- Canada

- /

- Metals and Mining

- /

- TSX:MAG

MAG Silver (TSX:MAG) Valuation in Focus After Juanicipio Project Operations and Construction Update

Reviewed by Simply Wall St

MAG Silver (TSX:MAG) just shared an update on its Juanicipio Project, reporting ongoing underground material production and steady construction progress on its new processing plant. Investors seem interested in the project’s clear operational momentum and future potential.

See our latest analysis for MAG Silver.

With the Juanicipio Project delivering steady operational progress, MAG Silver has seen momentum build, reflected in a 65% year-to-date share price return and an impressive 1-year total shareholder return of 107%. Investors appear optimistic about the company’s growth prospects as milestones are met.

If you’re keen to discover what other fast-growing companies with strong insider backing are up to, now is the perfect time to explore fast growing stocks with high insider ownership.

But with shares already up sharply this year, the key question for investors is whether MAG Silver is an overlooked value or whether the company’s rapid progress and future gains are already reflected in the current price. Is there still a buying opportunity, or has the market already priced in all the growth ahead?

Price-to-Earnings of 24.9x: Is it justified?

MAG Silver trades at a price-to-earnings ratio of 24.9, which is notably higher than the Canadian Metals and Mining sector average of 18.6x. This means the market is putting a premium on MAG’s earnings compared to its industry peers.

The price-to-earnings ratio, or P/E, measures the current share price relative to the company’s per-share earnings. Investors often use this multiple to gauge how the market values a company’s profitability and to compare valuation levels across similar businesses. For a growing miner like MAG, a higher P/E could either reflect strong growth expectations or an overheated share price.

Currently, MAG’s elevated P/E suggests that investors are optimistic about its future and may be paying up for anticipated growth. However, when compared against the broader industry, this elevated ratio could also be a warning that shares are expensive on an earnings basis, at least for now.

MAG’s ratio is actually lower than the peer group’s average of 27.1x. This indicates that while shares look pricey versus the industry overall, they could be more reasonably valued compared to select peers with even higher ratios. If the market realigns toward this higher peer multiple, there could still be further upside. On the other hand, any reversal in sentiment or an earnings surprise might hit the stock harder than its competitors.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.9 (OVERVALUED)

However, strong price gains and elevated valuations could make shares vulnerable if earnings disappoint or if sector sentiment suddenly turns negative.

Find out about the key risks to this MAG Silver narrative.

Another Perspective: What Does the SWS DCF Model Say?

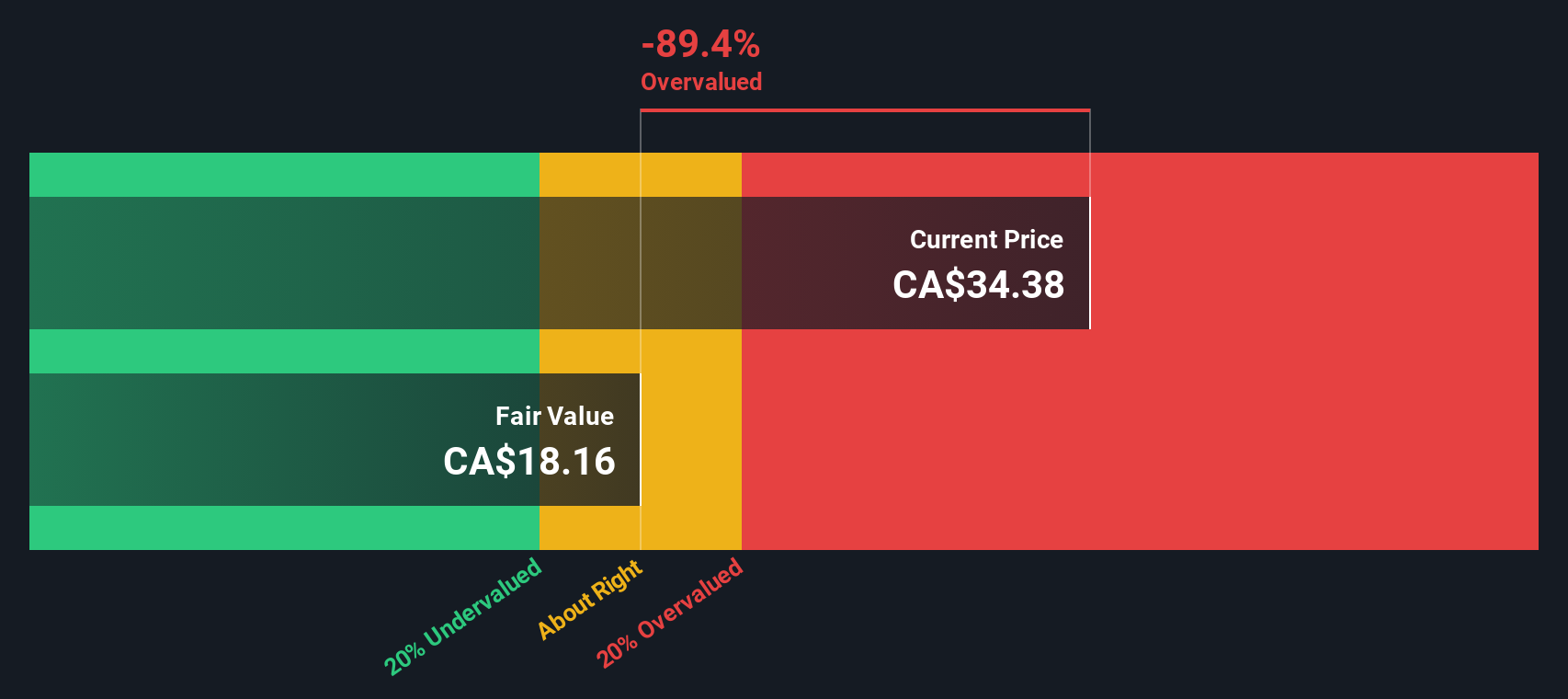

Looking through the lens of our DCF model, MAG Silver’s estimated fair value is CA$18.16, while its shares currently trade well above that at CA$34.38. This suggests the stock could be overvalued based on its projected future cash flows. It challenges the case for further upside and raises a new question: is optimism outpacing fundamentals here?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MAG Silver for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MAG Silver Narrative

If you want to dig deeper or chart your own course, it’s easy to analyze the data and form your own conclusions in just minutes with Do it your way.

A great starting point for your MAG Silver research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep their eyes open for standout opportunities. Don't miss the chance to power up your portfolio with these exciting investment themes.

- Tap into tomorrow’s tech trends with these 27 AI penny stocks, and discover companies pushing the boundaries of artificial intelligence and machine learning.

- Unlock high-yield potential and steady income by focusing on these 17 dividend stocks with yields > 3%, where you can find stocks offering robust dividend payments and balance sheet strength.

- Capitalize on emerging disruptive innovation with these 27 quantum computing stocks, featuring businesses at the frontier of quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MAG

MAG Silver

A mining and exploration company, engages in the acquisition, exploration, and advancement of mineral projects in Canada, the United States, and Mexico.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives