- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines (TSX:IVN) Valuation in Focus Following Q3 2025 Earnings Update

Reviewed by Simply Wall St

Ivanhoe Mines (TSX:IVN) just released its earnings for the third quarter and the first nine months of 2025, drawing attention for the sharp contrasts in year-on-year net income and earnings per share results.

See our latest analysis for Ivanhoe Mines.

Following these headline results, Ivanhoe Mines’ share price has experienced some volatility, down 14.6% over the past month and off 25% year-to-date. However, it is still sitting on a 122% total return for investors over five years, highlighting both the stock’s high-growth potential and pronounced cyclical swings. The recent step-back in price likely reflects shifting market sentiment around risk, even as long-term holders remain well in the green.

If you’re curious about what other fast-moving opportunities might be out there, now’s the time to broaden your search and discover fast growing stocks with high insider ownership

With strong revenue growth but a recent pullback in price, is Ivanhoe Mines now trading below its true value, or is the market accurately factoring in its future prospects? Could this be a buying opportunity, or is everything priced in?

Most Popular Narrative: 30% Undervalued

Ivanhoe Mines’ most popular narrative signals that, compared to its fair value estimate, the recent closing price of CA$12.91 leaves significant room for upside according to bullish consensus. The stage is set by high confidence among analysts, based on project ramp-ups, margin improvements, and robust copper market fundamentals.

“New project ramp-ups and expansions are set to drive significant revenue growth and margin improvement through higher production and lower costs. Diversification, ongoing resource expansion, and strong copper market fundamentals position the company for sustained, long-term organic growth.”

What is powering such a compelling gap between price and value? The narrative leans heavily on eye-catching projections, including rapid earnings growth, margin evolution, and bold production expectations. Want the precise financial targets and ambitious assumptions behind this outlook? Click through and see what sets this valuation apart.

Result: Fair Value of $18.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent operational disruptions and pressure from volatile copper prices could quickly challenge even the most optimistic analyst forecasts for Ivanhoe Mines.

Find out about the key risks to this Ivanhoe Mines narrative.

Another View: Are Multiples Sending a Mixed Signal?

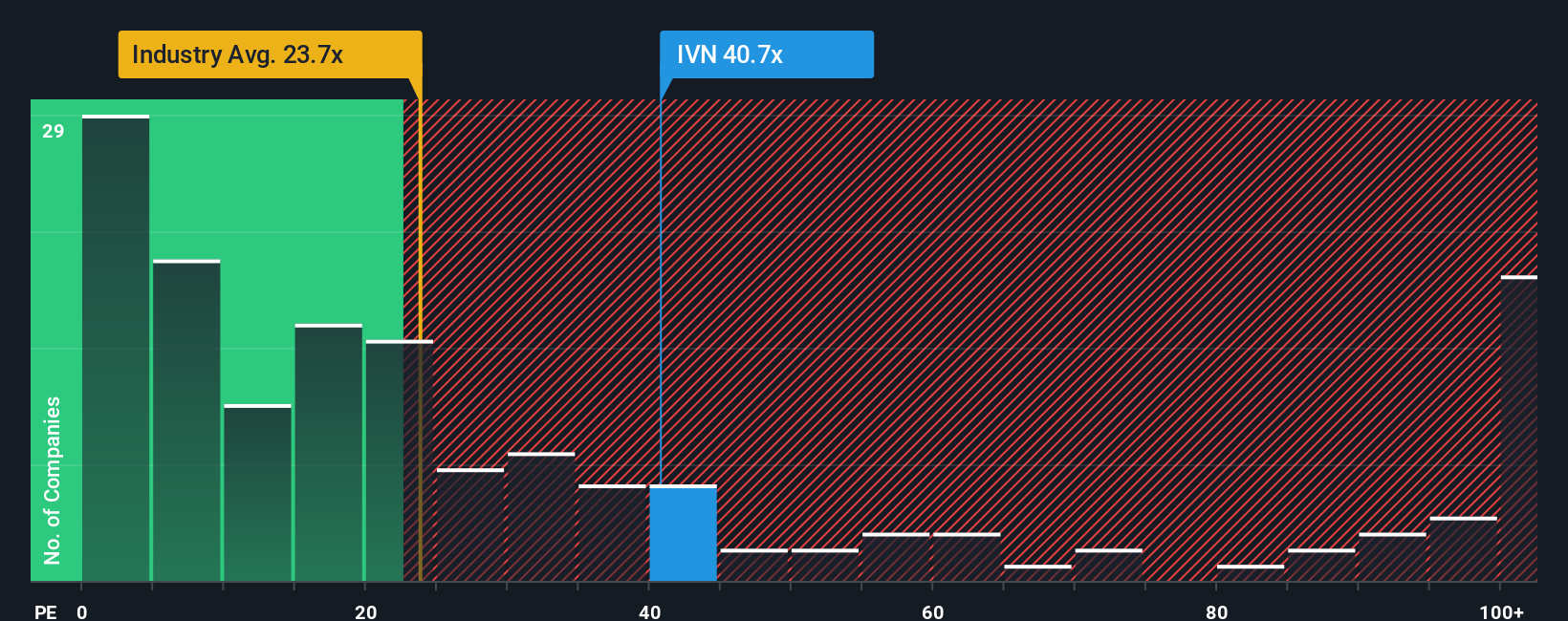

While analyst models see Ivanhoe Mines as undervalued, the current price-to-earnings ratio of 42.4x looks meaningfully higher than the industry average of 20.4x and even above the fair ratio of 29.7x. This premium suggests investors are paying up for growth, but does the stock deserve that confidence, or could a pullback follow if forecasts waver?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ivanhoe Mines Narrative

Keep in mind, if you're not aligned with the prevailing outlook or want to dive into the numbers first-hand, you can easily craft your own take right now in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ivanhoe Mines.

Looking for More Investment Ideas?

Capitalize on opportunities thousands of investors are tracking right now. Expand your investing toolkit and don’t let major trends pass you by. These screens highlight unique angles that could give you an edge:

- Uncover high yields and stable growth potential by reviewing these 20 dividend stocks with yields > 3% for businesses with strong, consistent payouts.

- Catch the next wave in tech by assessing these 26 AI penny stocks set to benefit from advances in artificial intelligence across major industries.

- Seize early potential by targeting these 3606 penny stocks with strong financials that exhibit robust financials and real momentum, before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives