- Canada

- /

- Metals and Mining

- /

- TSX:NCF

Northcliff Resources (TSX:NCF) Is Up 147.2% After Government Backs Sisson as a Nation-Building Project Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Northcliff Resources recently announced that its Sisson Tungsten-Molybdenum Project has been recognized by the Canadian government as a nation-building initiative and referred to the Major Projects Office for financial and regulatory support.

- This move includes funding from both the US Department of Defense and Natural Resources Canada, underscoring the project's significance in strengthening North America's critical minerals supply chain.

- We'll explore how government fast-tracking and critical mineral funding shape Northcliff’s investment narrative going forward.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Northcliff Resources' Investment Narrative?

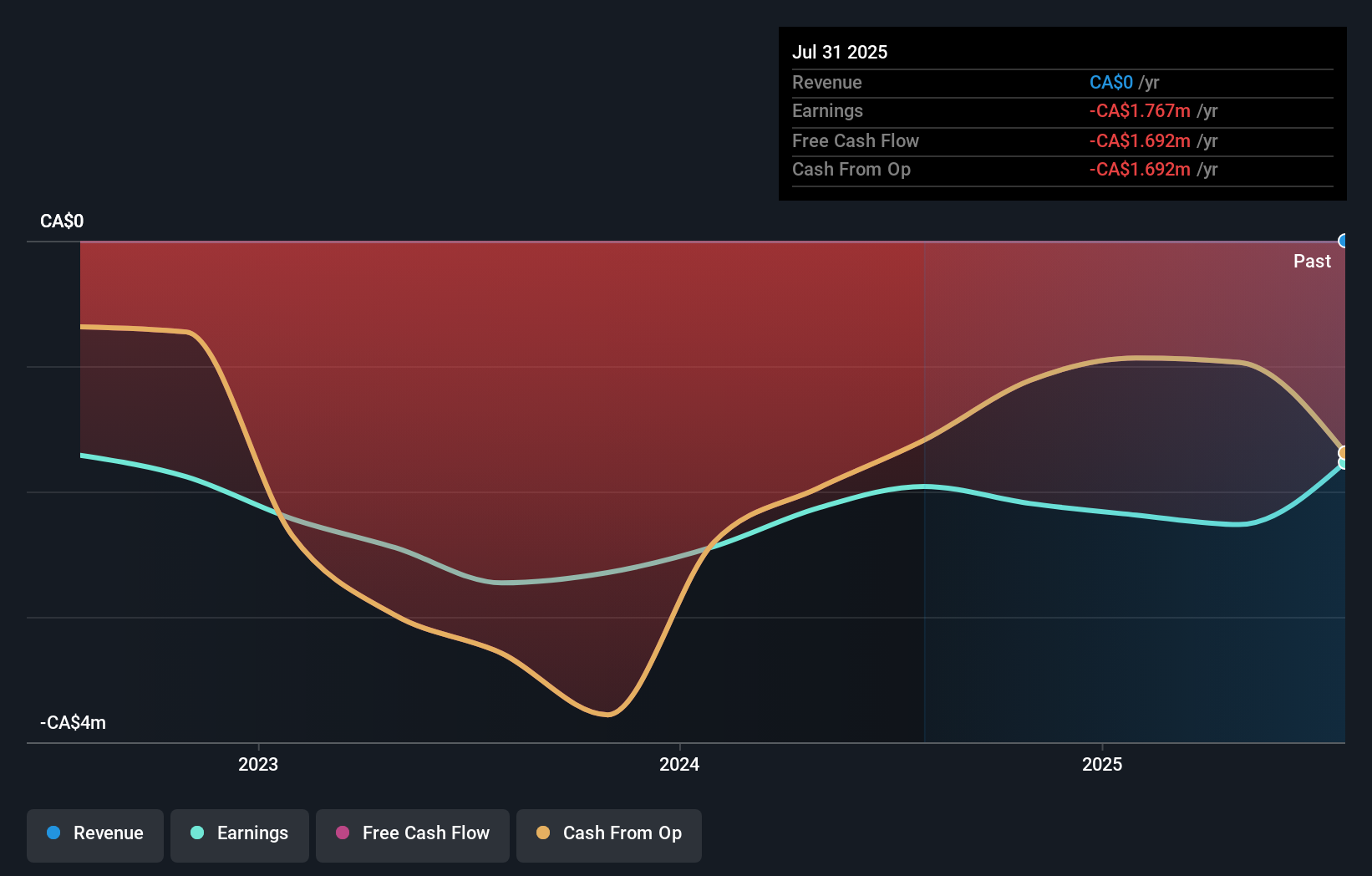

For anyone considering Northcliff Resources, the investment case centers on meaningful exposure to the Sisson Tungsten-Molybdenum Project, now designated a Canadian nation-building initiative. Recognition at this level fundamentally shifts the near-term narrative, as it brings heightened government backing and targeted critical minerals funding, likely to accelerate permitting and de-risk elements of project execution. Previously, concerns about liquidity, unprofitability and the company’s going concern status were at the forefront, amplified by volatile share price moves and recurring net losses. With support from both Natural Resources Canada and the US Department of Defense now confirmed, these risks remain, but there’s a clear shift in short-term catalysts: progress in feasibility updates, regulatory fast-tracking, and improved project financing prospects may become more significant. Nevertheless, project execution and the company’s limited cash runway continue to warrant close attention.

But with questions around future funding still unresolved, there’s a key risk investors should be aware of. Upon reviewing our latest valuation report, Northcliff Resources' share price might be too optimistic.Exploring Other Perspectives

Explore another fair value estimate on Northcliff Resources - why the stock might be worth as much as 12% more than the current price!

Build Your Own Northcliff Resources Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northcliff Resources research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Northcliff Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northcliff Resources' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Northcliff Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NCF

Northcliff Resources

Operates as a mineral exploration company in Canada.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives