- Canada

- /

- Diversified Financial

- /

- TSX:TF

3 TSX Stocks Estimated To Be Trading Below Their Fair Value In October 2025

Reviewed by Simply Wall St

As the Canadian market celebrates the third anniversary of its bull run, with the TSX having gained 67% since October 2022, investors are navigating a landscape shaped by cooling inflation and trade uncertainties. In this environment, identifying stocks trading below their fair value can be particularly appealing, offering potential opportunities for growth amidst broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$10.88 | CA$18.84 | 42.3% |

| Savaria (TSX:SIS) | CA$22.06 | CA$41.11 | 46.3% |

| Neo Performance Materials (TSX:NEO) | CA$19.87 | CA$34.51 | 42.4% |

| Magellan Aerospace (TSX:MAL) | CA$17.52 | CA$28.20 | 37.9% |

| Haivision Systems (TSX:HAI) | CA$5.09 | CA$8.24 | 38.2% |

| Boyd Group Services (TSX:BYD) | CA$217.20 | CA$365.52 | 40.6% |

| Bird Construction (TSX:BDT) | CA$30.56 | CA$56.52 | 45.9% |

| Artemis Gold (TSXV:ARTG) | CA$33.46 | CA$63.75 | 47.5% |

| Aritzia (TSX:ATZ) | CA$95.05 | CA$159.34 | 40.3% |

| Americas Gold and Silver (TSX:USA) | CA$5.65 | CA$9.80 | 42.3% |

We're going to check out a few of the best picks from our screener tool.

Magellan Aerospace (TSX:MAL)

Overview: Magellan Aerospace Corporation, with a market cap of CA$1 billion, engineers and manufactures aeroengine and aerostructure components for aerospace markets in Canada, the United States, and Europe.

Operations: The company's revenue segment primarily comprises aerospace, generating CA$974.91 million.

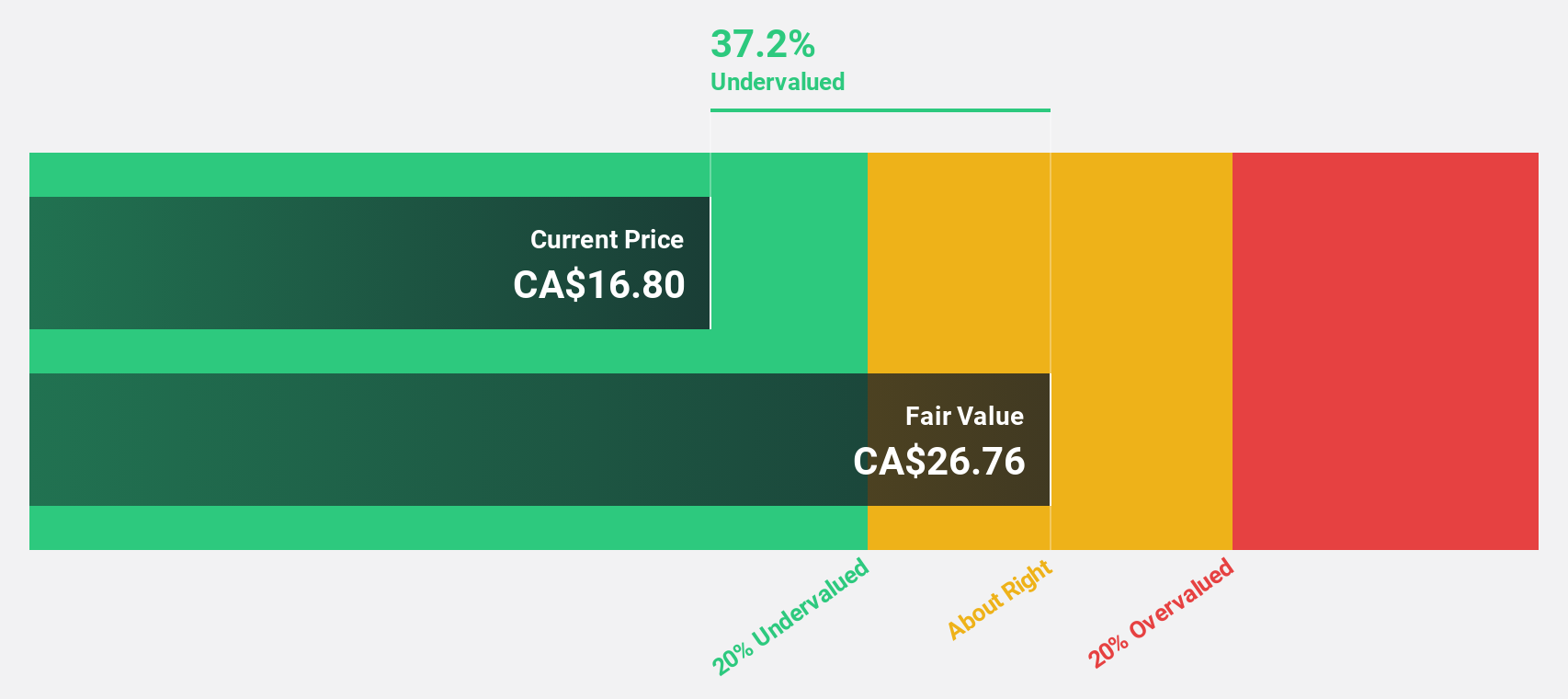

Estimated Discount To Fair Value: 37.9%

Magellan Aerospace is trading at CA$17.52, significantly below its estimated fair value of CA$28.2, indicating it may be undervalued based on cash flows. The company reported increased sales for the first half of 2025, though net income showed mixed results compared to last year. Earnings are forecast to grow at 33.22% annually, outpacing the Canadian market's growth rate and suggesting potential for future financial strength despite recent profit fluctuations.

- According our earnings growth report, there's an indication that Magellan Aerospace might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Magellan Aerospace.

Neo Performance Materials (TSX:NEO)

Overview: Neo Performance Materials Inc. manufactures and sells rare earth, magnetic powders, magnets, and rare metal-based functional materials across various global markets with a market cap of CA$826.57 million.

Operations: The company's revenue segments include Magnequench at $183.81 million, Rare Metals at $155.67 million, and Chemicals & Oxides at $148.47 million.

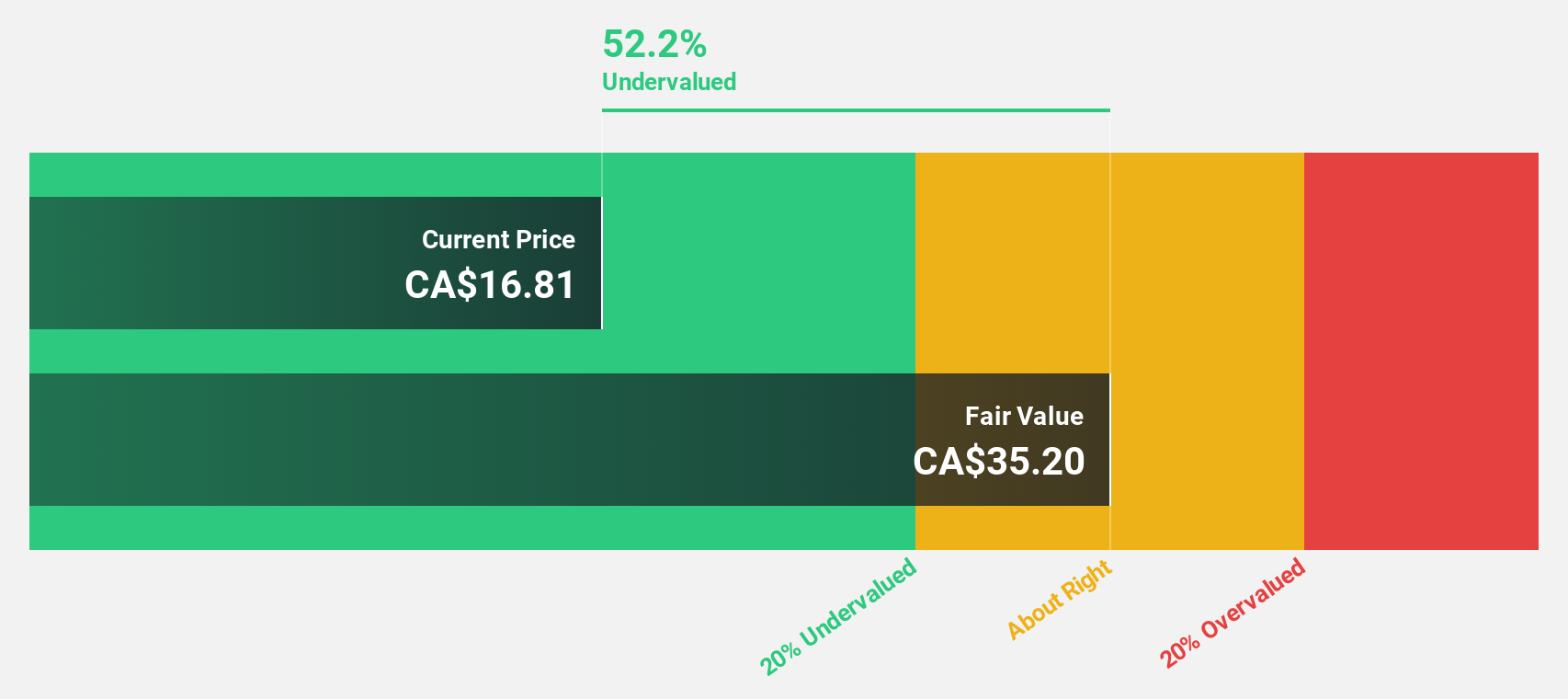

Estimated Discount To Fair Value: 42.4%

Neo Performance Materials, trading at CA$19.87, is priced 42.4% below its estimated fair value of CA$34.51, reflecting potential undervaluation based on cash flows. Recent earnings showed a substantial rise in net income to US$5.77 million from US$0.859 million year-over-year, with revenue growth forecasted to outpace the Canadian market at 10.2% annually. Strategic expansions and partnerships, like the new facility in Estonia and collaboration with Bosch, bolster its future growth trajectory despite low dividend coverage by earnings or free cash flow.

- The growth report we've compiled suggests that Neo Performance Materials' future prospects could be on the up.

- Dive into the specifics of Neo Performance Materials here with our thorough financial health report.

Timbercreek Financial (TSX:TF)

Overview: Timbercreek Financial Corp. offers shorter-duration structured financing solutions to commercial real estate investors in Canada, with a market cap of CA$603.27 million.

Operations: The company's revenue segment is primarily derived from Financial Services - Mortgage, amounting to CA$67.32 million.

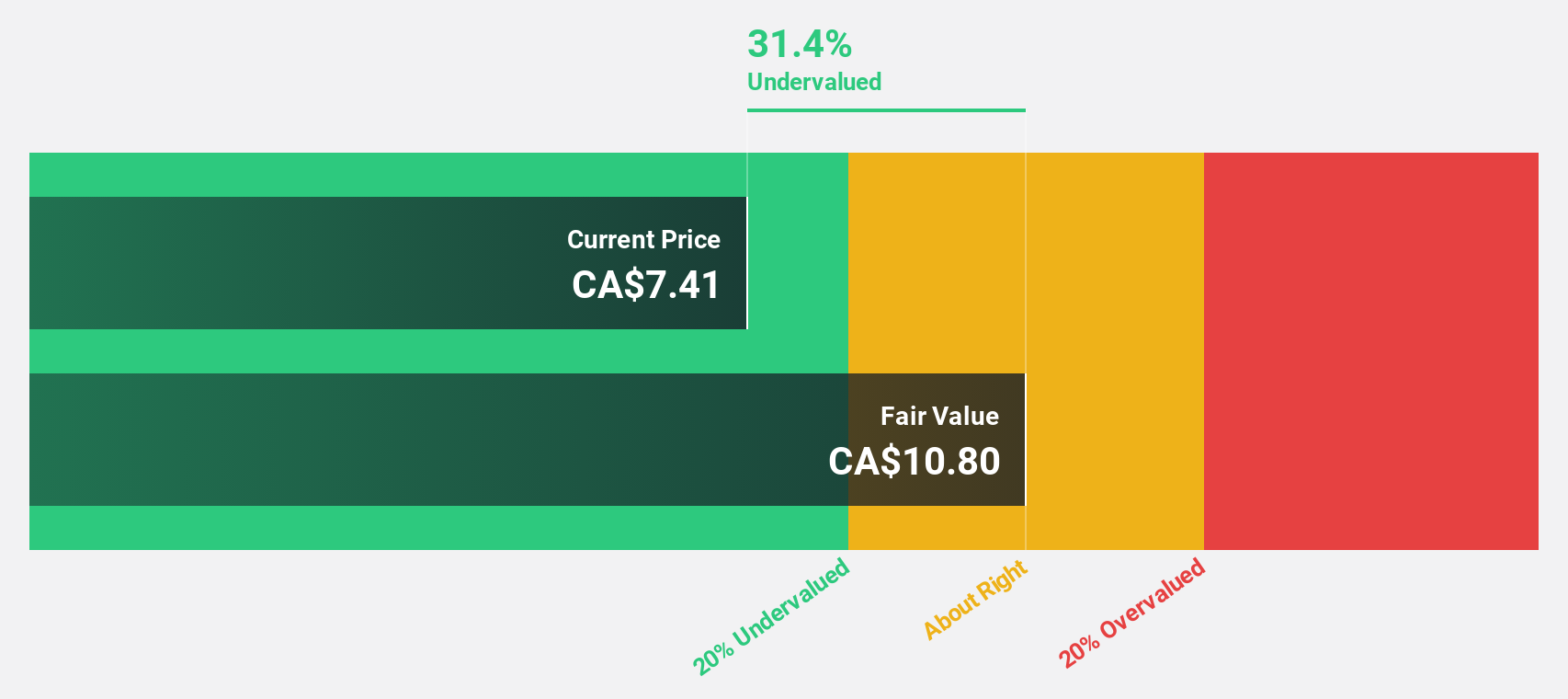

Estimated Discount To Fair Value: 35.9%

Timbercreek Financial, trading at CA$7.29, is priced 35.9% below its estimated fair value of CA$11.37, suggesting potential undervaluation based on cash flows. Despite a dividend yield of 9.47%, coverage by earnings or free cash flow remains inadequate. Earnings are forecast to grow at 18.81% annually, outpacing the Canadian market's growth rate of 11.9%. Recent credit facility expansion to $600 million demonstrates lender confidence in Timbercreek’s strategic direction and financial stability amidst growing revenue projections.

- Our comprehensive growth report raises the possibility that Timbercreek Financial is poised for substantial financial growth.

- Click here to discover the nuances of Timbercreek Financial with our detailed financial health report.

Key Takeaways

- Click this link to deep-dive into the 24 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Timbercreek Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TF

Timbercreek Financial

Provides shorter-duration structured financing solutions to commercial real estate investors in Canada.

Undervalued with moderate growth potential.

Market Insights

Community Narratives