- Canada

- /

- Metals and Mining

- /

- TSX:LUN

What the Recent 70% Surge Means for Lundin Mining’s True Value in 2025

Reviewed by Bailey Pemberton

If you’ve owned Lundin Mining for a while or you’re eyeing it as a potential addition to your portfolio, you’ve no doubt noticed the headlines and seen the numbers. Let’s be honest, the recent price action is tough to ignore. Year to date, the stock is up an eye-popping 70.5%. That’s not just a good year; that’s the kind of outperformance that gets people talking around the water cooler. Even when zooming out, Lundin’s five-year return clocks in at more than 200%, handily beating the broader market and many of its peers.

Of course, it hasn’t all been smooth sailing. The last month featured a notable 8.5% climb before a modest dip of 2.1% over the past week, hinting at a bit of volatility. This movement is likely driven by shifting investor perceptions around risk and macroeconomic factors impacting mining stocks this year. Recent news highlights Lundin’s continued investments in production capacity, as well as operational updates on its key assets, which appear to have bolstered confidence in the company’s long-term prospects. However, it is clear that much of the current enthusiasm may already be reflected in the share price.

So, what does all this mean for the company’s value? Here’s an interesting data point: based on several valuation checks, Lundin Mining scores a 0 out of 6 for indications of being undervalued. In other words, by traditional metrics, there aren’t obvious signs it is trading below its true worth—yet.

Let’s break down how those valuation checks work, and why a purely numbers-based approach might not tell the whole story. Stick around, because at the end, I’ll share a perspective that goes one step further in understanding what Lundin is really worth.

Lundin Mining scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lundin Mining Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) is a classic method for valuing companies that pay regular dividends. It estimates a stock’s intrinsic value by projecting future dividends and discounting them back to their value today, taking into account dividend growth and the company’s ability to sustain payouts over time.

For Lundin Mining, the most recent annual dividend per share stands at $0.08, with a payout ratio of roughly 49.4%. This means about half of earnings are returned to shareholders as dividends. According to recent calculations, the sustainable growth rate for future dividends is estimated at 2.4%, based on the company’s return on equity of 4.7% and the payout ratio. This indicates there is only modest long-term growth built in.

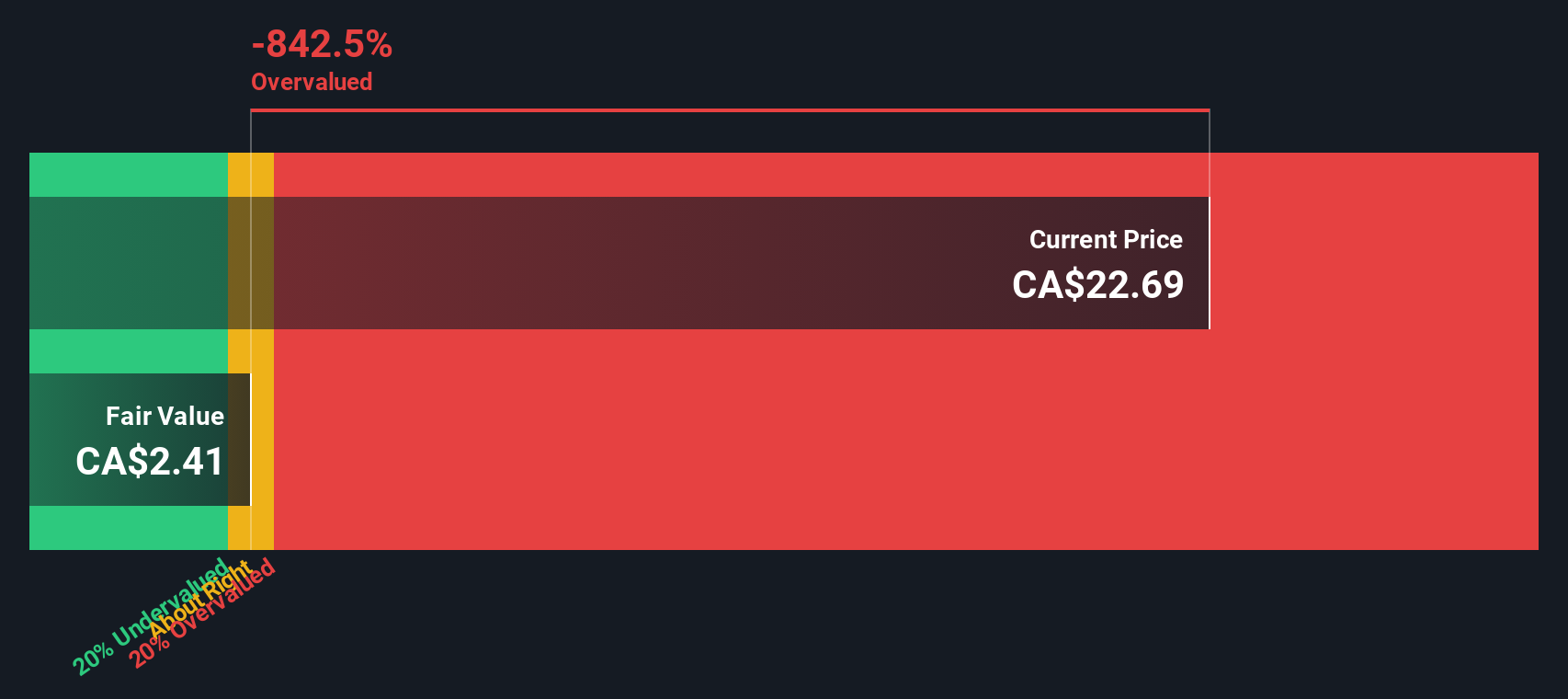

Taking these assumptions, the DDM model generates an intrinsic value of just $2.61 per share. Compared to the current market price, this implies the stock is trading at a 721% premium, indicating significant overvaluation based on dividend potential alone. This suggests expectations for payout growth are low, or current dividends are not enough to support today’s price on their own.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Lundin Mining may be overvalued by 721.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lundin Mining Price vs Earnings

When analyzing profitable companies like Lundin Mining, the Price-to-Earnings (PE) ratio is typically the go-to metric for valuation. It reflects how much investors are willing to pay for each dollar of a company's earnings, making it especially useful for gauging if a stock is attractively priced relative to its profitability.

But what makes a "fair" PE ratio? Growth expectations, risk, profit margins, and how the broader industry is performing all affect what is reasonable. Companies with strong growth prospects or lower risks can justify a higher PE, while more sluggish or riskier firms typically see their multiples trimmed.

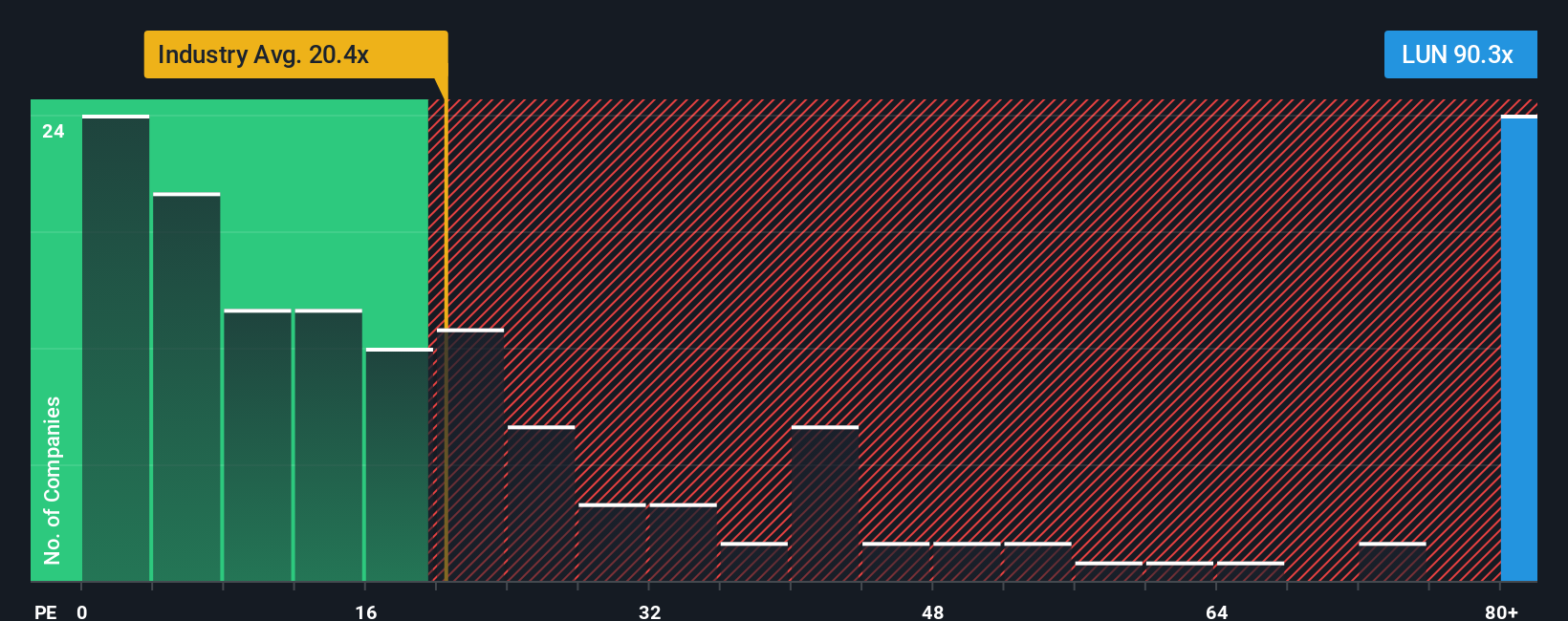

Lundin Mining is currently trading at a lofty PE ratio of 86x. For context, that is well above the Metals and Mining industry average PE of 21.18x and higher than the peer group’s 48.18x. There is another lens you can use: Simply Wall St’s “Fair Ratio,” which blends in expectations for growth, margins, risks, company size, and its industry specifics. The Fair Ratio for Lundin is calculated at 35.09x. This gives a more tailored benchmark than industry averages, which can miss company-specific nuance.

Stacking it all up, Lundin's PE at 86x is far above both its Fair Ratio and broader benchmarks. This points to the stock being priced much higher than what fundamentals alone might suggest.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lundin Mining Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, combining your perspective on what will drive its future with your forecasts for things like revenue, earnings, and margins to arrive at a fair value. Put another way, a Narrative links a company’s unique journey to the numbers in your valuation and guides what you think the business is truly worth.

Narratives are both powerful and easily accessible. Millions of investors on the Simply Wall St Community page use them to capture their personal view of a company. They are dynamic; as news or earnings updates emerge, your Narrative and its fair value adjust, so it always reflects the latest information. Narratives help you make actionable investment decisions by showing clearly where your fair value differs from the current share price, so you can identify when to buy or sell.

For example, within Lundin Mining, some investors build bullish Narratives that imagine copper demand soaring and margins improving, leading to a high fair value (recent community estimates go as high as CA$21.08). Others see operational or geographic risks limiting future growth and arrive at much lower fair values (as low as CA$14.04). This shows how Narratives put your unique investment view at the center, empowering you to act with confidence, backed by your own logic, not just market sentiment.

Do you think there's more to the story for Lundin Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LUN

Lundin Mining

A diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Chile, Brazil, the United States, Portugal, Sweden, and Argentina.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives