- Canada

- /

- Metals and Mining

- /

- TSX:NGD

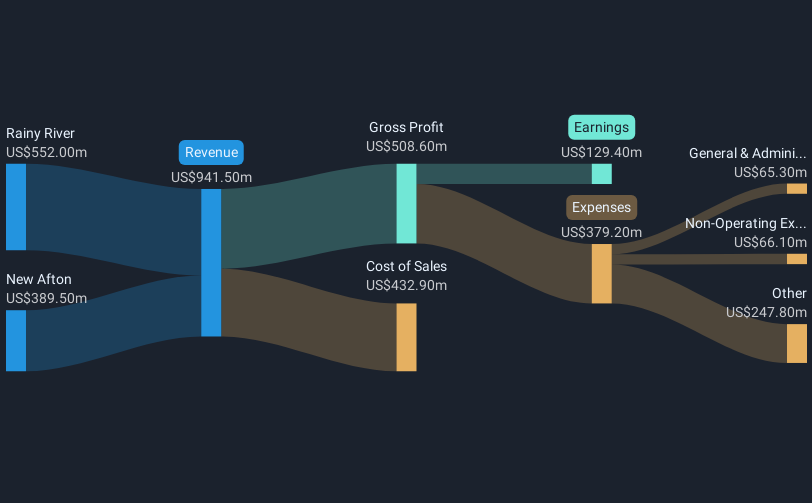

New Gold (TSX:NGD) Reports USD 308 Million in Q2 2025 Sales

Reviewed by Simply Wall St

New Gold (TSX:NGD) recently announced significant increases in sales and net income, reporting USD 308 million in sales and USD 69 million in net income for Q2 2025, up from the previous year. Despite a marginal dip in its copper production, the company's impressive financial performance, alongside a broader bullish sentiment driven by the stock market reaching all-time highs, likely contributed to the 25% uplift in its share price over the last quarter. These positive financial results possibly underscored broader market optimism, mitigating any minor declines in production metrics.

Buy, Hold or Sell New Gold? View our complete analysis and fair value estimate and you decide.

The recent announcement of increased sales and net income for New Gold is likely to have a meaningful impact on the company's future revenue and earnings forecasts. The impressive financial performance underscores the efficiency gains and resource expansion efforts mentioned in the narrative. Should these trends persist, the company's financial flexibility is likely to be enhanced, supporting improved shareholder returns despite the noted risks associated with high capital demands and maturing assets.

Over a three-year period, New Gold's total return, including share price and dividends, was very large, providing significant context when considering its recent quarter performance. For comparison, in the past year, New Gold outperformed the broader Canadian market, which returned 20.2%, and surpassed the Canadian Metals and Mining industry, which returned 44.1%.

The current share price of CA$6.72 highlights a discount to the consensus analyst price target of CA$8.59. This indicates potential upside if the company continues to meet or exceed market expectations in terms of revenue growth and earnings improvement. Recent operational achievements and market conditions could, therefore, catalyze closer alignment between the share price and analyst valuations, assuming ongoing strong financial results.

Take a closer look at New Gold's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Community Narratives