- Canada

- /

- Commercial Services

- /

- TSX:CGY

Top TSX Stocks That May Be Undervalued In August 2024

Reviewed by Simply Wall St

As the Canadian market navigates through a period of anticipation driven by global monetary policies, particularly those hinted at during the recent U.S. Federal Reserve symposium in Jackson Hole, investors are keenly observing potential shifts in economic conditions. In this environment, identifying undervalued stocks can be pivotal for building a resilient portfolio, especially when market sentiments are influenced by upcoming policy decisions and rate cut expectations.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$188.76 | CA$358.02 | 47.3% |

| Computer Modelling Group (TSX:CMG) | CA$12.27 | CA$22.24 | 44.8% |

| Kinaxis (TSX:KXS) | CA$156.74 | CA$278.82 | 43.8% |

| Obsidian Energy (TSX:OBE) | CA$9.51 | CA$18.21 | 47.8% |

| Africa Oil (TSX:AOI) | CA$2.03 | CA$3.65 | 44.4% |

| Calibre Mining (TSX:CXB) | CA$2.33 | CA$4.51 | 48.4% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| NFI Group (TSX:NFI) | CA$18.87 | CA$37.15 | 49.2% |

| NanoXplore (TSX:GRA) | CA$2.23 | CA$4.18 | 46.7% |

| TerrAscend (TSX:TSND) | CA$1.64 | CA$2.97 | 44.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

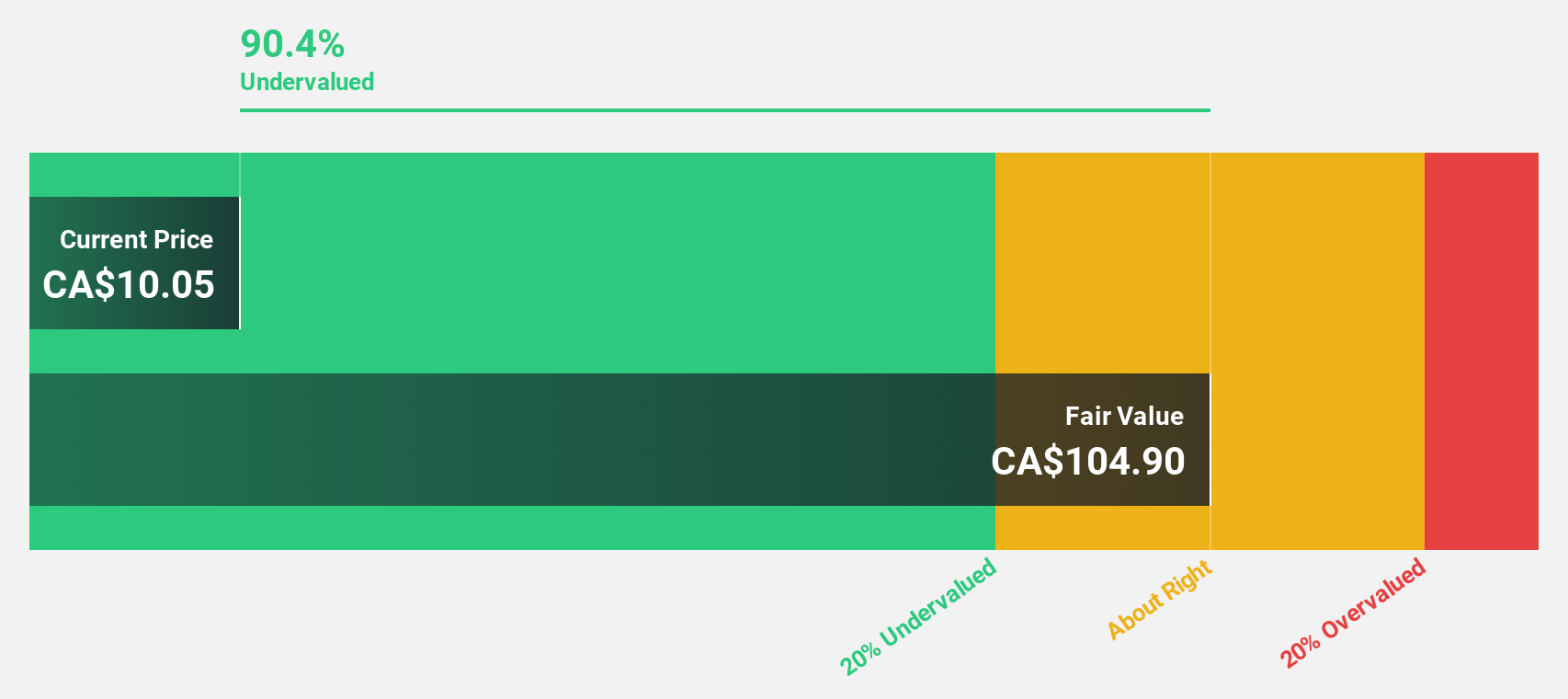

Calian Group (TSX:CGY)

Overview: Calian Group Ltd. offers business services and solutions both in Canada and internationally, with a market cap of CA$536.65 million.

Operations: The company generates revenue from four main segments: ITCS (CA$215.64 million), Health (CA$211.36 million), Learning (CA$106.89 million), and Advanced Technologies (CA$207.51 million).

Estimated Discount To Fair Value: 38.8%

Calian Group Ltd. appears undervalued based on discounted cash flow analysis, trading 38.8% below its estimated fair value of CA$72.99 at CA$44.68 per share. Despite a recent dip in Q3 net income to CA$1.3 million from CA$4.67 million, revenue increased to CA$185 million from last year's CA$166.55 million, with strong future earnings growth forecasted at 35.81% annually over the next three years and reliable dividends enhancing its investment appeal.

- Our expertly prepared growth report on Calian Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Calian Group's balance sheet health report.

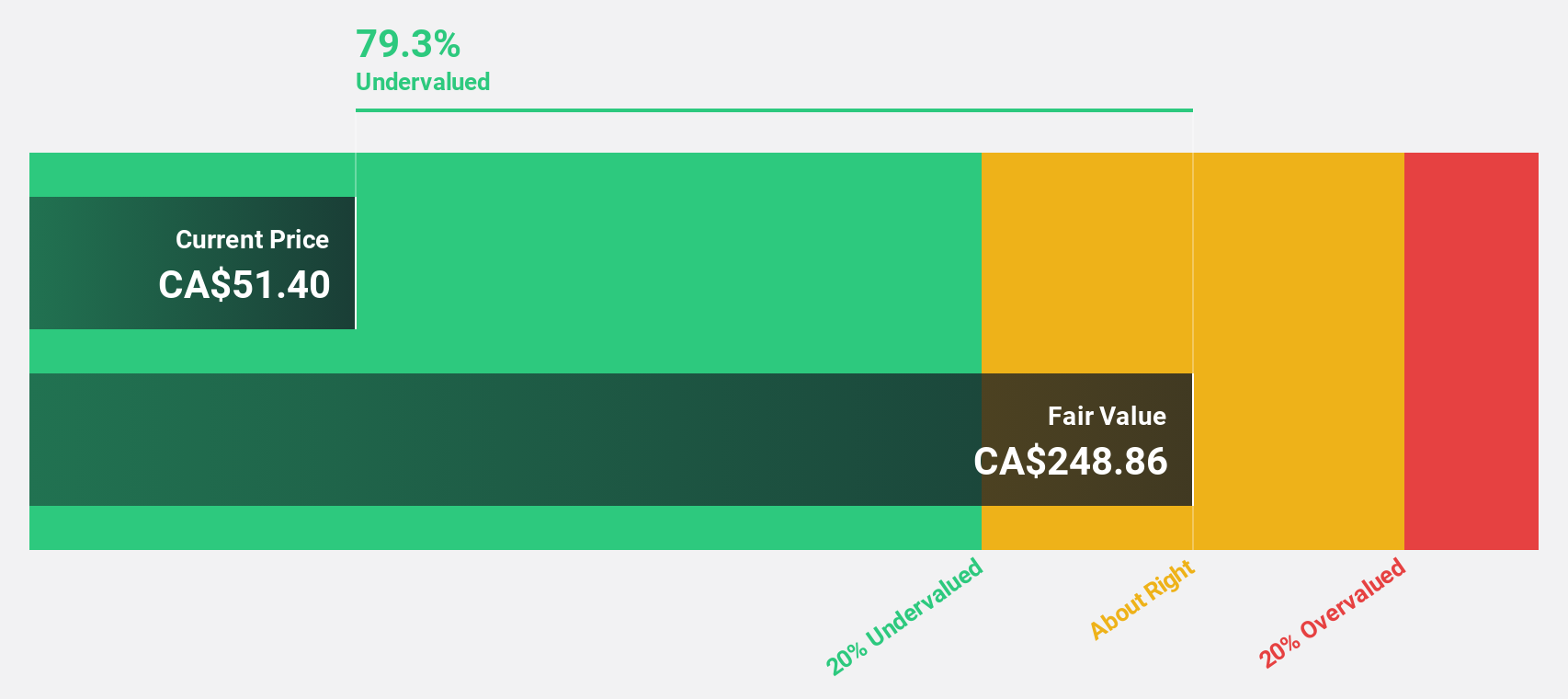

goeasy (TSX:GSY)

Overview: goeasy Ltd. offers non-prime leasing and lending services through its easyhome, easyfinancial, and LendCare brands to Canadian consumers, with a market cap of CA$3.21 billion.

Operations: Revenue Segments (in millions of CA$): Easyhome: 154.10, Easyfinancial: 1240.65

Estimated Discount To Fair Value: 47.3%

goeasy Ltd. is trading at CA$188.76, significantly below its estimated fair value of CA$358.02, indicating it may be undervalued based on cash flows. Recent earnings showed a strong performance with Q2 revenue at CA$377.8 million and net income of CA$65.4 million, up from last year’s figures. Despite high debt levels not well covered by operating cash flow, the company has robust revenue growth forecasts and substantial insider buying, supporting its potential as an undervalued stock in Canada.

- Insights from our recent growth report point to a promising forecast for goeasy's business outlook.

- Get an in-depth perspective on goeasy's balance sheet by reading our health report here.

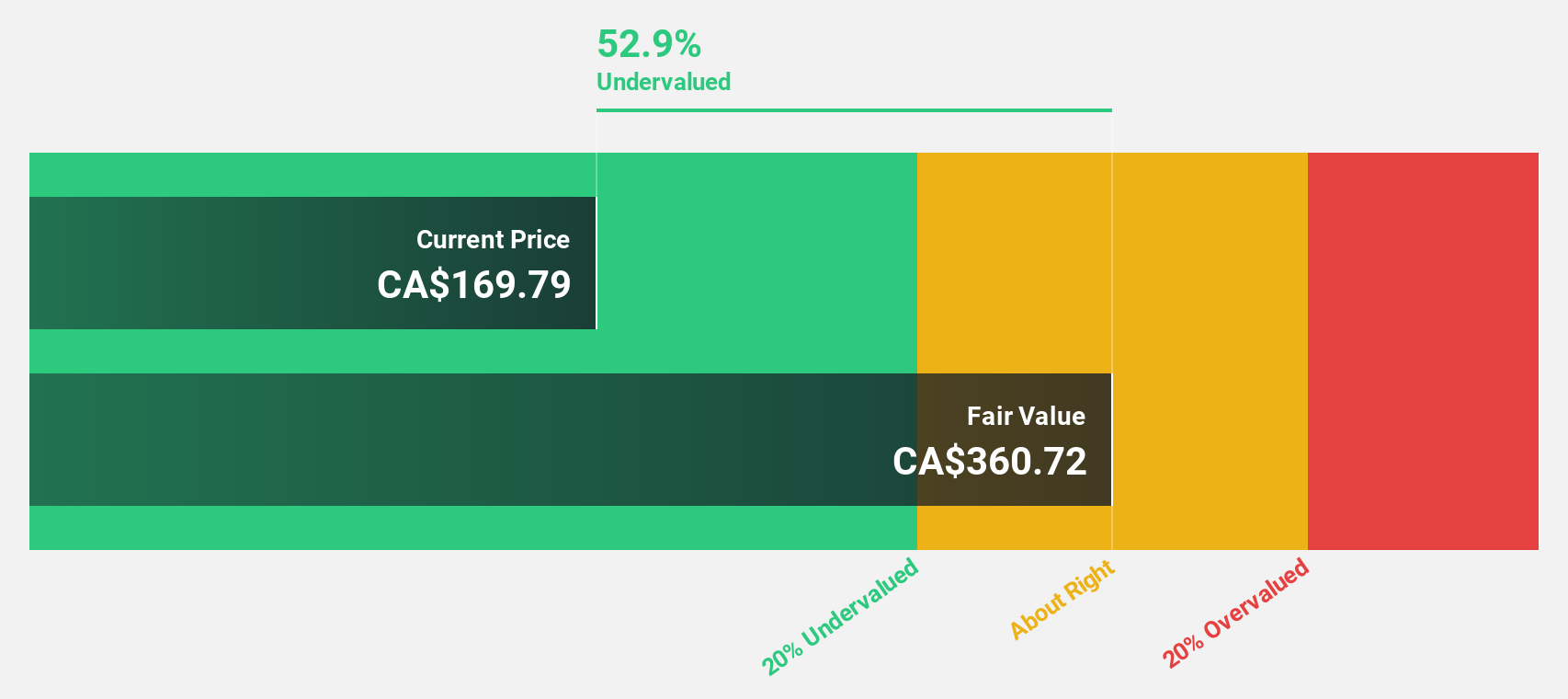

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$25.61 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through the mining, development, and exploration of minerals and precious metals across Africa.

Estimated Discount To Fair Value: 16.3%

Ivanhoe Mines Ltd. is trading at CA$18.99, below its estimated fair value of CA$22.69, suggesting it may be undervalued based on cash flows. Recent earnings showed a decline with Q2 net income at US$76.4 million compared to US$92.04 million last year, but the company’s revenue and earnings are forecasted to grow significantly faster than the Canadian market. The completion of the Phase 3 concentrator at Kamoa-Kakula ahead of schedule is expected to boost production and cash flow substantially in 2024.

- The growth report we've compiled suggests that Ivanhoe Mines' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Ivanhoe Mines.

Seize The Opportunity

- Get an in-depth perspective on all 30 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGY

Calian Group

Provides business services and solutions in Canada and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.