- Canada

- /

- Metals and Mining

- /

- TSX:LUN

Does Lundin Mining’s 72.6% Rally in 2025 Signal Genuine Value?

Reviewed by Bailey Pemberton

- Wondering if Lundin Mining is a compelling bargain or just riding the commodity wave? Let’s dig into whether the recent momentum matches up with what the company is truly worth.

- The stock’s price has soared 72.6% year-to-date and is up a remarkable 59.4% over the past year. This comes despite some shorter-term ups and downs over the last week and month.

- Recent headlines have spotlighted the resurgence in copper prices and sector-wide optimism. Lundin Mining’s recent expansion announcements and project updates have sparked renewed investor attention. M&A chatter and supply-demand dynamics are also contributing to the speculation driving those moves.

- On our simple valuation scorecard, Lundin Mining earns a 0 out of 6. This means it doesn’t tick any boxes for being undervalued, at least by traditional checks. In a moment, we’ll look at what’s behind that number, why classic methods sometimes fall short, and how a broader perspective could reveal more about the true value story.

Lundin Mining scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lundin Mining Dividend Discount Model (DDM) Analysis

The Dividend Discount Model (DDM) bases its valuation on the present value of future dividends, projecting how much cash shareholders can expect to receive and then discounting those payments back to today. The model assumes companies continue to pay out a steady or growing stream of dividends over time, making it best suited for businesses with predictable distributions.

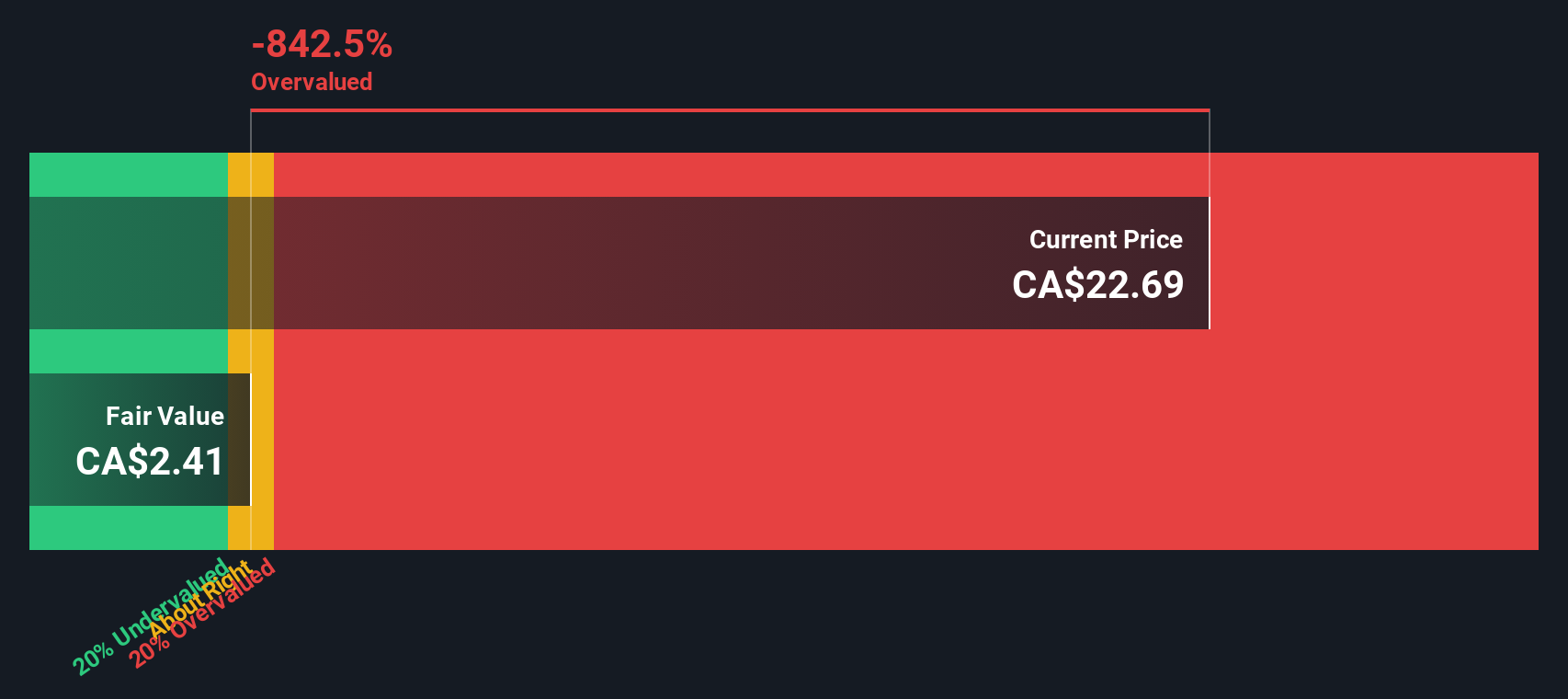

For Lundin Mining, the model uses a dividend per share of $0.08, a return on equity of 4.68%, and a payout ratio just under 50%. This results in an expected long-term dividend growth rate of roughly 2.4%, calculated as (1 - 49.43%) times 4.68%. These relatively modest rates suggest limited upside driven by dividends alone.

Based on this approach, the estimated intrinsic value for Lundin Mining is just $2.40 per share, far below its recent trading price. In fact, the DDM implies the stock is overvalued by 803.4%, indicating a significant disconnect between the share price and what the model deems fair value based on dividends.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Lundin Mining may be overvalued by 803.4%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lundin Mining Price vs Earnings (PE)

For profitable companies, the price-to-earnings (PE) ratio is a widely recognized valuation tool. It is favored because it directly relates a company’s share price to its actual earnings, making it easier to compare across firms and industries with positive bottom lines.

A “normal” or fair PE ratio is not a one-size-fits-all figure. Fast-growing companies often command higher ratios since investors are willing to pay more today for anticipated future earnings. Conversely, higher risk or slower growth typically results in lower ratios, with the fair range influenced by factors such as sector trends and overall market expectations.

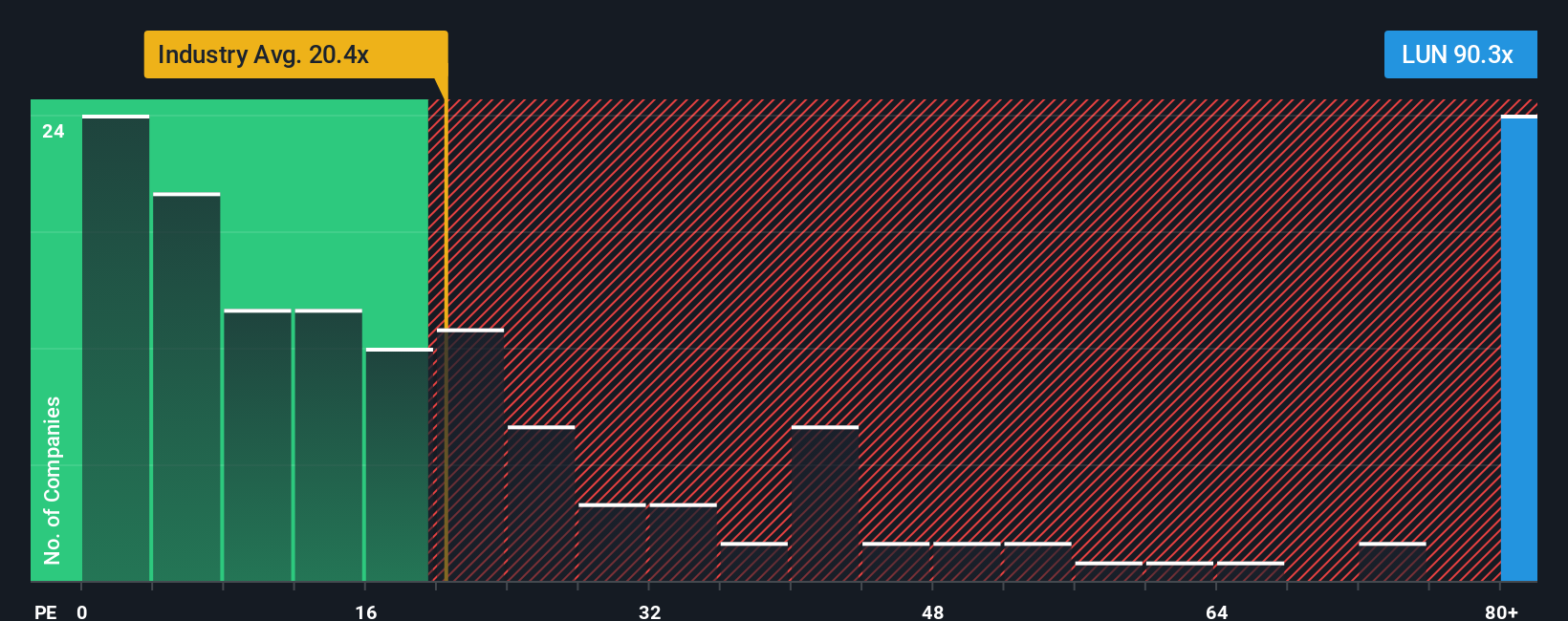

Lundin Mining currently trades at a lofty PE ratio of 86.4x. This stands well above the Metals and Mining industry average of 19.8x and the average for its direct peers at 16.1x. Such a high multiple signals that investors are pricing in significant future growth or perhaps overestimating the company’s near-term prospects.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is calculated using a company’s individual profile, including factors like future earnings growth, profit margins, risk scores, its industry, and actual market cap. This makes it a much more tailored benchmark than a simple industry average. For Lundin Mining, the Fair Ratio is 30.1x, which is substantially below the current market valuation.

By comparing the Fair Ratio of 30.1x to the company’s actual PE of 86.4x, it is clear that Lundin Mining’s shares are priced considerably above what would be justified by its fundamentals and risk profile.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lundin Mining Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or thesis about a company, the reasoning behind your view of its future revenue, earnings, and margins, all tied together to produce your own fair value estimate.

Unlike static financial models, Narratives connect the dots between a company's real-world journey, expected results, and what you think the shares should be worth. They allow you to personalize forecasts and assumptions in a straightforward way, synthesizing headlines, earnings updates, and personal insight into a tailored investment outlook.

On Simply Wall St's platform, Narratives are available in the Community page and are used by millions of investors to help guide smarter buy and sell decisions by comparing their calculated Fair Value to the current market Price. Narratives update dynamically as new information comes in, adapting your view automatically to the latest news or analyst estimates without complex recalculations.

For Lundin Mining, one investor’s Narrative might price in the bullish analyst forecast of CA$21.08 per share, based on strong growth from new copper projects. A more cautious outlook could lean toward the bearish scenario at CA$14.04, highlighting risk from region-specific challenges; both perspectives help you act with greater clarity and conviction.

Do you think there's more to the story for Lundin Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LUN

Lundin Mining

A diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Chile, Brazil, the United States, Portugal, Sweden, and Argentina.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives