- Canada

- /

- Metals and Mining

- /

- TSX:III

These 4 Measures Indicate That Imperial Metals (TSE:III) Is Using Debt Extensively

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Imperial Metals Corporation (TSE:III) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

What Is Imperial Metals's Net Debt?

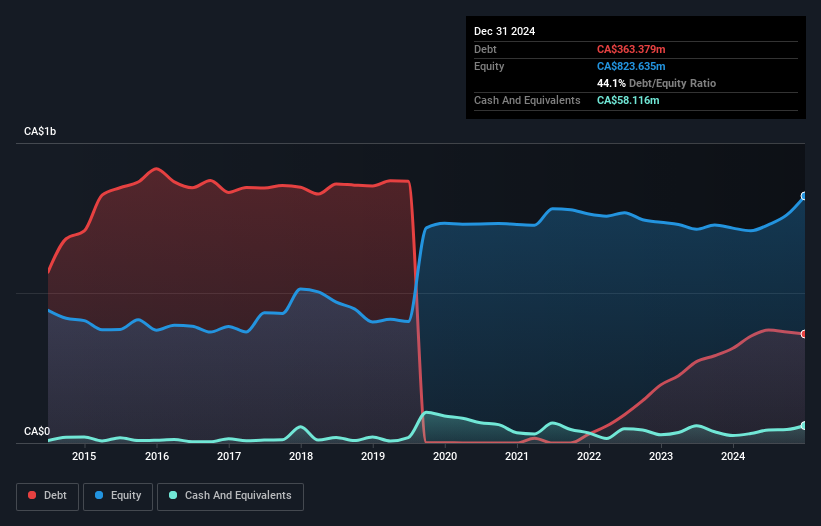

As you can see below, at the end of December 2024, Imperial Metals had CA$363.4m of debt, up from CA$315.8m a year ago. Click the image for more detail. However, because it has a cash reserve of CA$58.1m, its net debt is less, at about CA$305.3m.

How Healthy Is Imperial Metals' Balance Sheet?

We can see from the most recent balance sheet that Imperial Metals had liabilities of CA$377.3m falling due within a year, and liabilities of CA$457.0m due beyond that. Offsetting this, it had CA$58.1m in cash and CA$30.1m in receivables that were due within 12 months. So it has liabilities totalling CA$746.0m more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CA$492.3m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Imperial Metals would likely require a major re-capitalisation if it had to pay its creditors today.

See our latest analysis for Imperial Metals

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Looking at its net debt to EBITDA of 1.5 and interest cover of 4.0 times, it seems to us that Imperial Metals is probably using debt in a pretty reasonable way. So we'd recommend keeping a close eye on the impact financing costs are having on the business. We also note that Imperial Metals improved its EBIT from a last year's loss to a positive CA$141m. When analysing debt levels, the balance sheet is the obvious place to start. But it is Imperial Metals's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it is important to check how much of its earnings before interest and tax (EBIT) converts to actual free cash flow. Considering the last year, Imperial Metals actually recorded a cash outflow, overall. Debt is far more risky for companies with unreliable free cash flow, so shareholders should be hoping that the past expenditure will produce free cash flow in the future.

Our View

To be frank both Imperial Metals's level of total liabilities and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But on the bright side, its net debt to EBITDA is a good sign, and makes us more optimistic. Overall, it seems to us that Imperial Metals's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. Given the risks around Imperial Metals's use of debt, the sensible thing to do is to check if insiders have been unloading the stock.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:III

Imperial Metals

Engages in the exploration, development, and production of base and precious metals in the United States, Switzerland, China, the Philippines, Singapore, and Canada.

Solid track record and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026