- Canada

- /

- Energy Services

- /

- TSX:TOT

TSX Dividend Stocks Featuring Alaris Equity Partners Income Trust And 2 More

Reviewed by Simply Wall St

As the Canadian market navigates a period of anticipation following the U.S. Federal Reserve's annual symposium in Jackson Hole, investors are keenly watching for cues on potential rate cuts and their implications. In this environment of cautious optimism, dividend stocks offer a compelling option for those seeking stable income and resilience amid market fluctuations.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.31% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 6.99% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.28% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.38% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.49% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.45% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.22% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.57% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.63% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.23% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

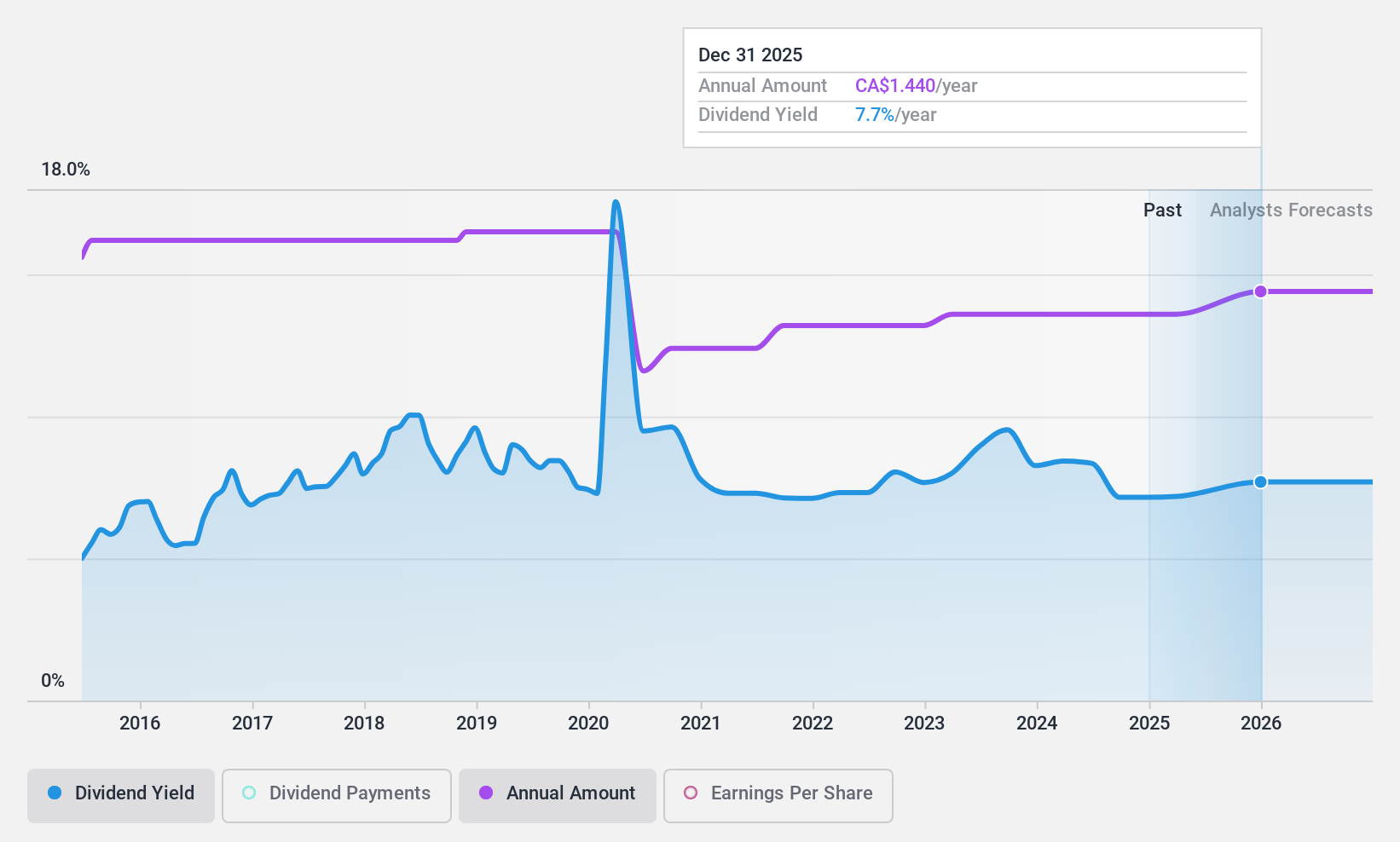

Alaris Equity Partners Income Trust (TSX:AD.UN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Alaris Equity Partners Income Trust is a private equity firm that focuses on management buyouts, growth capital, lower and middle market investments, later stage ventures, industry consolidation, and mature investments with a market cap of CA$757.54 million.

Operations: Alaris Equity Partners Income Trust generates revenue from unclassified services amounting to CA$215.71 million.

Dividend Yield: 8.3%

Alaris Equity Partners Income Trust offers a high dividend yield of 8.29%, placing it in the top 25% of Canadian dividend payers. Despite this, its dividend history has been volatile and unreliable over the past decade, with payments falling significantly at times. Recent earnings reports show mixed results: while net income rose to CAD 31.68 million in Q2 2024 from CAD 28.39 million a year ago, revenue declined from CAD 46.84 million to CAD 28.5 million over the same period.

- Unlock comprehensive insights into our analysis of Alaris Equity Partners Income Trust stock in this dividend report.

- Our expertly prepared valuation report Alaris Equity Partners Income Trust implies its share price may be lower than expected.

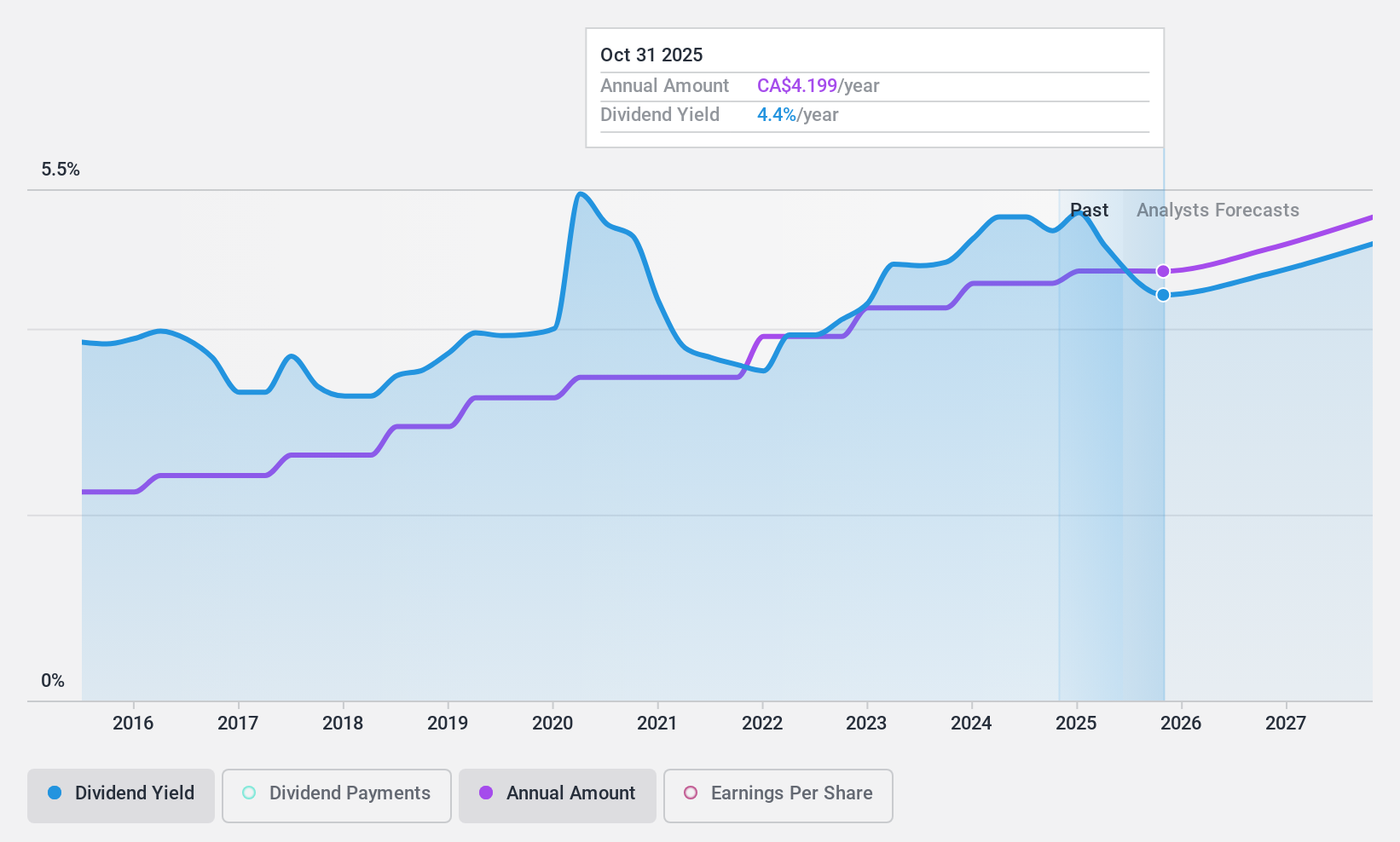

Toronto-Dominion Bank (TSX:TD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Toronto-Dominion Bank, along with its subsidiaries, offers a range of financial products and services in Canada, the United States, and internationally, with a market cap of CA$139.53 billion.

Operations: Toronto-Dominion Bank generates revenue from several segments, including CA$17.77 billion from Canadian Personal and Commercial Banking, CA$12.75 billion from U.S. Retail, CA$12.20 billion from Wealth Management and Insurance, CA$6.76 billion from Wholesale Banking, and CA$1.19 billion from Corporate operations.

Dividend Yield: 5.1%

Toronto-Dominion Bank's dividend yield of 5.08% is below the top quartile of Canadian dividend payers and its high payout ratio (92.7%) raises sustainability concerns. Despite stable and growing dividends over the past decade, recent financial results show a net loss of CAD 181 million for Q3 2024, compared to a net income of CAD 2.88 billion last year, impacting profit margins significantly. However, earnings are forecasted to cover dividends in three years with a projected payout ratio of 51%.

- Delve into the full analysis dividend report here for a deeper understanding of Toronto-Dominion Bank.

- Our comprehensive valuation report raises the possibility that Toronto-Dominion Bank is priced higher than what may be justified by its financials.

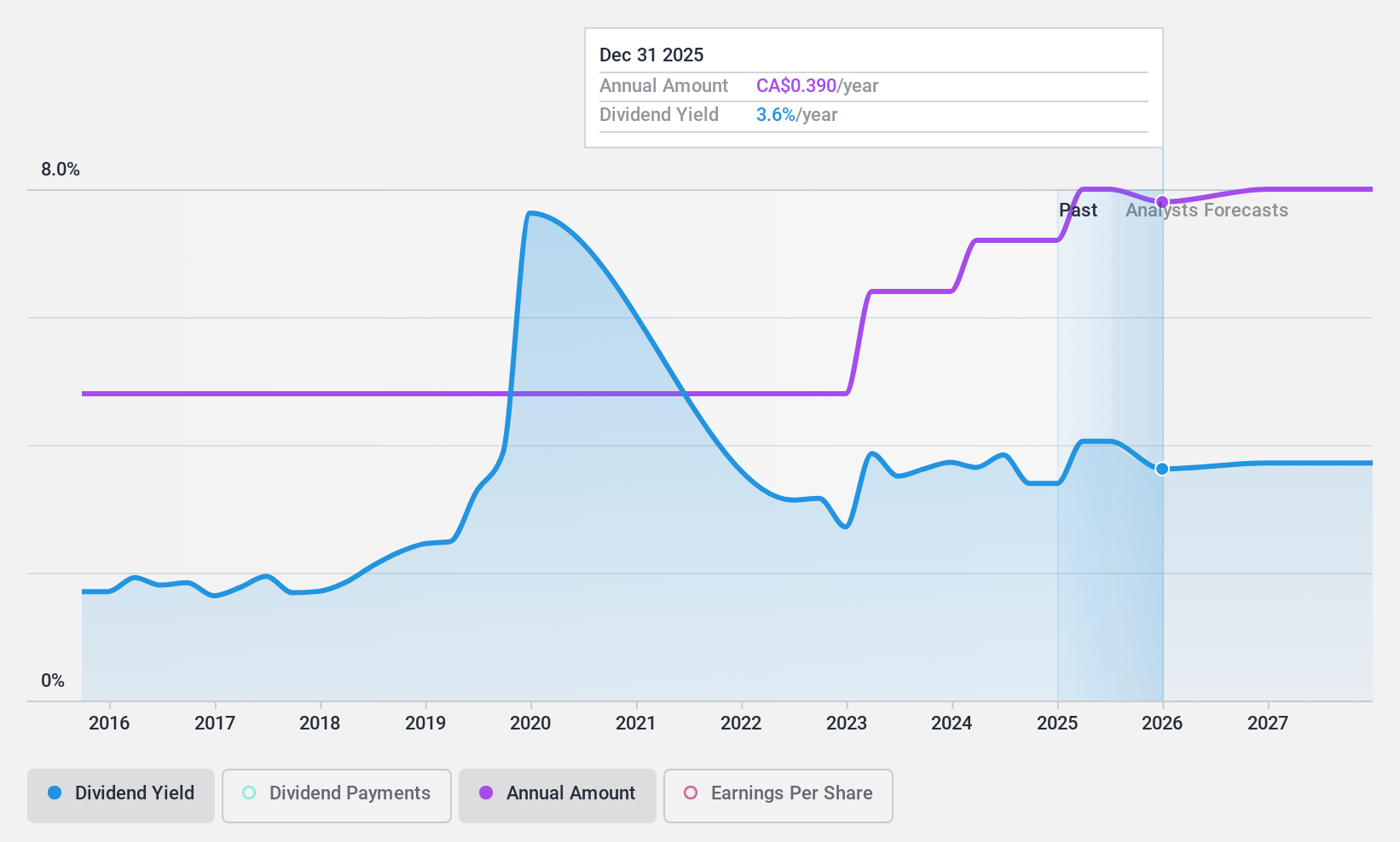

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company operating in Canada, the United States, and Australia with a market cap of CA$382.68 million.

Operations: Total Energy Services Inc.'s revenue segments include Well Servicing (CA$89.94 million), Contract Drilling Services (CA$299.62 million), Compression and Process Services (CA$393.38 million), and Rentals and Transportation Services (CA$80.86 million).

Dividend Yield: 3.7%

Total Energy Services has a low payout ratio of 32%, indicating dividends are well covered by earnings. However, its dividend history is volatile with payments decreasing more than 20% annually at times. Despite a below-market P/E ratio of 9x, recent financials show improved performance with Q2 net income rising to CAD 15.47 million from CAD 6.2 million last year. The current dividend yield of 3.68% is lower than the top Canadian payers' average of 6.08%.

- Click here to discover the nuances of Total Energy Services with our detailed analytical dividend report.

- Our expertly prepared valuation report Total Energy Services implies its share price may be too high.

Where To Now?

- Delve into our full catalog of 34 Top TSX Dividend Stocks here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Total Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOT

Total Energy Services

Operates as an energy services company primarily in Canada, the United States, and Australia.

Flawless balance sheet average dividend payer.