- Canada

- /

- Metals and Mining

- /

- TSX:K

Is Kinross Gold Still a Value Play After 128.9% 2025 Rally?

Reviewed by Bailey Pemberton

- Ever wondered if Kinross Gold’s impressive run means the stock is truly undervalued, or if the easy gains are behind us? Let’s cut through the noise and get to the numbers.

- Kinross Gold has seen eye-popping returns recently, up 128.9% year-to-date and a massive 136.4% over the last 12 months, with a slight pullback of -8.0% in the past month.

- Fueling these moves, investors have responded to sector-wide optimism driven by rising gold prices and strategic asset acquisitions, such as the high-profile acquisition of Great Bear Resources. Market chatter about safe haven demand and Kinross Gold’s operational updates have also played into sentiment.

- When it comes to valuation, Kinross Gold scores a 3 out of 6 on our value checks. This means half of the metrics suggest the company’s shares are still undervalued. We’ll break down what this means with several valuation approaches and highlight a smarter way to look at value by the end of this article.

Approach 1: Kinross Gold Discounted Cash Flow (DCF) Analysis

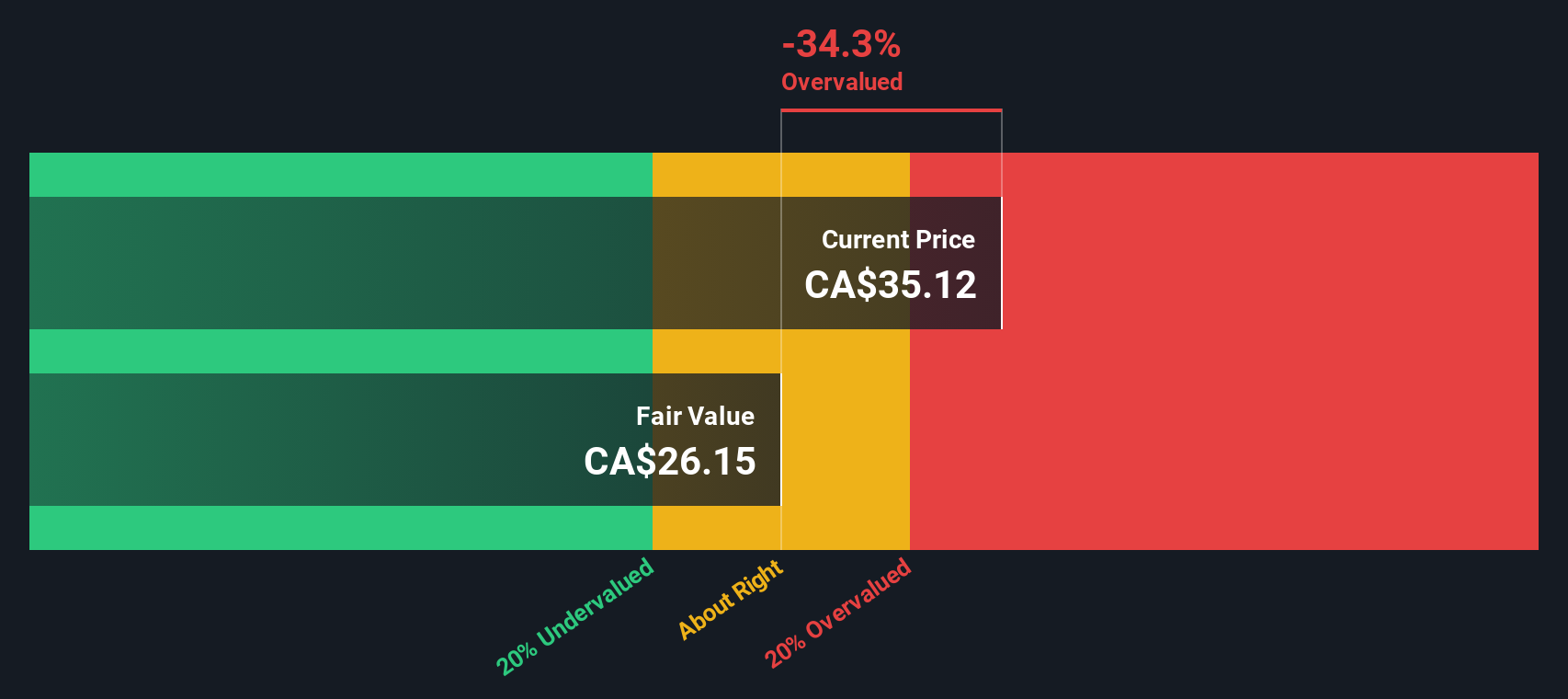

The Discounted Cash Flow (DCF) model is a popular valuation method that estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Kinross Gold, the model begins with the most recent Free Cash Flow, which stands at $1.62 billion, and uses analyst estimates for the next five years. Beyond that, future cash flows are extrapolated to provide a ten-year outlook. This results in a projected Free Cash Flow of $861 million by 2035.

This DCF valuation uses a two-stage Free Cash Flow to Equity approach. Analyst estimates account for higher Free Cash Flow totals in the next few years, with expected declines in later years as projections move further out and become less certain. All figures are reported in US dollars, regardless of the share price currency.

The DCF calculation yields an estimated intrinsic value per share of $25.32. Compared to the current market price, this suggests Kinross Gold is trading at a 28.9% premium, making the stock overvalued according to this model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kinross Gold may be overvalued by 28.9%. Discover 833 undervalued stocks or create your own screener to find better value opportunities.

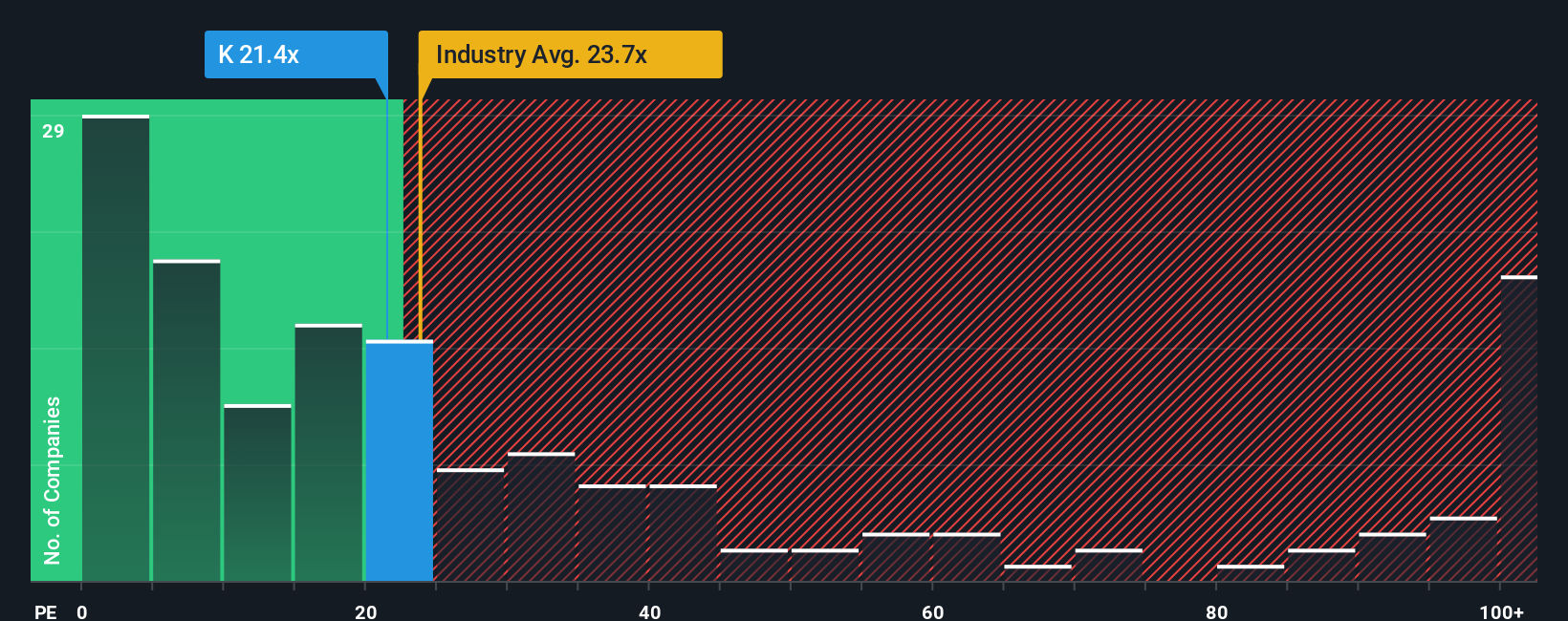

Approach 2: Kinross Gold Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies because it directly connects a company's current share price to its earnings power. Investors often rely on the PE ratio to quickly gauge whether a stock’s price reflects its underlying profitability.

What counts as a “normal” or “fair” PE ratio depends on how fast a company is expected to grow and how risky its earnings are. Generally, higher growth and lower risk justify a higher PE ratio, while lower growth or higher risks warrant a lower multiple.

Kinross Gold currently trades at an 18.5x PE ratio. This is slightly below the Metals and Mining industry average of 21.2x and well under its peer group average of 33.7x. These comparisons suggest its stock could be undervalued, but absolute multiples do not tell the whole story.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. Unlike simple benchmarks, the Fair Ratio (20.3x for Kinross Gold) factors in not just earnings growth but also the company’s risk profile, profit margins, market cap, and the unique characteristics of the metals and mining sector. This broader context makes the Fair Ratio a more grounded guide to what is really “fair” for Kinross today.

Comparing Kinross Gold’s actual PE (18.5x) to its Fair Ratio (20.3x), the stock trades at a slight discount, but not dramatically so. With only a modest gap, Kinross Gold appears to be valued about right based on its earnings outlook and risk factors.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kinross Gold Narrative

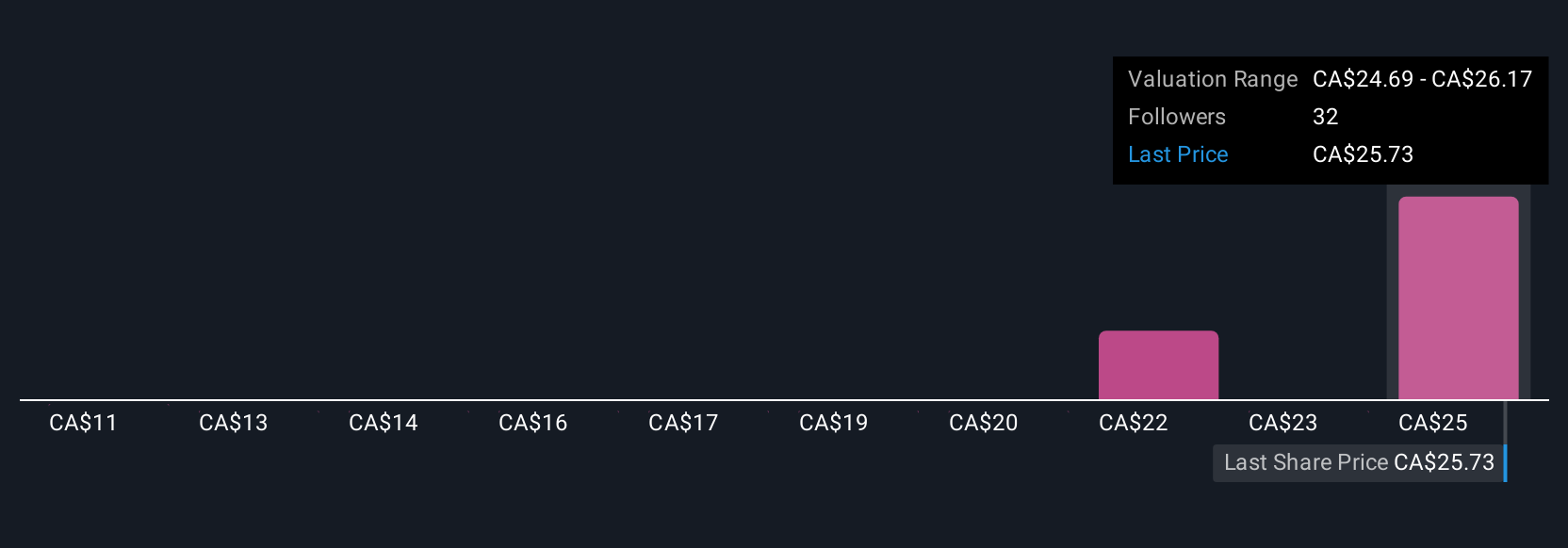

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a clear story you build about a company, tying together your view on its business prospects with a financial forecast and resulting fair value. It's not just about crunching numbers, but about giving those numbers real context by combining your assumptions about revenue, margins, and growth with your confidence in Kinross Gold's story.

Narratives connect the dots between what’s happening in the company, the industry, or the world at large, and what you think Kinross Gold is truly worth. On Simply Wall St’s Community page, millions of investors use Narratives to transparently express their personal forecasts and quickly compare their Fair Value estimates to the current Price, helping them decide when it might be time to buy or sell.

Narratives update automatically as new information such as quarterly results or big news emerges, so you’re always factoring in the latest developments rather than relying on outdated analysis. For example, some investors in Kinross Gold see long-term upside thanks to major mine expansions and sustained gold demand, leading them to set Fair Values as high as CA$29.93. More cautious investors, wary of rising costs and regulatory risks, see Fair Value closer to CA$9.98.

Do you think there's more to the story for Kinross Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives