- Canada

- /

- Metals and Mining

- /

- TSX:K

Surging Earnings and Record Cash Flow Could Be a Game Changer for Kinross Gold (TSX:K)

Reviewed by Simply Wall St

- Kinross Gold announced second-quarter 2025 results showing net income of US$530.7 million and earnings per share of US$0.43, both substantially higher than the comparable period last year, supported by resilient production and steady dividends.

- An interesting insight is that, despite a slight year-over-year decrease in gold production, the company delivered record free cash flow and strong operating margins, enabling meaningful shareholder returns through dividends and buybacks.

- Let's examine how the significant jump in quarterly earnings supports Kinross Gold's overall investment thesis and future outlook.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Kinross Gold Investment Narrative Recap

Shareholders in Kinross Gold generally need to have confidence in the company’s ability to maintain robust free cash flow and healthy margins, even during periods of flat or slightly declining production. While the recent earnings beat showcases strong profitability and continues to support the investment case, the short-term trajectory still hinges on the company's ability to balance operational efficiency with disciplined capital allocation, especially as cost pressures and production challenges persist. The biggest near-term risk, rising production costs driven by lower ore grades and planned throughput reductions at key assets, has not been materially offset by this quarter’s strong results, so it remains top of mind for investors.

Among the company’s recent developments, the reaffirmed quarterly dividend stands out as a tangible sign of management’s ongoing confidence in shareholder returns. This payout, consistent with past quarters, highlights how Kinross is continuing to prioritize capital returns even as it contends with flat production and ongoing cost pressures, supporting the narrative that disciplined capital management is central to the company’s outlook. However, that consistency doesn’t negate the need for investors to monitor future cost trends and project updates, especially as production guidance evolves...

Read the full narrative on Kinross Gold (it's free!)

Kinross Gold's outlook anticipates $6.6 billion in revenue and $1.5 billion in earnings by 2028. This is based on a 5.7% annual revenue growth rate and a $0.3 billion increase in earnings from the current $1.2 billion.

Uncover how Kinross Gold's forecasts yield a CA$24.41 fair value, a 9% upside to its current price.

Exploring Other Perspectives

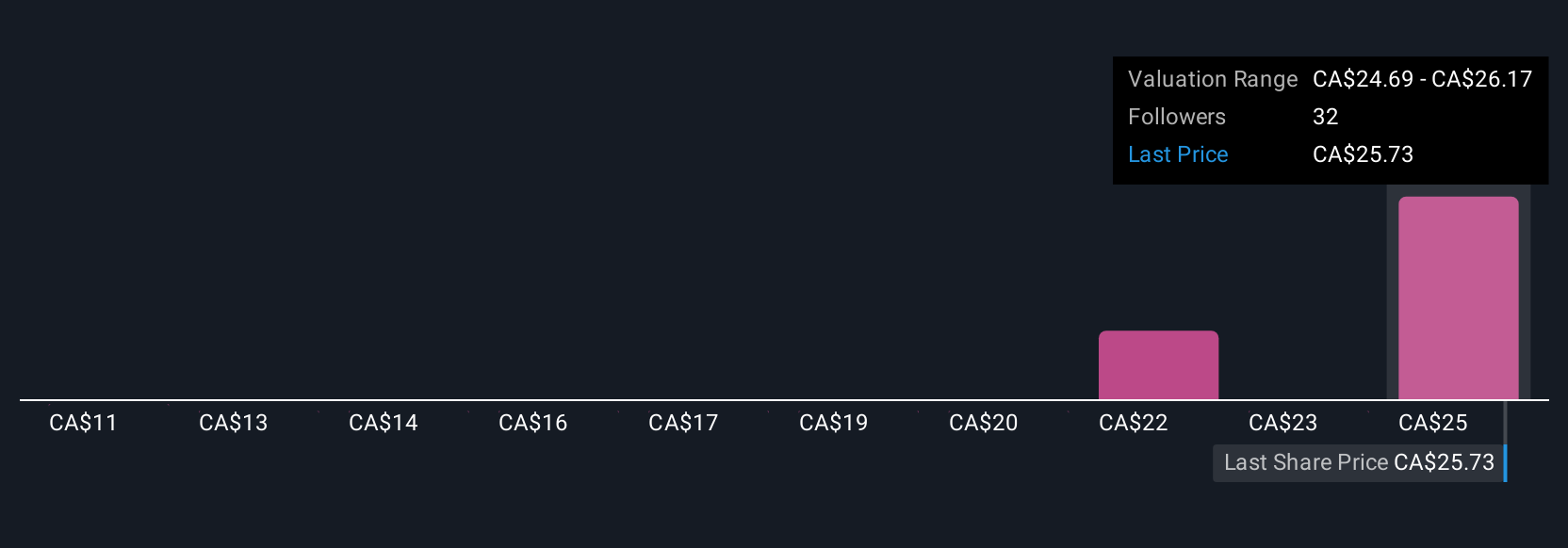

Simply Wall St Community members have published three fair value estimates for Kinross Gold ranging from US$11.38 to US$24.41 per share. Many are watching whether rising production costs and grade transitions could challenge the company’s margin outlook, take time to review several perspectives before making your assessment.

Explore 3 other fair value estimates on Kinross Gold - why the stock might be worth 49% less than the current price!

Build Your Own Kinross Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinross Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kinross Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinross Gold's overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives