- Canada

- /

- Metals and Mining

- /

- TSX:MAU

Can Resource Upgrades at Montage (TSX:MAU) Sustain Momentum in Its Exploration-Driven Growth Story?

Reviewed by Simply Wall St

- Montage Gold recently announced that its H1-2025 Kone exploration program in Côte d'Ivoire delivered significant results, confirming higher-grade mineralization and increased Indicated Resources at the Gbongogo South and Koban North deposits, with ongoing expansion at several other targets.

- An interesting aspect is the company’s rapid conversion rate from Inferred to Indicated Resources, underscoring exploration success across a large portion of its portfolio and strengthening confidence in short-term resource objectives.

- We’ll explore how confirmation of higher-grade mineralization and expanding Indicated Resources may influence Montage Gold’s investment narrative.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Montage Gold's Investment Narrative?

For investors looking at Montage Gold, the big picture hinges on the successful ramp-up of the Kone project and the ability to meaningfully grow high-grade resources across the company’s portfolio. The latest drilling and assay results suggest near-term catalysts are strengthening, with credible progress on increasing Indicated Resources, especially given the high conversion rate from Inferred to Indicated categories at multiple deposits. This news may reduce some exploration risk for the short term, as recent assays reinforce the possibility of hitting the company’s ambitious 1Moz target for higher-grade resources. However, key risks remain: the company continues to report rising losses, with another US$24.64 million net loss for Q1 2025 and a recent track record of shareholder dilution and no revenue generation. The modest share price reaction to this news hints that the market may be waiting for more conclusive developments, particularly around funding runway and resource model updates later in the year. Yet, dilution and funding needs still cast a shadow over the growth story and shouldn't be overlooked.

Montage Gold's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

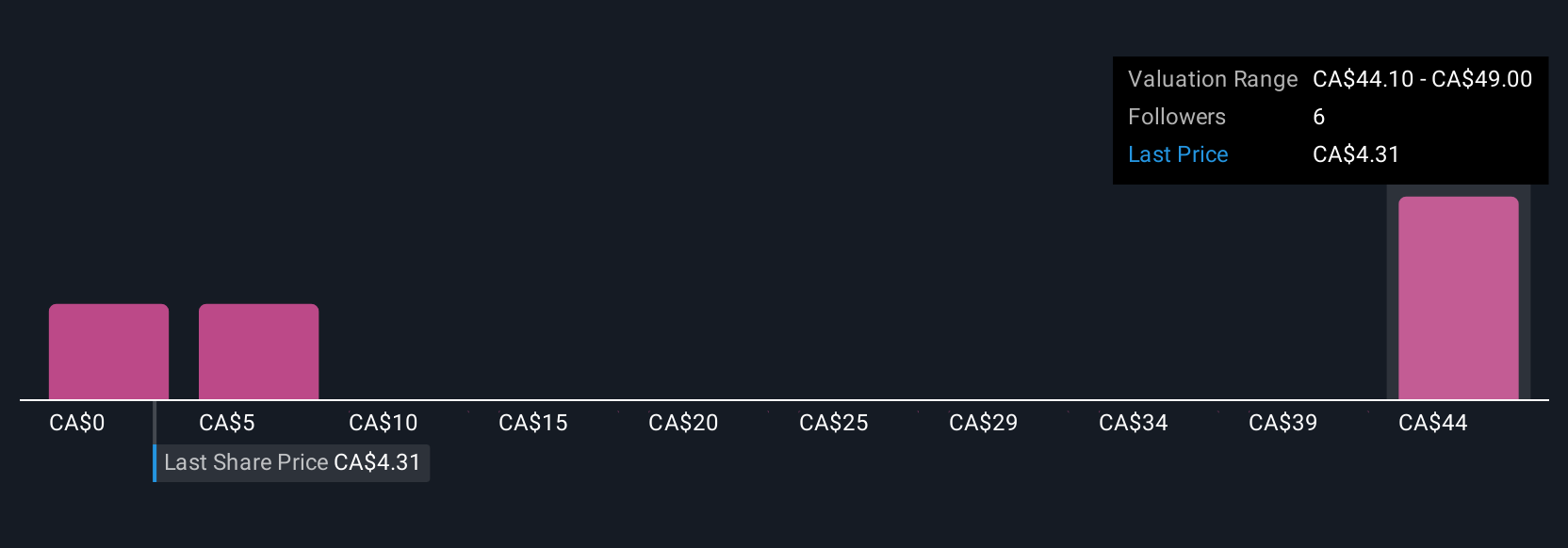

Explore 5 other fair value estimates on Montage Gold - why the stock might be a potential multi-bagger!

Build Your Own Montage Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Montage Gold research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Montage Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Montage Gold's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAU

Montage Gold

Engages in the acquisition, exploration, and development of mineral properties in Africa.

Slight with moderate growth potential.

Similar Companies

Market Insights

Community Narratives