- Canada

- /

- Metals and Mining

- /

- TSX:ERD

TSX Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As the Canadian economy experiences a contraction, contrasting with the U.S.'s steady growth, investors are closely watching potential monetary easing from the Bank of Canada. This shifting landscape has sparked renewed interest in areas of the market that were previously overlooked. Penny stocks, often representing smaller or newer companies, continue to offer intriguing opportunities for those looking beyond established names. By focusing on financial strength and growth potential, these stocks can present valuable prospects for investors seeking under-the-radar companies with promising futures.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.20 | CA$55.63M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$22.05M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.29 | CA$2.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.295 | CA$45.81M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.20 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.01 | CA$20.02M | ✅ 2 ⚠️ 4 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.26 | CA$361.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.05 | CA$207.08M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$187.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.455 | CA$5.35M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 407 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Erdene Resource Development (TSX:ERD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erdene Resource Development Corporation is engaged in the exploration and development of precious and base metal deposits in Mongolia, with a market cap of CA$468.78 million.

Operations: Erdene Resource Development Corporation does not report any revenue segments.

Market Cap: CA$468.78M

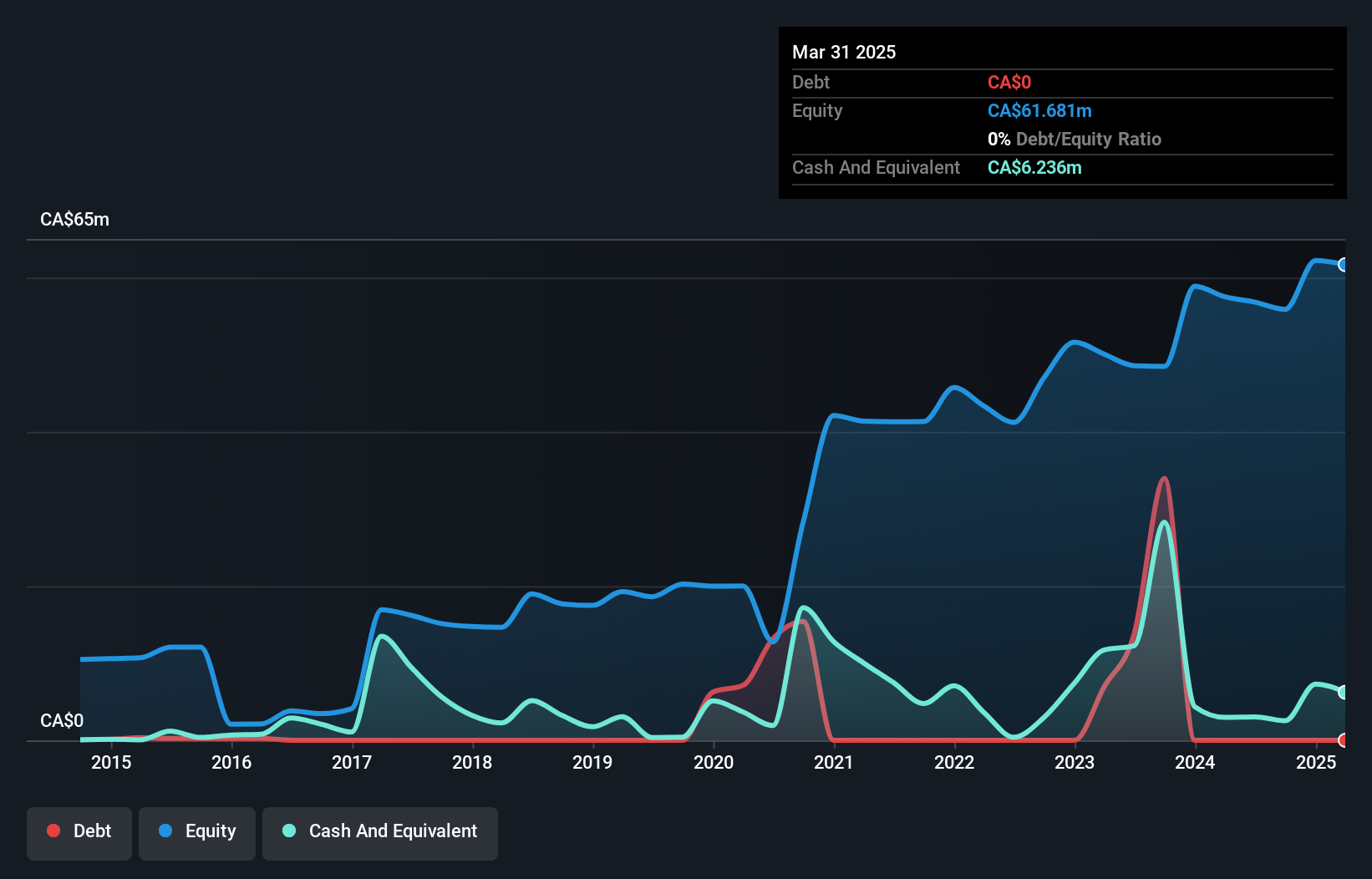

Erdene Resource Development Corporation, engaged in Mongolian mineral exploration, remains pre-revenue with a market cap of CA$468.78 million. Despite being unprofitable, the company is debt-free and has reduced losses over five years by 9.1% annually. Recent strategic moves include an option agreement to acquire up to 80% of the Tereg Uul copper-gold prospect, requiring significant investment but potentially enhancing future prospects. The board and management are seasoned with extensive tenures averaging over nine years, contributing stability amid its cash runway exceeding a year based on current free cash flow levels.

- Dive into the specifics of Erdene Resource Development here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Erdene Resource Development's track record.

G2 Goldfields (TSX:GTWO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: G2 Goldfields Inc. focuses on acquiring and exploring mineral properties in Canada and Guyana, with a market capitalization of CA$752.35 million.

Operations: The company generates revenue primarily from its mineral exploration activities, amounting to CA$0.63 million.

Market Cap: CA$752.35M

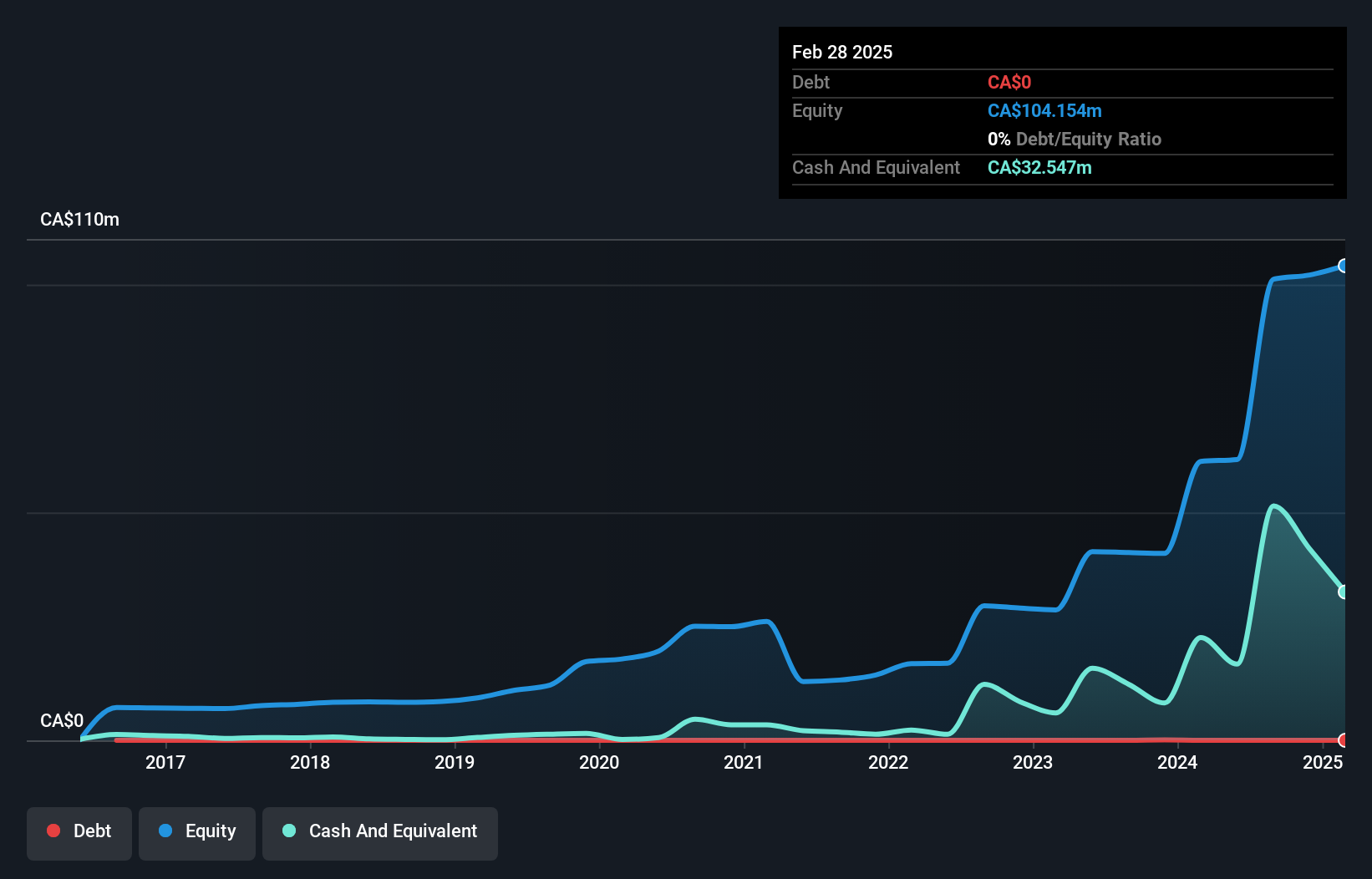

G2 Goldfields Inc. is pre-revenue with a market capitalization of CA$752.35 million, focusing on mineral exploration in Canada and Guyana. The company recently secured two Large Scale Prospecting Licenses for its high-grade Oko-Ghanie Gold Deposit, enhancing its exploration potential in Guyana. Despite being debt-free and having short-term assets exceeding liabilities, G2 faces financial challenges with less than a year of cash runway and increasing losses over the past five years at 3.9% annually. However, revenue is forecast to grow significantly at 92.97% per year, indicating potential future growth prospects despite current unprofitability.

- Take a closer look at G2 Goldfields' potential here in our financial health report.

- Explore G2 Goldfields' analyst forecasts in our growth report.

Quarterhill (TSX:QTRH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quarterhill Inc. operates in the intelligent transportation systems sector both in Canada and internationally, with a market cap of CA$126.21 million.

Operations: The company generates revenue of $153.86 million from its intelligent transportation systems segment.

Market Cap: CA$126.21M

Quarterhill Inc. operates in the intelligent transportation systems sector with a market cap of CA$126.21 million and generates revenue of $153.86 million, indicating it is not pre-revenue. The company recently expanded its international footprint with new contracts in Djibouti, Thailand, and South Korea, showcasing the effectiveness of its technology in high-traffic environments. Despite being unprofitable and having an inexperienced board and management team, Quarterhill's short-term assets exceed both short-term and long-term liabilities. Recent strategic workforce reductions aim to reduce costs by US$12 million annually, potentially accelerating progress toward positive cash flow outcomes.

- Unlock comprehensive insights into our analysis of Quarterhill stock in this financial health report.

- Assess Quarterhill's future earnings estimates with our detailed growth reports.

Taking Advantage

- Take a closer look at our TSX Penny Stocks list of 407 companies by clicking here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Erdene Resource Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERD

Erdene Resource Development

Focuses on the exploration and development of precious and base metal deposits in Mongolia.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives