- Canada

- /

- Metals and Mining

- /

- TSX:JAG

Jaguar Mining Inc. (TSE:JAG) Stock Catapults 33% Though Its Price And Business Still Lag The Industry

The Jaguar Mining Inc. (TSE:JAG) share price has done very well over the last month, posting an excellent gain of 33%. Unfortunately, despite the strong performance over the last month, the full year gain of 3.6% isn't as attractive.

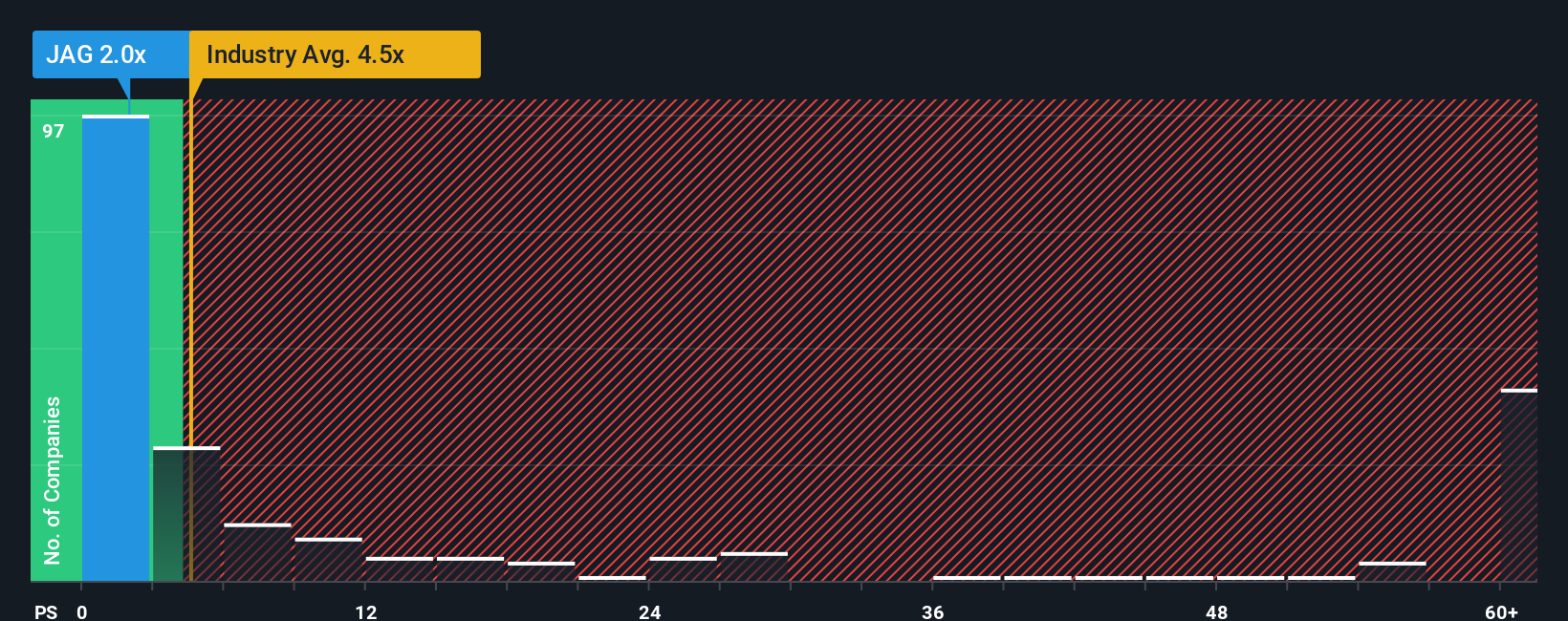

In spite of the firm bounce in price, Jaguar Mining may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 4.5x and even P/S higher than 28x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Jaguar Mining

What Does Jaguar Mining's Recent Performance Look Like?

It looks like revenue growth has deserted Jaguar Mining recently, which is not something to boast about. Perhaps the market believes the recent lacklustre revenue performance is a sign of future underperformance relative to industry peers, hurting the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Jaguar Mining will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Jaguar Mining's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 5.0% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 40% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Jaguar Mining's P/S would sit below the majority of other companies. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Jaguar Mining's P/S Mean For Investors?

Even after such a strong price move, Jaguar Mining's P/S still trails the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's no surprise that Jaguar Mining maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Jaguar Mining that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:JAG

Jaguar Mining

A junior gold mining company, engages in the acquisition, exploration, development, and operation of gold mineral properties in Brazil.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026