- Canada

- /

- Metals and Mining

- /

- TSX:MND

Canadian Hidden Gems Including 3 Promising Small Caps

Reviewed by Simply Wall St

As we head into the second half of 2025, the Canadian market is navigating a complex landscape shaped by ongoing trade negotiations and potential tariff adjustments, particularly between major economies like the U.S. and China. While these developments could influence inflation and economic growth, Canada's service-driven economy may help cushion some of these impacts, allowing small-cap companies to potentially thrive by leveraging strategic supply chain adjustments and resilient business models. In this environment, identifying promising small-cap stocks involves looking for those that demonstrate adaptability and strong fundamentals amidst evolving trade dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mako Mining | 6.32% | 19.64% | 64.11% | ★★★★★★ |

| Pulse Seismic | NA | 11.60% | 32.30% | ★★★★★★ |

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Majestic Gold | 9.90% | 11.70% | 9.35% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Corby Spirit and Wine | 57.06% | 9.84% | -5.44% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Dundee | 2.02% | -35.84% | 57.23% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Cardinal Energy (TSX:CJ)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cardinal Energy Ltd. is involved in the acquisition, exploration, development, optimization, and production of petroleum and natural gas across Alberta, British Columbia, and Saskatchewan in Canada with a market cap of approximately CA$1.13 billion.

Operations: Cardinal Energy generates revenue primarily from its oil and gas exploration and production activities, amounting to CA$502.63 million. The company's financial performance is influenced by its ability to manage costs associated with these operations.

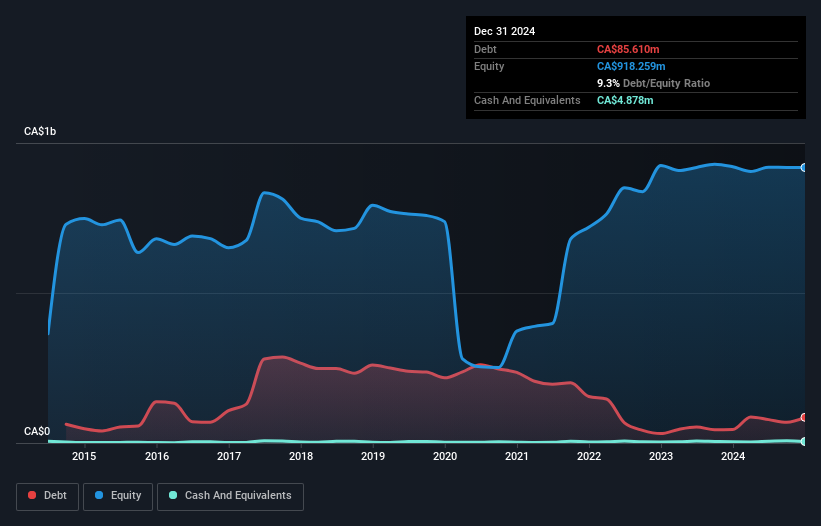

Cardinal Energy, a smaller player in the oil and gas sector, has shown robust financial health with earnings growing by 8.6% over the past year, outpacing the industry average of 3.9%. The company’s debt to equity ratio has impressively dropped from 84.6% to just 11.8% in five years, indicating effective debt management. Recent earnings reports reveal revenue of C$118.81 million for Q1 2025, up from C$114.66 million a year prior, with net income rising to C$21.4 million from C$16.75 million last year—demonstrating solid profitability amidst industry challenges while trading significantly below estimated fair value offers potential upside for investors seeking undervalued opportunities in Canada’s energy market.

- Take a closer look at Cardinal Energy's potential here in our health report.

Review our historical performance report to gain insights into Cardinal Energy's's past performance.

Mandalay Resources (TSX:MND)

Simply Wall St Value Rating: ★★★★★★

Overview: Mandalay Resources Corporation is involved in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Australia, Sweden, Chile, and Canada with a market capitalization of CA$483.36 million.

Operations: Mandalay Resources generates revenue primarily from its Metals & Mining segment, focusing on gold and other precious metals, amounting to $263.21 million.

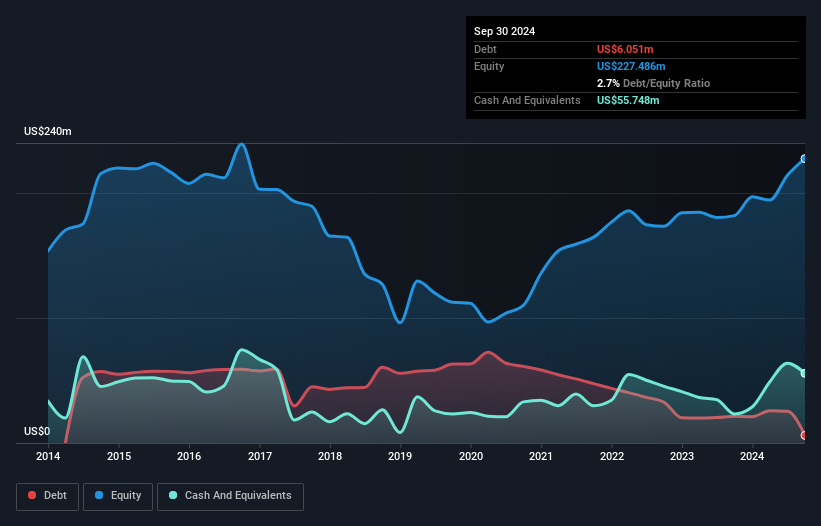

Mandalay Resources, a nimble player in the mining sector, has demonstrated impressive earnings growth of 330% over the past year, outpacing industry averages. The company is trading at nearly 70% below its estimated fair value, offering potential upside for investors. With its debt-to-equity ratio dropping from 75% to just 2.6% in five years and interest payments well-covered by EBIT at a multiple of 102 times, Mandalay shows robust financial health. However, with anticipated revenue declines ahead and limited mine life at key sites like Costerfield, careful consideration of future prospects is advisable.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of approximately CA$2.38 billion.

Operations: North West generates revenue primarily from its retail operations, with CA$2.60 billion attributed to the sale of food and everyday products and services.

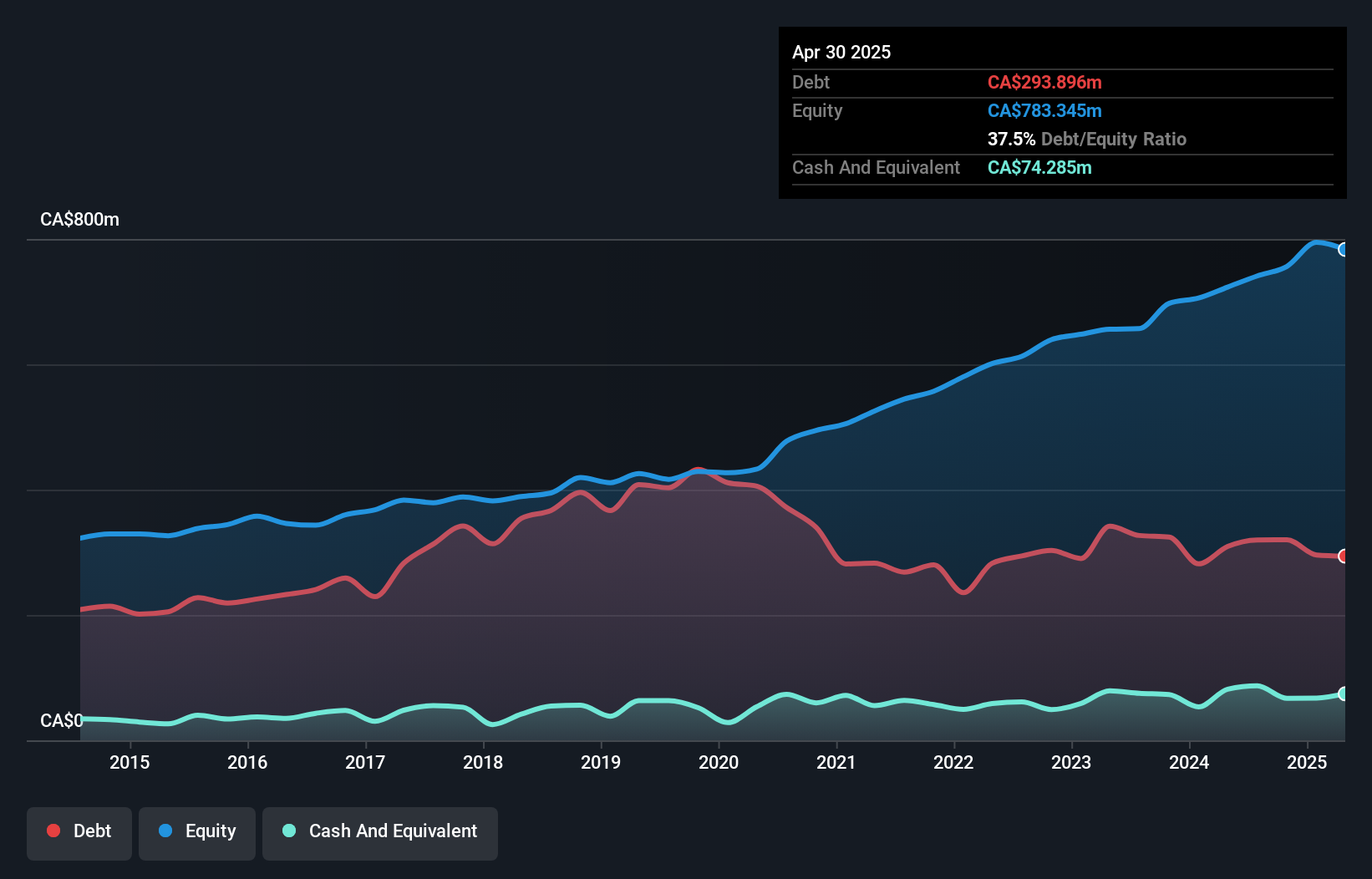

Trading at 61% below its estimated fair value, North West shines with high-quality earnings and a satisfactory net debt to equity ratio of 28%. The company has shown resilience, with earnings growth of 2.7% over the past year outpacing the industry average. Interest payments are comfortably covered by EBIT at 11.9 times, indicating strong financial health. Recent results highlight steady progress: Q1 sales reached CAD 641 million compared to CAD 618 million last year, while net income slightly increased to CAD 25.84 million from CAD 25.53 million. With a forecasted revenue growth of over 5%, North West appears poised for continued stability in its niche market.

Summing It All Up

- Delve into our full catalog of 44 TSX Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MND

Mandalay Resources

Engages in the acquisition, exploration, extraction, processing, and reclamation of mineral properties in Australia, Sweden, Chile, and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives