Could Government Pressure on Nutrien (TSX:NTR) Reveal a Strategic Shift in Global Expansion Plans?

Reviewed by Sasha Jovanovic

- Wells Fargo initiated coverage on Nutrien Ltd. with an Equal Weight rating following the company's solid third-quarter results, while analysts expressed concerns about near-term headwinds for farmers and softer crop prices going into 2026.

- Meanwhile, the Canadian government is urging Nutrien to reconsider its decision to build a new potash export terminal in the U.S., reflecting increased political and strategic scrutiny around the company's international expansion plans.

- We'll examine how Canadian government intervention in Nutrien's U.S. terminal project could influence its investment narrative and long-term positioning.

Find companies with promising cash flow potential yet trading below their fair value.

Nutrien Investment Narrative Recap

To be a shareholder in Nutrien, you need to believe that global food demand and sustained fertilizer use will continue to underpin sales of potash, nitrogen, and phosphate, while Nutrien’s operational improvements deliver margin gains. The latest political headwinds from Canada over its planned U.S. potash terminal don’t materially change the biggest short-term risk: softer crop prices and farmer headwinds, which could pressure fertilizer demand and pricing over the next year.

Recent Q3 results, which saw sharp year-on-year gains in both revenue and net income, offer reassurance that Nutrien’s scale and product mix still confer resilience, even as guidance on major nutrient volumes remains largely unchanged. Steady progress on cost controls and efficiency programs continues to be a core catalyst for the company, offsetting some sector volatility.

However, unlike the recent boost in profits, the risk of rising regulatory scrutiny on its international operations is something investors should be aware of…

Read the full narrative on Nutrien (it's free!)

Nutrien's outlook anticipates $27.5 billion in revenue and $2.3 billion in earnings by 2028. This scenario is based on a projected 3.2% annual revenue growth rate and a $0.9 billion increase in earnings from the current $1.4 billion.

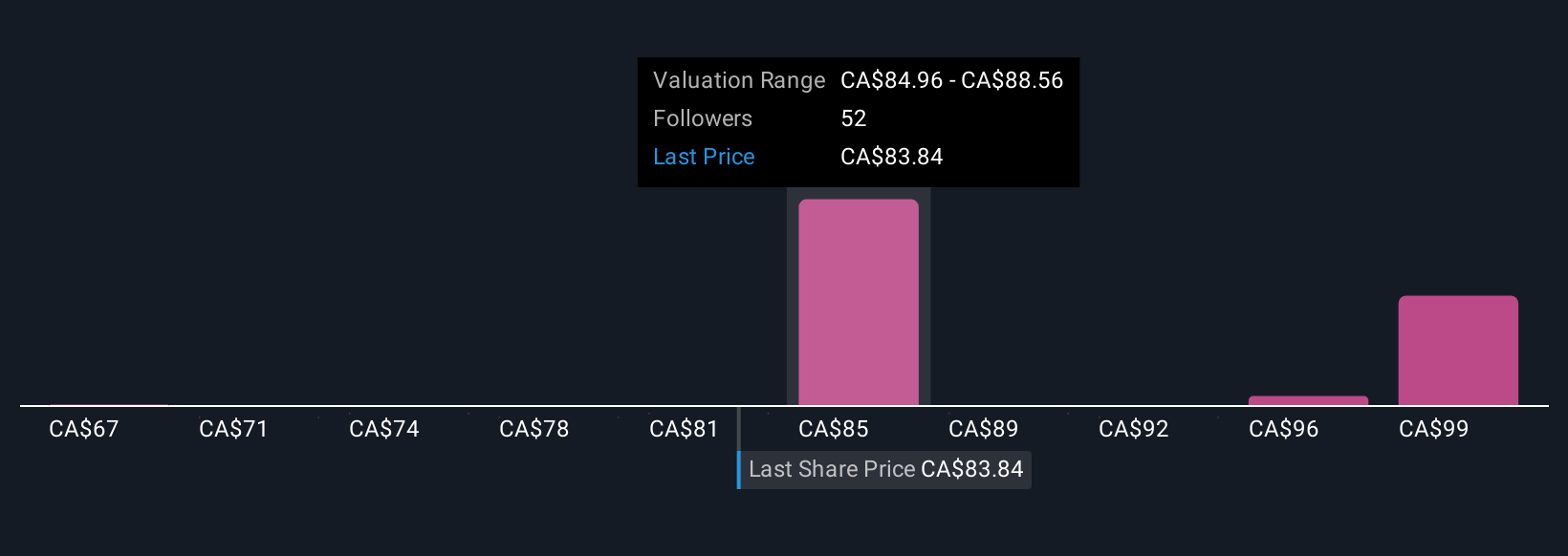

Uncover how Nutrien's forecasts yield a CA$88.43 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered 9 fair value estimates for Nutrien, ranging from CA$68.22 to CA$98.01 per share. While opinions are wide apart, concerns about increased regulatory scrutiny and potential operational cost increases could have far-reaching implications for your investment view.

Explore 9 other fair value estimates on Nutrien - why the stock might be worth as much as 24% more than the current price!

Build Your Own Nutrien Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nutrien research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nutrien research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nutrien's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nutrien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NTR

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives