- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Did Platreef Mine’s Grand Opening Just Shift Ivanhoe Mines’ (TSX:IVN) Investment Narrative?

Reviewed by Sasha Jovanovic

- On November 18, 2025, Ivanhoe Mines celebrated the official opening of the Platreef platinum-palladium-nickel-rhodium-gold-copper mine in Mokopane, South Africa, at a ceremony attended by President Cyril Ramaphosa and more than 2,000 guests.

- The launch marks the commencement of what is expected to be Africa's largest precious metals mine, enhancing Ivanhoe's regional presence and promising to deliver substantial local employment and empowerment opportunities.

- We’ll now explore how the Platreef Mine’s operational start and production ramp-up could influence Ivanhoe Mines’ investment outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ivanhoe Mines Investment Narrative Recap

To be a shareholder in Ivanhoe Mines, you have to believe in the company’s ability to deliver consistent project execution across multiple jurisdictions, supported by commodity demand for copper and platinum group metals. The recent official start of production at Platreef is clearly a short-term catalyst, confirming progress toward new, high-margin revenue streams; however, the ramp-up phase will still test operational reliability, while Kamoa-Kakula’s recovery from 2025’s seismic disruption remains the most important near-term risk for financial performance. The immediate impact of the Platreef opening on these core issues is not material, but steady operational advances could help offset future volatility.

One recent announcement of particular relevance is Ivanhoe’s update on equipping Shaft #3 at Platreef, which is on track for a major capacity boost by March 2026. This expansion aligns with key production targets and will be central to the company’s ability to achieve scale from Platreef within the expected timeframe, potentially strengthening Ivanhoe’s position against ongoing operational risks like those faced at Kamoa-Kakula.

In contrast, investors should be aware of persistent risks around operational disruptions in the DRC and South Africa...

Read the full narrative on Ivanhoe Mines (it's free!)

Ivanhoe Mines is expected to generate $1.1 billion in revenue and $805.9 million in earnings by 2028. This outlook assumes a 73.9% annual revenue growth rate and a $414.8 million increase in earnings from the current level of $391.1 million.

Uncover how Ivanhoe Mines' forecasts yield a CA$18.40 fair value, a 46% upside to its current price.

Exploring Other Perspectives

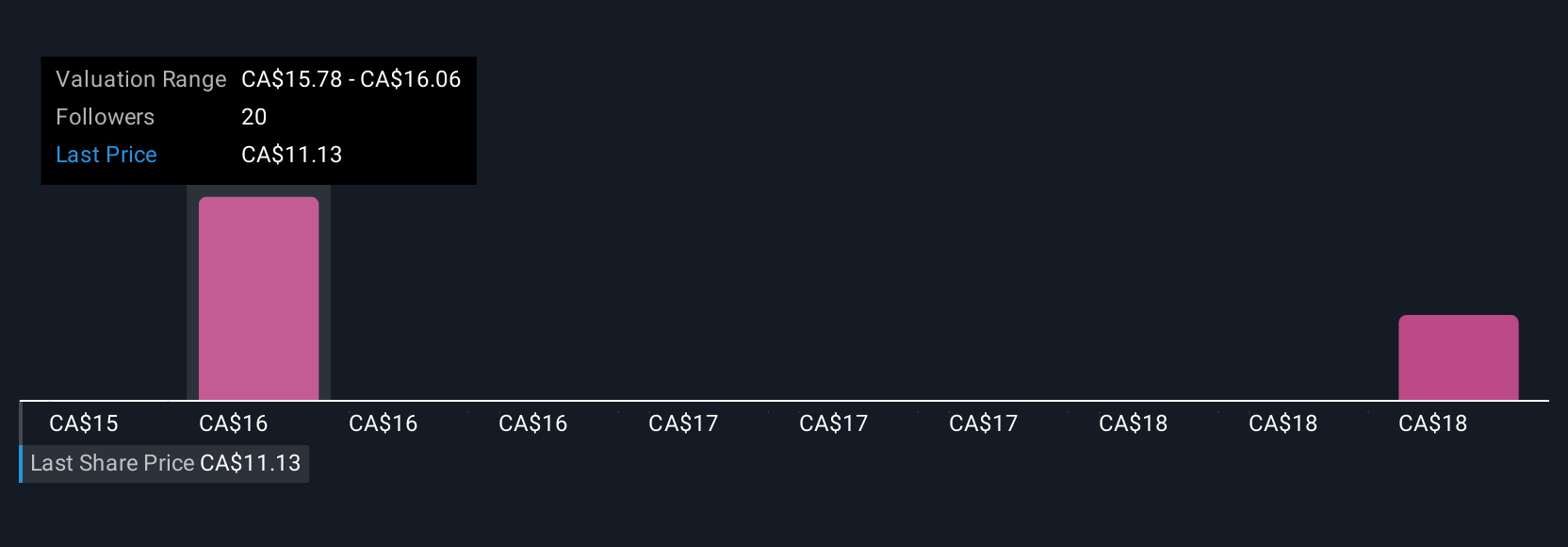

Three members of the Simply Wall St Community independently estimate Ivanhoe Mines’ fair value between CA$12.02 and CA$20.66 per share. Amid this wide range of views, keep in mind that successful ramp-up at new mines is a live issue affecting future returns, so consider multiple perspectives before making any decisions.

Explore 3 other fair value estimates on Ivanhoe Mines - why the stock might be worth as much as 64% more than the current price!

Build Your Own Ivanhoe Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ivanhoe Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ivanhoe Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ivanhoe Mines' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives