- Canada

- /

- Metals and Mining

- /

- TSX:LAR

Why Lithium Argentina (TSX:LAR) Is Up 29.8% After Unveiling a Major Lithium Project With Ganfeng

Reviewed by Sasha Jovanovic

- On November 10, 2025, Lithium Argentina AG announced the results of the Scoping Study for the Pozuelos-Pastos Grandes lithium brine project in Salta Province, revealing plans for a 150,000 tonne-per-annum lithium carbonate operation in partnership with Ganfeng Lithium Group.

- The project’s integration, scalable production strategy, and hybrid processing approach position it among the world’s largest undeveloped lithium resources, aiming for improved efficiency and reduced freshwater use.

- We'll explore how the resource scale and cost profile of Pozuelos-Pastos Grandes could shape Lithium Argentina's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Lithium Argentina's Investment Narrative?

To be a shareholder in Lithium Argentina right now, you need to believe in the company’s ability to transform one of the world’s largest undeveloped lithium resources into a meaningful, profitable operation. The new scoping study for Pozuelos-Pastos Grandes, with a 150,000 tonne-per-year vision and cost-efficient, scalable production in partnership with Ganfeng, could give a lift to investor optimism. This announcement spotlights the project’s significant resource scale and cost competitiveness, bringing near-term catalysts into sharper focus, especially the DIA permitting progress and potential fiscal incentives in 2026. However, the Q3 results did little to calm nerves, with losses widening and genuine revenue still a future prospect. The biggest risk remains project execution and timely financing. While the resource base is huge, everything depends on translating plans into production within budget and on schedule. But a project of this scale isn’t without substantial execution risk for those following closely.

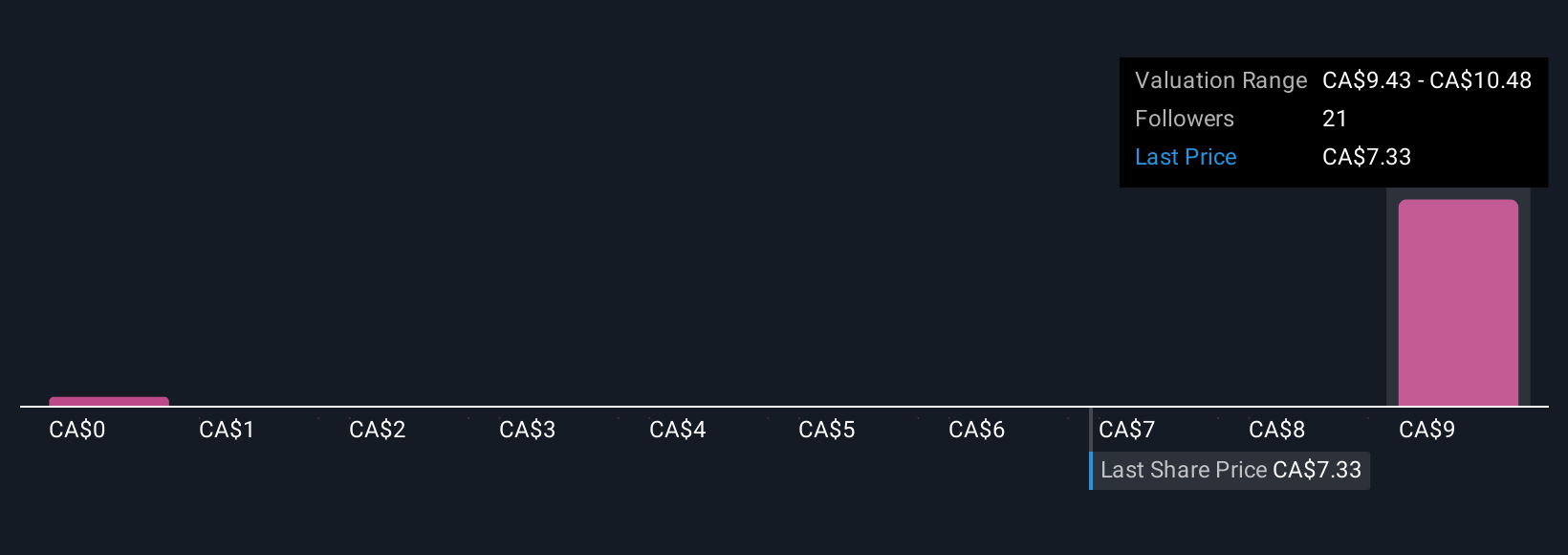

Lithium Argentina's shares have been on the rise but are still potentially undervalued by 18%. Find out what it's worth.Exploring Other Perspectives

Explore 3 other fair value estimates on Lithium Argentina - why the stock might be worth as much as 37% more than the current price!

Build Your Own Lithium Argentina Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithium Argentina research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lithium Argentina research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithium Argentina's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LAR

Lithium Argentina

A resource and materials company, focuses on advancing lithium projects in Argentina.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives