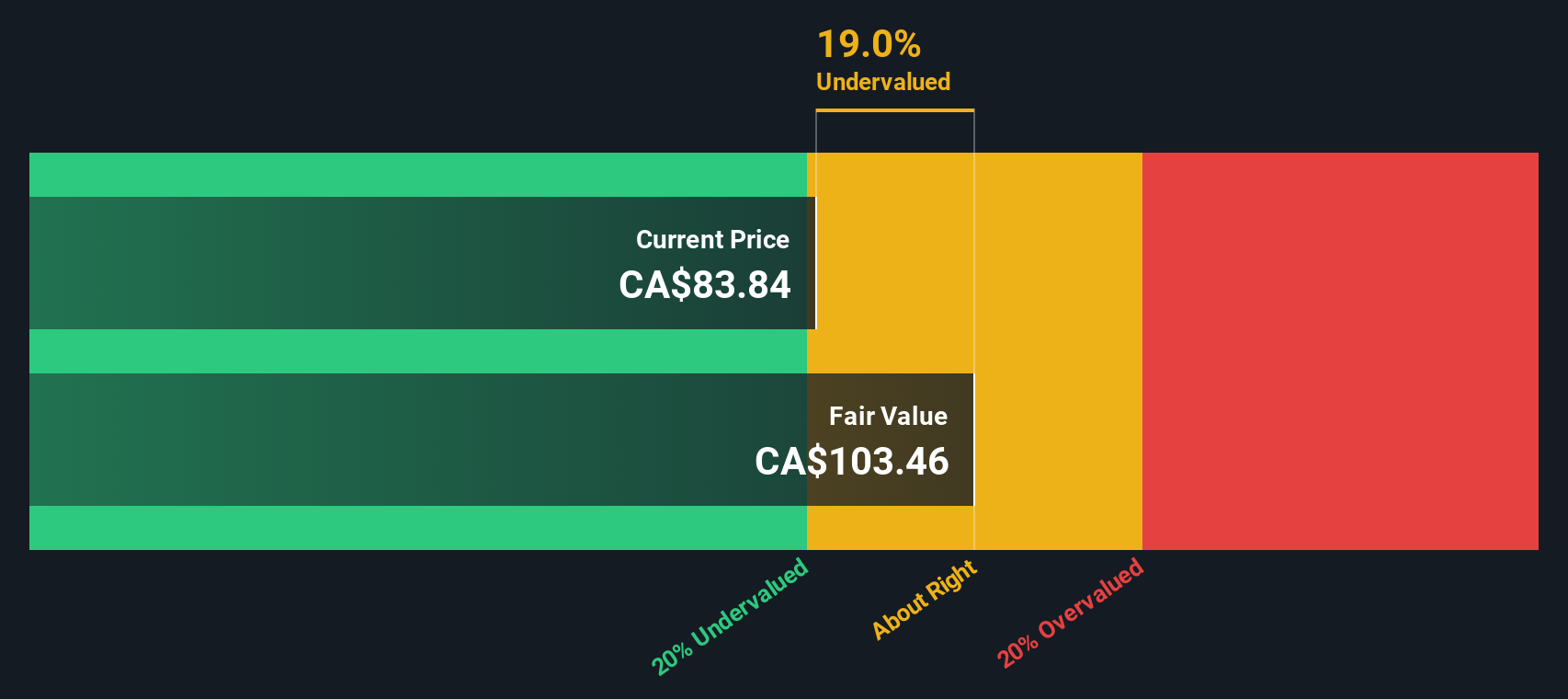

- On our 6-point valuation scorecard, Nutrien comes in at 5 out of 6. This suggests it is undervalued by several key measures, but the full story depends on which valuation method you trust. There is an even more insightful approach to valuation coming up later in the article.

Find out why Nutrien's 13.3% return over the last year is lagging behind its peers.

Approach 1: Nutrien Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true value by projecting its future free cash flows and then discounting those forecasts back to their value in today's dollars. This approach helps determine if the current stock price is attractive compared to what the company is expected to generate in the years ahead.

For Nutrien, the most recently reported Free Cash Flow is $1.53 Billion. According to analyst projections, Free Cash Flow is expected to grow gradually and reach around $2 Billion by 2029. Beyond that, additional cash flow estimates are extrapolated to extend the outlook over the next decade, capturing potential growth as well as more stable later years.

Running these cash flow numbers through the DCF model provides an estimated intrinsic value for Nutrien of $103.14 per share. This is roughly 25.7% higher than the company’s current share price, suggesting the stock may be undervalued if the cash flow projections play out as expected.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nutrien is undervalued by 25.7%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

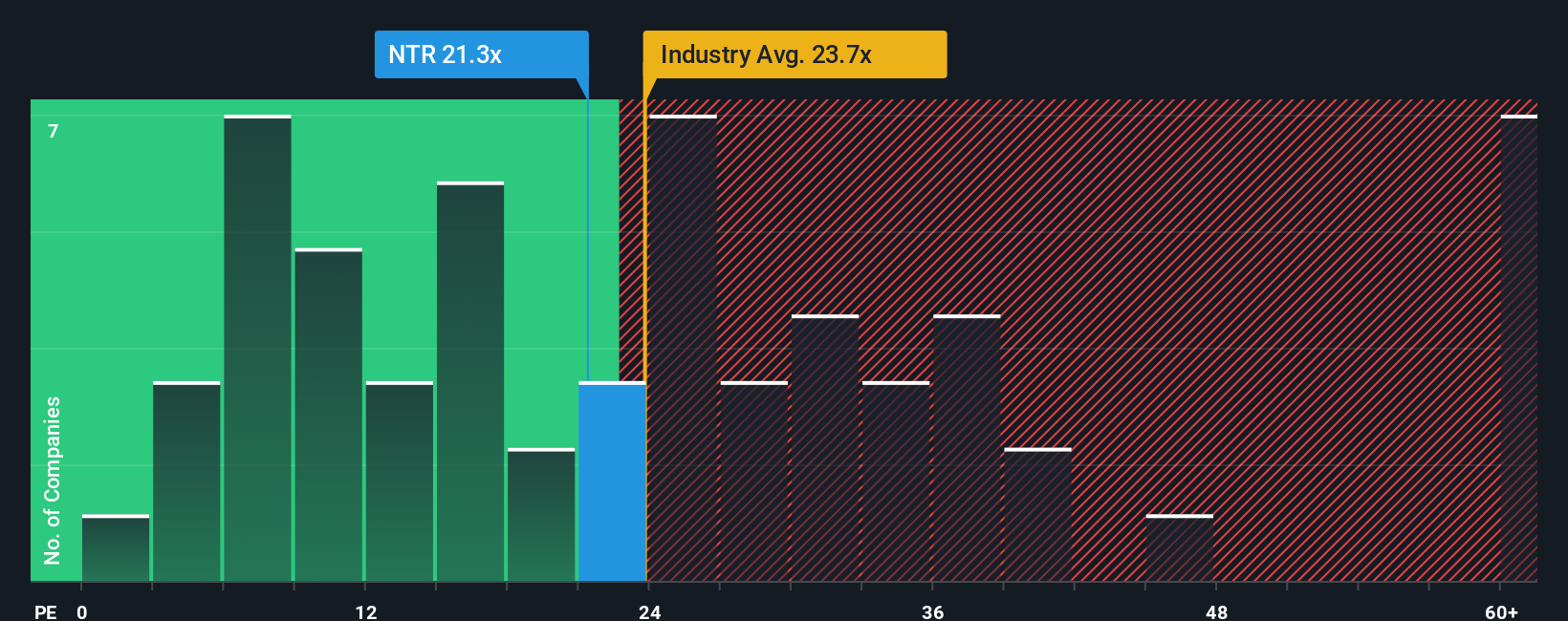

Approach 2: Nutrien Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is often the preferred valuation metric for profitable companies like Nutrien because it directly measures how much investors are willing to pay for each dollar of earnings. It is a tried-and-true indicator for assessing whether a stock appears cheap or expensive compared to its ability to generate profits.

But what makes for a “normal” or “fair” P/E ratio? Expectations of earnings growth, profit stability, and risk all play major roles. Companies with higher expected growth or lower risk typically deserve a higher P/E ratio, while slower growers or riskier names tend to trade at lower multiples.

Nutrien trades at a P/E of 19.45x, which is below both the Chemicals industry average of 22.19x and the peer average of 23.20x. This could signal a discount, but simple comparisons can be misleading. That is where Simply Wall St's Fair Ratio comes in. The Fair Ratio, calculated at 22.25x for Nutrien, is a proprietary metric that incorporates not only industry comparisons but also factors such as company-specific growth, profitability, risk profile, and market cap.

Because the Fair Ratio adjusts for what truly matters to Nutrien’s valuation, it often gives a clearer perspective than just looking at peers or industry averages. For Nutrien, the actual P/E of 19.45x is about 2.80x lower than its Fair Ratio, which points to the stock being undervalued on this basis.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

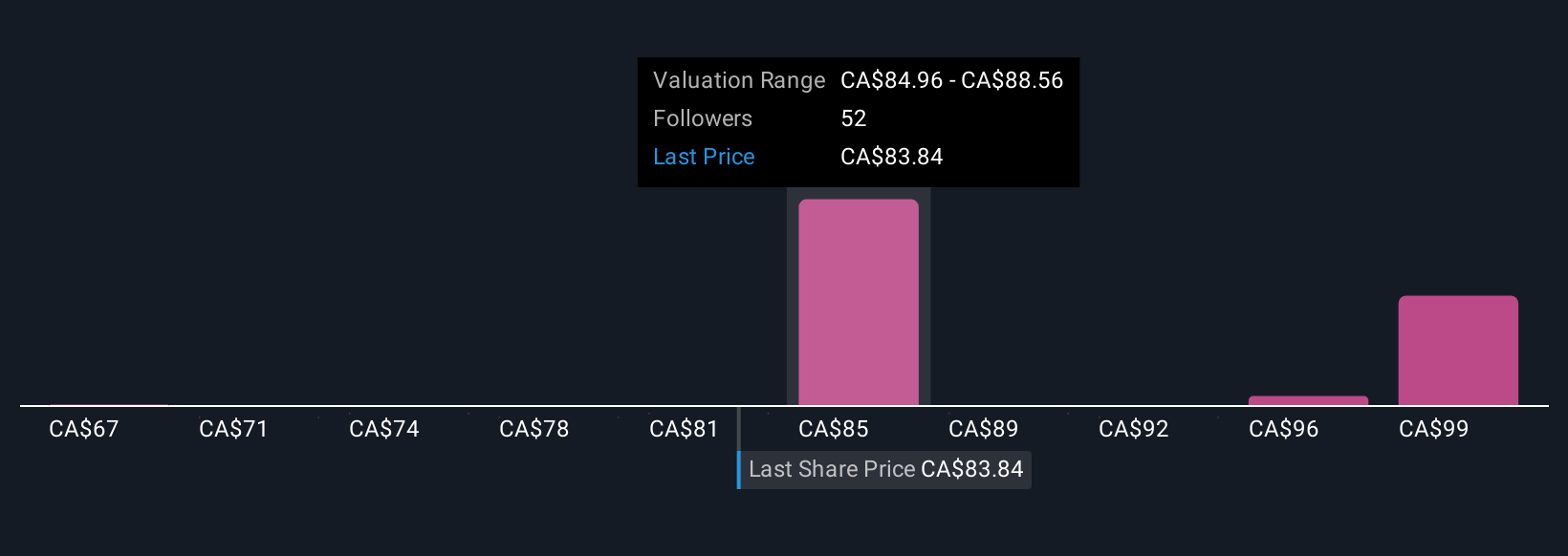

Upgrade Your Decision Making: Choose your Nutrien Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your perspective or “story” about a company, combining what you believe about its industry, strategy, financials, and the future into a concrete forecast that connects your viewpoint directly to future revenue, profit and margin estimates, and ultimately leads to your own fair value assessment.

Unlike static reports, Narratives give you an easy way to frame your expectations and assumptions, showing how your story drives financial projections and what the resulting fair value would be. On Simply Wall St’s Community page, millions of investors use Narratives to see their personal investment thesis mapped to real-time numbers, making it simple to compare fair value to the current share price and spot compelling buy or sell opportunities.

Because Narratives update dynamically as news and earnings arrive, they quickly reflect changes in the business or wider market, keeping your decisions relevant and responsive. For example, with Nutrien, one investor might build a bullish Narrative around strong fertilizer demand and margin expansion and arrive at a high fair value closely matching optimistic analyst targets around CA$96 per share. Another investor could focus on industry risks or lower growth and land on a more cautious estimate like CA$61. This demonstrates the power of personal perspective in investing.

Do you think there's more to the story for Nutrien? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutrien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NTR

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives