- Canada

- /

- Metals and Mining

- /

- TSX:IAU

Investors Appear Satisfied With i-80 Gold Corp.'s (TSE:IAU) Prospects As Shares Rocket 34%

The i-80 Gold Corp. (TSE:IAU) share price has done very well over the last month, posting an excellent gain of 34%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

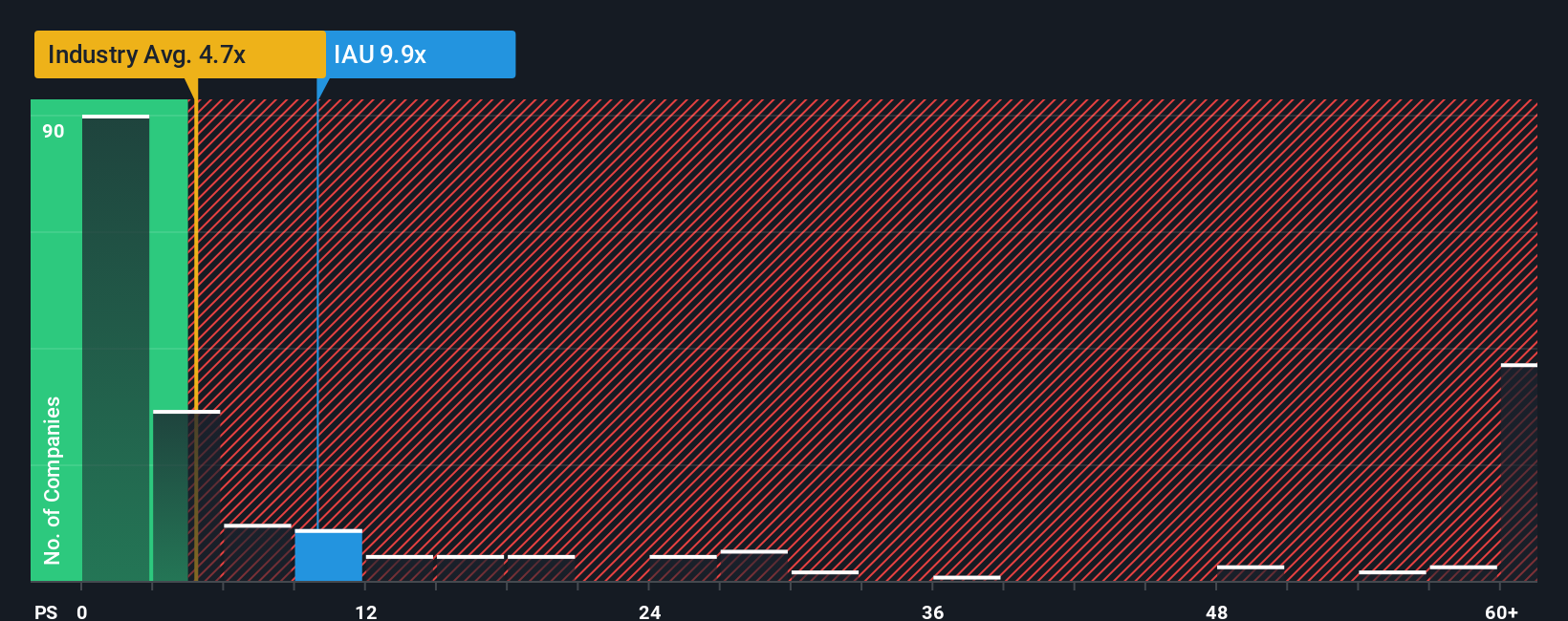

After such a large jump in price, i-80 Gold may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 9.9x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios under 4.7x and even P/S lower than 2x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for i-80 Gold

How i-80 Gold Has Been Performing

There hasn't been much to differentiate i-80 Gold's and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on i-80 Gold will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, i-80 Gold would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 40%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 74% per year as estimated by the three analysts watching the company. With the industry only predicted to deliver 45% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why i-80 Gold is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

i-80 Gold's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into i-80 Gold shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with i-80 Gold, and understanding these should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if i-80 Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IAU

i-80 Gold

A mining company, explores for, develops, and produces gold, silver, and polymetallic deposits in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives