- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

How Investors May Respond To NGEx Minerals (TSX:NGEX) Spinning Out Lunahuasi and Los Helados Royalties

Reviewed by Sasha Jovanovic

- NGEx Minerals Ltd. recently completed the spin-out of net smelter returns royalties from its Lunahuasi and Los Helados projects to LunR Royalties Corp., distributing shares of the new entity to NGEx shareholders while retaining a 19.9% ownership interest.

- This transaction marks a significant realignment in NGEx's asset structure, offering shareholders exposure to both the ongoing mining projects and the new royalty company.

- We'll explore how NGEx’s separation of royalty interests could shape investor perceptions and the company’s future asset profile.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is NGEx Minerals' Investment Narrative?

If you’re considering NGEx Minerals as an investment, you really have to believe in the continued success of its exploration projects in Argentina and Chile, and the potential for eventual value as these resources progress through development. The recent spin-out of the Lunahuasi and Los Helados net smelter returns royalties to LunR Royalties adds a new twist, providing shareholders direct exposure to a separate royalty play while NGEx keeps focus on advancing its core properties. While this move could help fine-tune NGEx’s asset mix and appeal to both exploration-focused and yield-seeking investors, it doesn’t appear to fundamentally shift the company’s more pressing short-term catalysts, which remain anchored to new exploration discoveries and drill results. The key risks, persistent financial losses, lack of revenue, and the long lead times to monetizing discoveries, remain the same, even as the company’s structure evolves to highlight both operating and royalty potential.

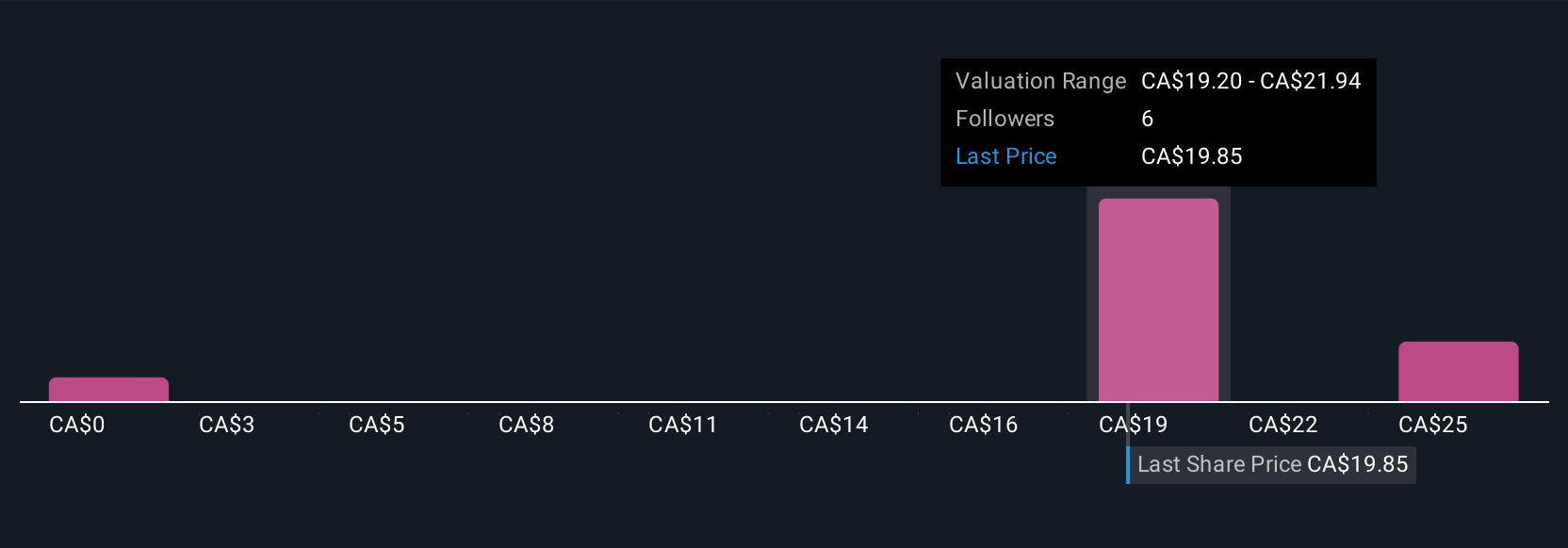

On the flip side, the lack of current revenue hasn’t changed with this spin-out, and that’s something investors should keep in mind. NGEx Minerals' shares have been on the rise but are still potentially undervalued by 5%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on NGEx Minerals - why the stock might be worth less than half the current price!

Build Your Own NGEx Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NGEx Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NGEx Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NGEx Minerals' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives