- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

NGEx Minerals (TSX:NGEX) Expands Lunahuasi Drilling Plan Is Management Signaling New Exploration Ambitions?

Reviewed by Simply Wall St

- NGEx Minerals Ltd. has provided an update on its ongoing Phase 3 drill program at the 100% owned Lunahuasi copper-gold-silver project in San Juan, Argentina, noting that initial results were positive and prompting the addition of two more drill rigs in February alongside an increase in total planned drilling to 25,000 meters.

- This expansion underscores management's heightened optimism about the project's mineral potential based on encouraging geological findings from early drilling.

- We’ll explore how the expanded drill program, reflecting increased confidence in Lunahuasi’s potential, could reshape NGEx Minerals’ investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is NGEx Minerals' Investment Narrative?

To be a shareholder in NGEx Minerals, you need to see big potential in early-stage copper, gold, and silver exploration, particularly the remarkable geology emerging at their Lunahuasi project in Argentina. The recent news of a Phase 3 drill program expansion, prompted by positive results, suggests management’s confidence is on the upswing and could move the needle on some of the company’s most important short-term catalysts, especially the resource growth story at Lunahuasi. While this boost in drilling could strengthen near-term excitement and address calls for more resource clarity, the fundamental risk remains: NGEx is unprofitable, generates no revenue, and isn’t expected to do so soon, with mounting losses creating pressure for future funding or asset sales. The sharp price moves following the drill results reflect changing risk-reward, but also highlight sensitivity to any setbacks or delays. Shareholders should weigh the speculative nature of exploration success against the uncertain path to profitability.

Yet, beneath all the optimism from drilling, funding uncertainty remains a risk investors should not ignore.

Exploring Other Perspectives

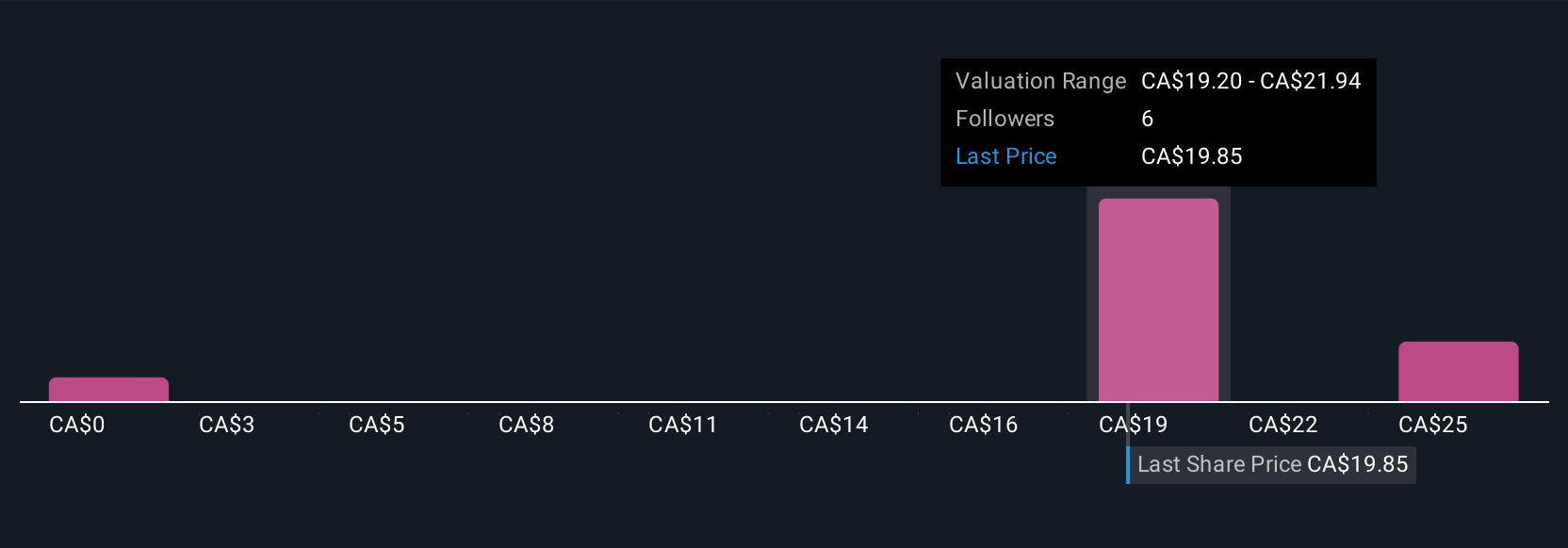

Explore 3 other fair value estimates on NGEx Minerals - why the stock might be worth less than half the current price!

Build Your Own NGEx Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NGEx Minerals research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free NGEx Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NGEx Minerals' overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet low.

Market Insights

Community Narratives