- Canada

- /

- Metals and Mining

- /

- TSX:IMG

Share Buyback and Mixed Q3 Results Could Be a Game Changer for IAMGOLD (TSX:IMG)

Reviewed by Sasha Jovanovic

- On November 4, 2025, IAMGOLD Corporation announced the launch of a share repurchase program for up to 10% of its outstanding common shares, contingent on TSX approval, and released its third quarter results, reporting sales of US$706.7 million and net income of US$139.4 million for the period.

- The news highlighted a significant increase in sales year-over-year, but net income and earnings per share from continuing operations were lower compared to the same quarter in the previous year.

- We’ll examine how the launch of a major share buyback could impact IAMGOLD's investment narrative and capital return outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

IAMGOLD Investment Narrative Recap

To own shares in IAMGOLD, you need confidence in the company’s ability to ramp up high-impact assets like Côté Gold, optimize costs, and convert rising production into sustainable earnings growth. The recent share buyback announcement is unlikely to materially affect near-term catalysts such as the operational ramp-up at Côté Gold or the primary risk related to concentrated asset exposure and cost inflation. Instead, it signals a commitment to shareholder returns after completing key debt repayments.

Of the company’s latest news, the share repurchase program stands out for its potential to alter capital return expectations, especially as IAMGOLD pivots to a period of stronger operating cash flow. While this move could be perceived as a sign of balance sheet strength, it does not directly address the main short-term opportunity, which remains the continued ramp-up, cost performance, and production reliability at Côté Gold, core factors likely to shape financial outcomes over the coming quarters.

However, investors should also be aware that ongoing reliance on a handful of key mines can leave IAMGOLD vulnerable if ...

Read the full narrative on IAMGOLD (it's free!)

IAMGOLD's narrative projects $2.5 billion in revenue and $553.7 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $245 million decrease in earnings from the current $798.7 million.

Uncover how IAMGOLD's forecasts yield a CA$23.79 fair value, a 40% upside to its current price.

Exploring Other Perspectives

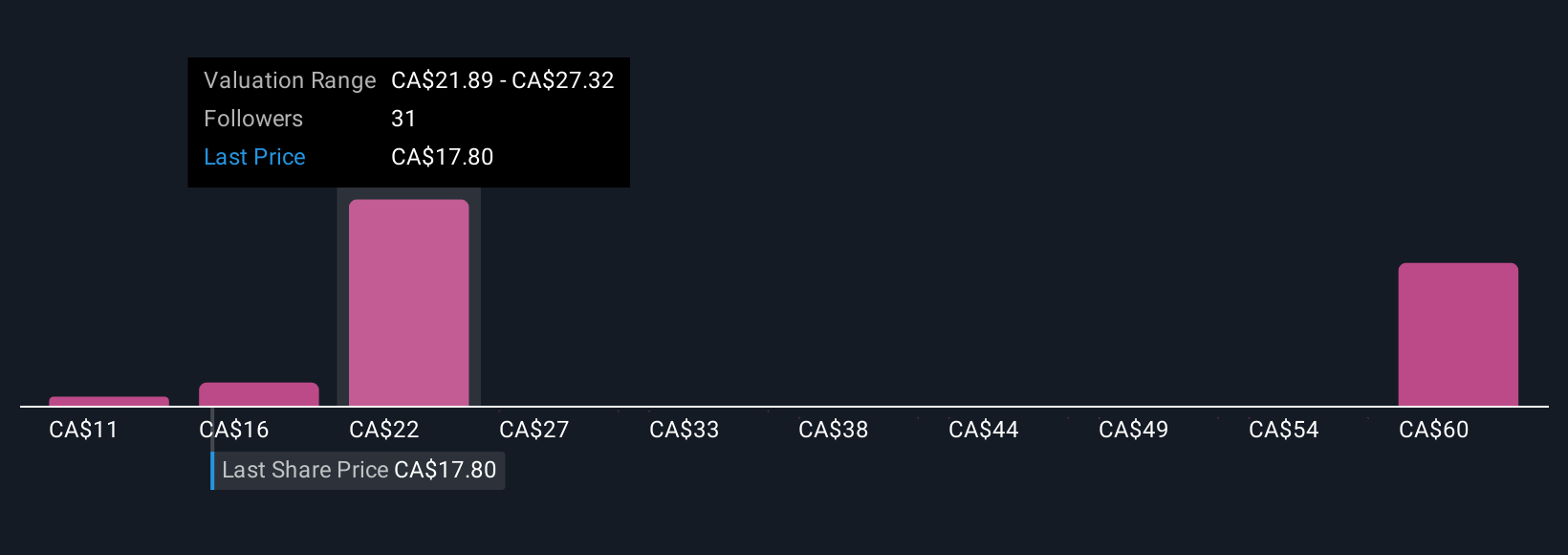

Simply Wall St Community members value IAMGOLD shares from US$11.04 to US$65.68 based on 12 separate forecasts. While optimism about Côté Gold’s ramp-up fuels future growth expectations, concentrated asset risk could shape outcomes for many shareholders.

Explore 12 other fair value estimates on IAMGOLD - why the stock might be worth over 3x more than the current price!

Build Your Own IAMGOLD Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IAMGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free IAMGOLD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IAMGOLD's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives