- Canada

- /

- Metals and Mining

- /

- TSX:K

Is Kinross Gold Still Appealing After a 153% Surge and Recent Production Milestones?

Reviewed by Bailey Pemberton

- Wondering if Kinross Gold is still a bargain after such an incredible run? Let’s dive in and see if this mining giant’s stock is as undervalued as it seems.

- Despite a slight 2.0% dip over the past week, Kinross Gold is still up 153.2% over the last year and 582.8% over three years.

- Recent headlines have highlighted Kinross’s successful ramp-up from key mine projects and a surge in gold prices, helping fuel fresh investor interest. Expansion updates and positive production milestones have caught the market's eye, pushing momentum even further.

- The company's current valuation score is 3/6, suggesting there is plenty to unpack in the numbers. Next, we will break down how these valuation checks stack up, plus share a smarter way to assess Kinross’s true worth, so keep reading.

Approach 1: Kinross Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Kinross Gold, this analysis relies on future Free Cash Flow (FCF) trends to gauge whether the current share price truly reflects the company’s potential.

Kinross generated about $1.87 billion in Free Cash Flow over the last twelve months, measured in US dollars. Analysts forecast varied FCF growth over the near term, peaking at close to $2.98 billion by 2027. Projections for a full decade out, mainly extrapolated beyond the first five years, suggest FCF may moderate to roughly $798 million in 2035 as growth stabilizes.

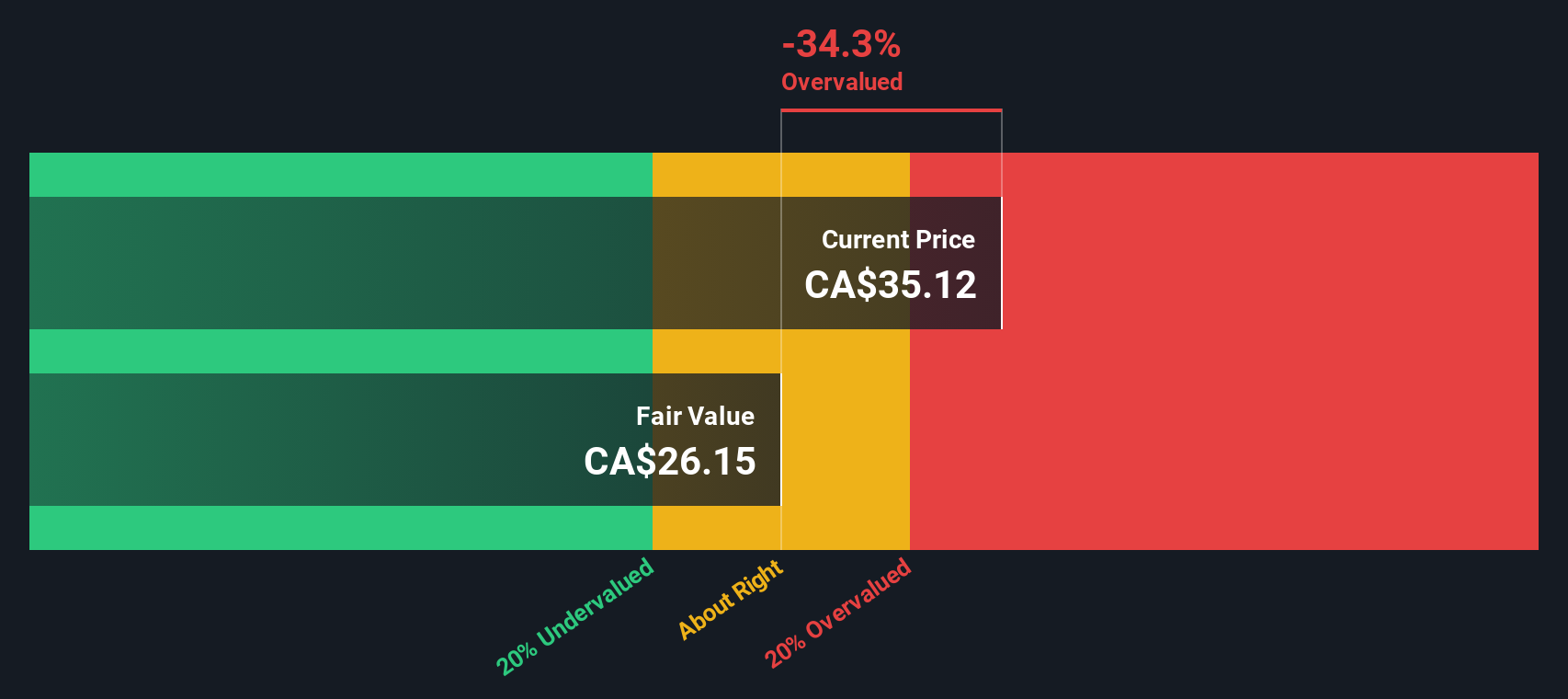

Based on these forecasts, the estimated fair value for Kinross Gold stock is $23.96 per share. However, with the current market price sitting about 43.4% higher than this fair value, the DCF approach signals that shares are overvalued right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kinross Gold may be overvalued by 43.4%. Discover 926 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Kinross Gold Price vs Earnings

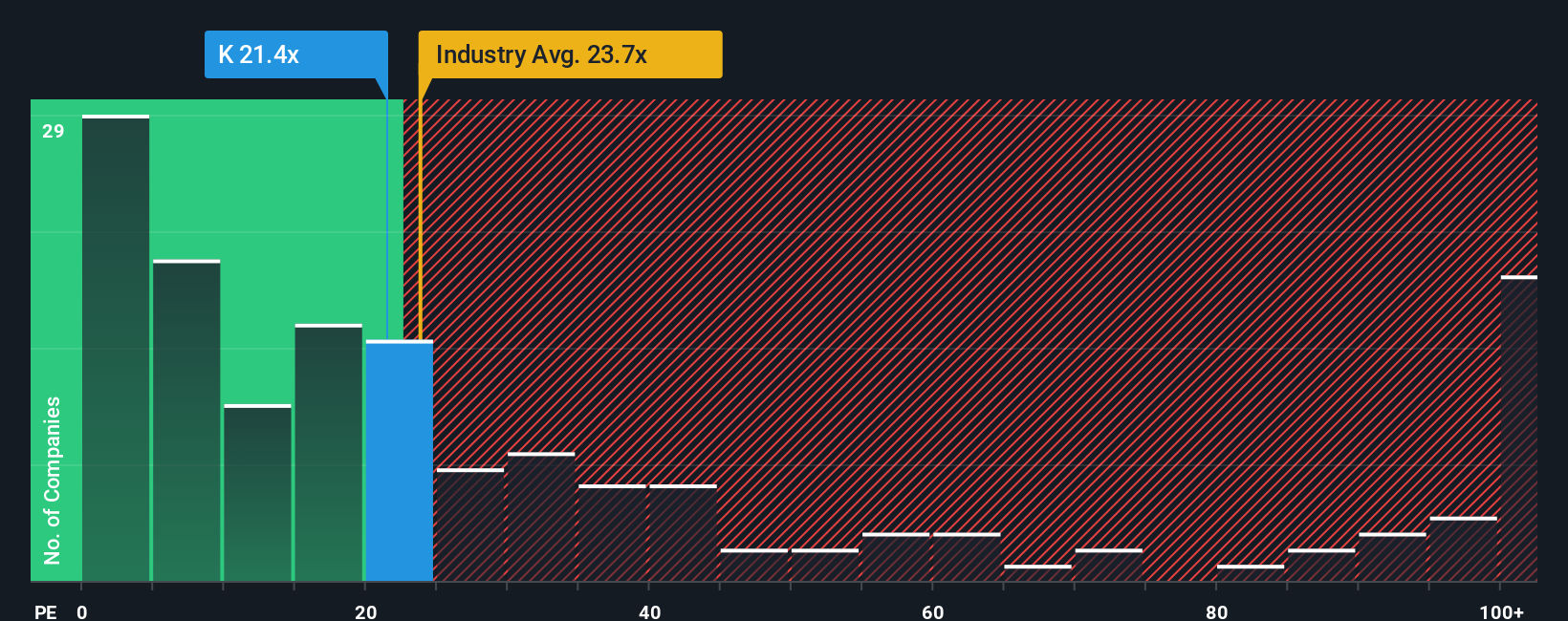

The price-to-earnings (PE) ratio is a widely used metric for valuing profitable companies because it relates the share price to what the business is actually earning right now. For investors, the PE ratio offers a quick way to gauge whether the market might be overpaying or underpaying for the company’s current profits.

It is important to recognize that what counts as a “normal” or “fair” PE ratio can vary. Companies with higher growth potential or lower risk often command higher multiples. Likewise, cyclical or riskier businesses typically trade lower, so industry context matters.

Kinross Gold currently trades at 16.7x earnings. This is below both the Metals and Mining industry average of 18.4x and the peer group average of 34.1x. On the surface, this looks like a potential bargain. However, raw PE comparisons can be misleading because they ignore company-specific factors such as earnings growth prospects, profit margins, and business risk.

The Simply Wall St “Fair Ratio” helps address this limitation. This proprietary metric suggests Kinross should trade at around 19.1x earnings, based on its blend of growth outlook, profitability, industry profile, market capitalization, and risk factors. Since the current 16.7x PE is moderately below this tailored fair value, it indicates Kinross Gold may be slightly undervalued using this lens.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1438 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kinross Gold Narrative

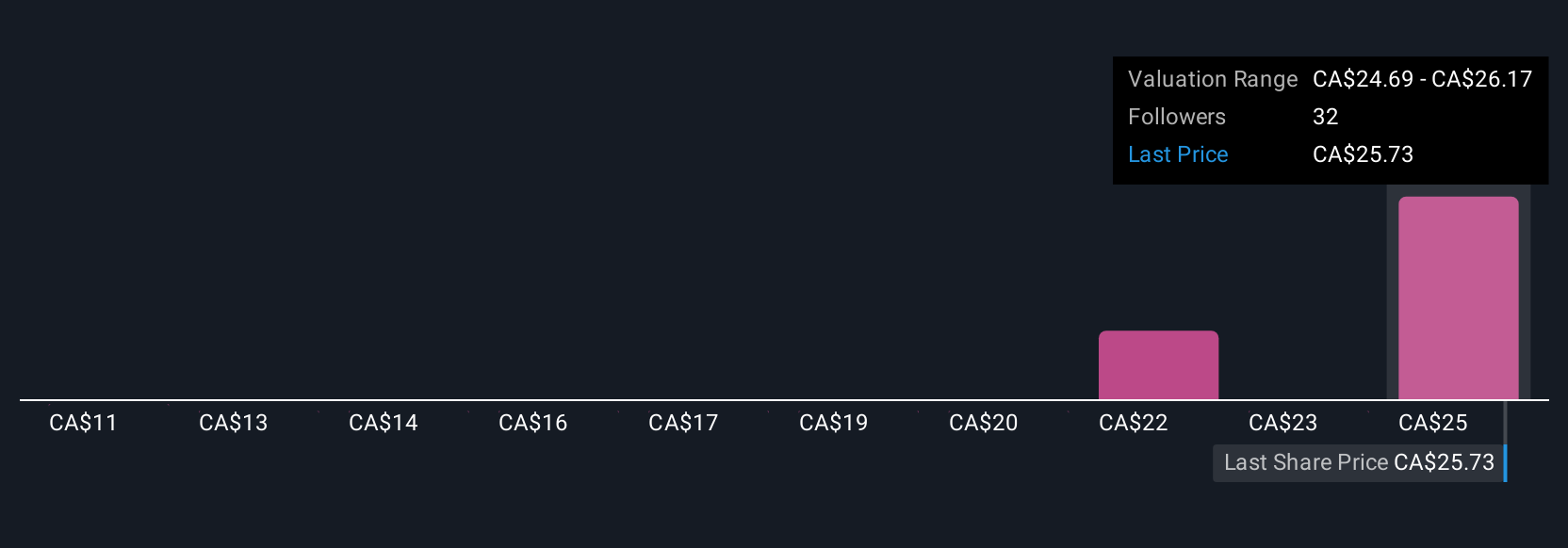

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple and user-friendly way to link your view of Kinross Gold's story to a financial forecast and a fair value. More than just crunching numbers, a Narrative lets you capture your investment thesis, including your assumptions about future revenue, earnings, and profit margins. It then translates these into an actionable fair value estimate tailored to your outlook.

Narratives are easily accessible right on Simply Wall St’s Community page, which is used by millions of investors to share and compare ideas. This tool reveals how different investors justify their buy or sell decisions. When your Narrative fair value is above the current market price, Kinross Gold might appear to be a buy, and vice versa. Narratives also update automatically whenever major news or financial results emerge, so your insights remain relevant in real time.

For example, at the time of writing, Community Narratives for Kinross Gold show that the most optimistic investors believe shares could be worth as much as CA$37.79, while the most conservative value the company at just CA$9.98. This illustrates that the right price truly depends on your view of the company’s future.

Do you think there's more to the story for Kinross Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives