Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSXV:EMX

NanoXplore And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The TSX has been experiencing a strong year, with gains surpassing 17%, reflecting a broader trend of market strength driven by a growing economy, favorable interest-rate policies, and rising corporate profits. Despite their vintage label, penny stocks remain an intriguing investment area for those seeking opportunities beyond the mainstream. These typically smaller or newer companies can offer surprising value and growth potential when backed by solid financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

NanoXplore (TSX:GRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for industrial markets in Australia, with a market cap of CA$452.11 million.

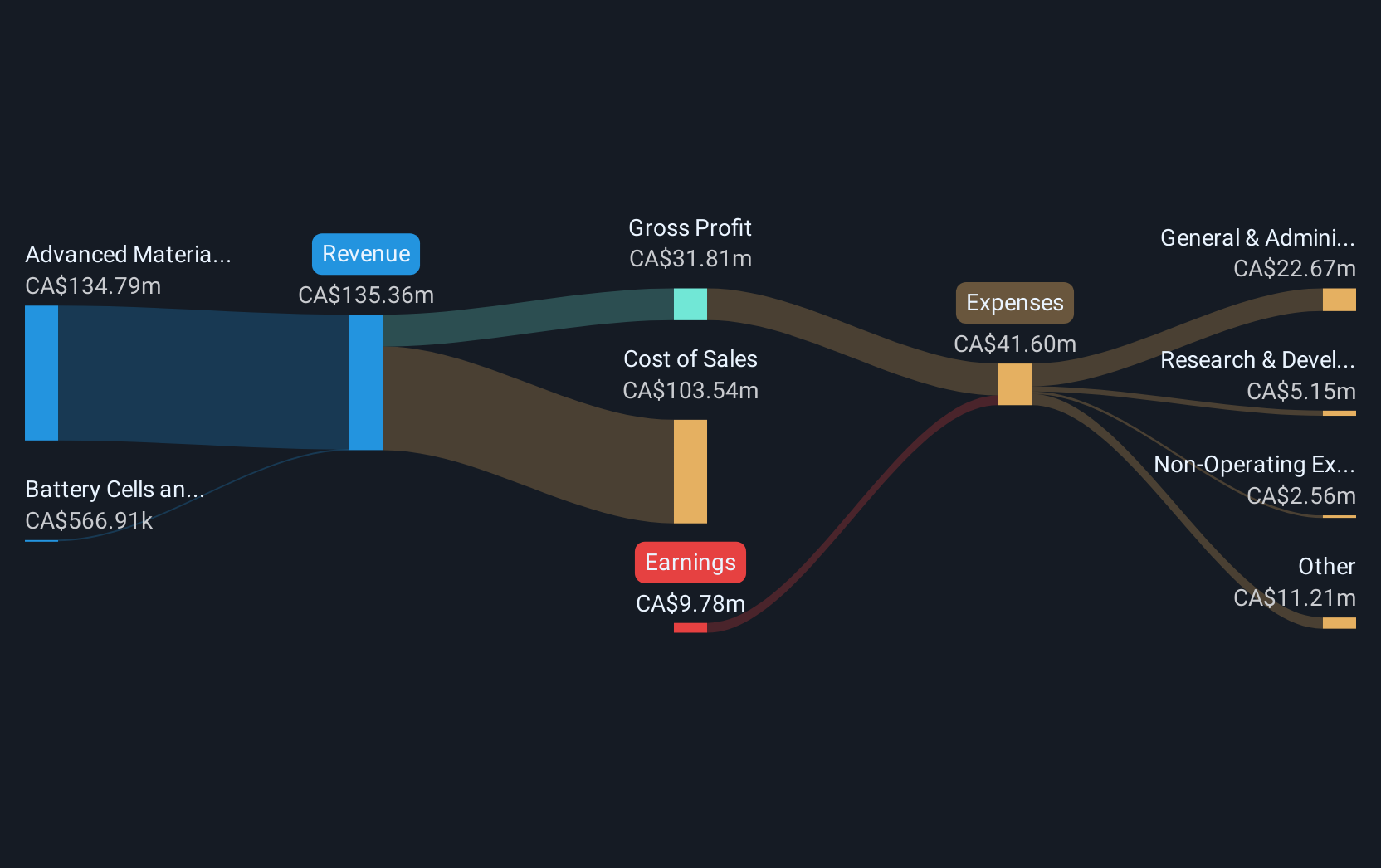

Operations: The company's revenue is primarily derived from its Advanced Materials, Plastics and Composite Products segment, which generated CA$129.96 million, while the Battery Cells segment contributed CA$0.03 million.

Market Cap: CA$452.11M

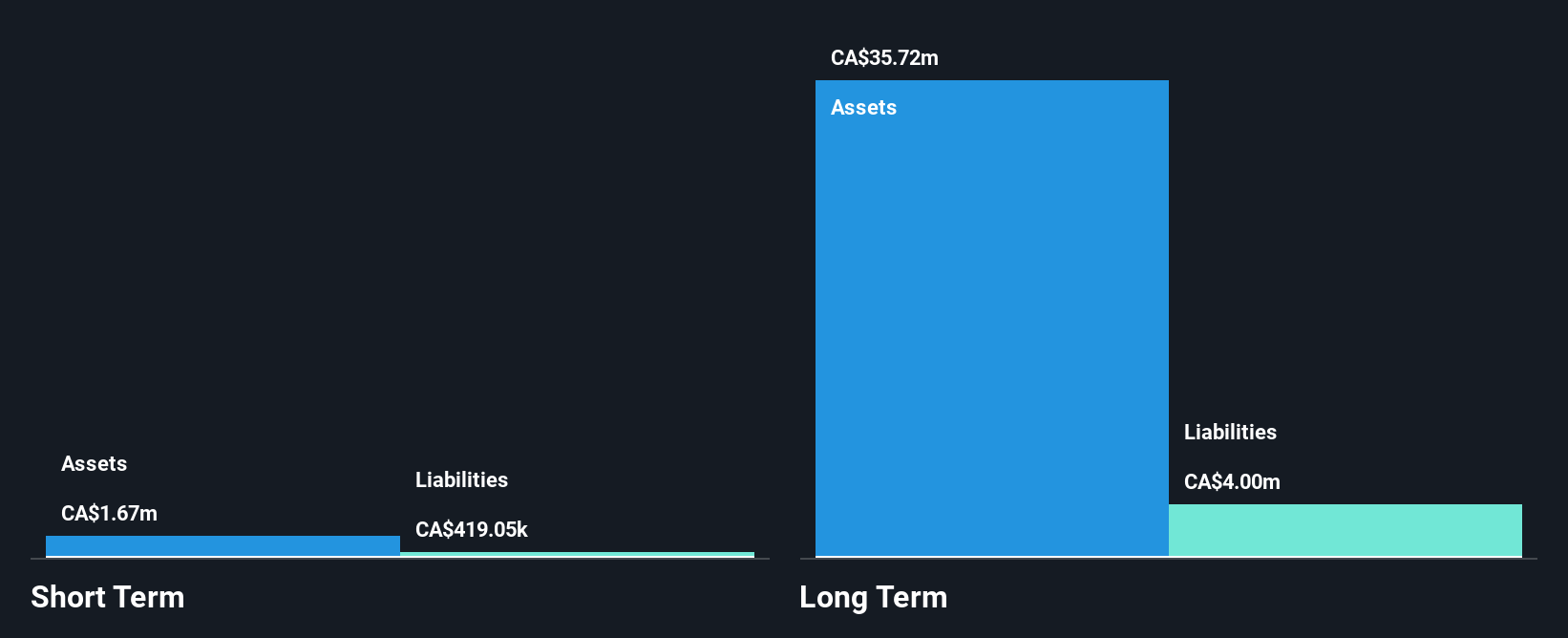

NanoXplore Inc., with a market cap of CA$452.11 million, operates in the graphene sector and reported revenues of CA$129.99 million for the fiscal year ending June 2024, slightly up from the previous year. Despite being unprofitable with a net loss of CA$11.67 million, it maintains a strong financial position as its short-term assets exceed both short and long-term liabilities. The company has more cash than total debt and has not diluted shareholders recently. However, its negative return on equity highlights ongoing profitability challenges despite forecasts predicting significant earnings growth annually at 72.55%.

- Click here to discover the nuances of NanoXplore with our detailed analytical financial health report.

- Understand NanoXplore's earnings outlook by examining our growth report.

Cartier Resources (TSXV:ECR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cartier Resources Inc. is involved in the acquisition and exploration of mining properties in Canada, with a market cap of CA$35.18 million.

Operations: Cartier Resources Inc. has not reported any revenue segments as it focuses on acquiring and exploring mining properties in Canada.

Market Cap: CA$35.18M

Cartier Resources Inc., with a market cap of CA$35.18 million, is pre-revenue as it focuses on exploration activities. Recent drilling at its East Cadillac property has yielded promising high-grade gold results, indicating potential for significant discoveries in the Larder Lake - Cadillac Fault Zone. Despite no revenue streams, Cartier remains debt-free but faces financial constraints with short-term assets of CA$3.4 million not fully covering long-term liabilities of CA$5 million. The company has seen shareholder dilution over the past year and experiences high share price volatility, reflecting inherent risks associated with early-stage mining ventures.

- Get an in-depth perspective on Cartier Resources' performance by reading our balance sheet health report here.

- Learn about Cartier Resources' historical performance here.

EMX Royalty (TSXV:EMX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: EMX Royalty Corporation, along with its subsidiaries, is involved in exploring and generating royalties from metals and minerals properties, with a market cap of CA$301.56 million.

Operations: The company generates revenue of $32.72 million from its resource industry segment.

Market Cap: CA$301.56M

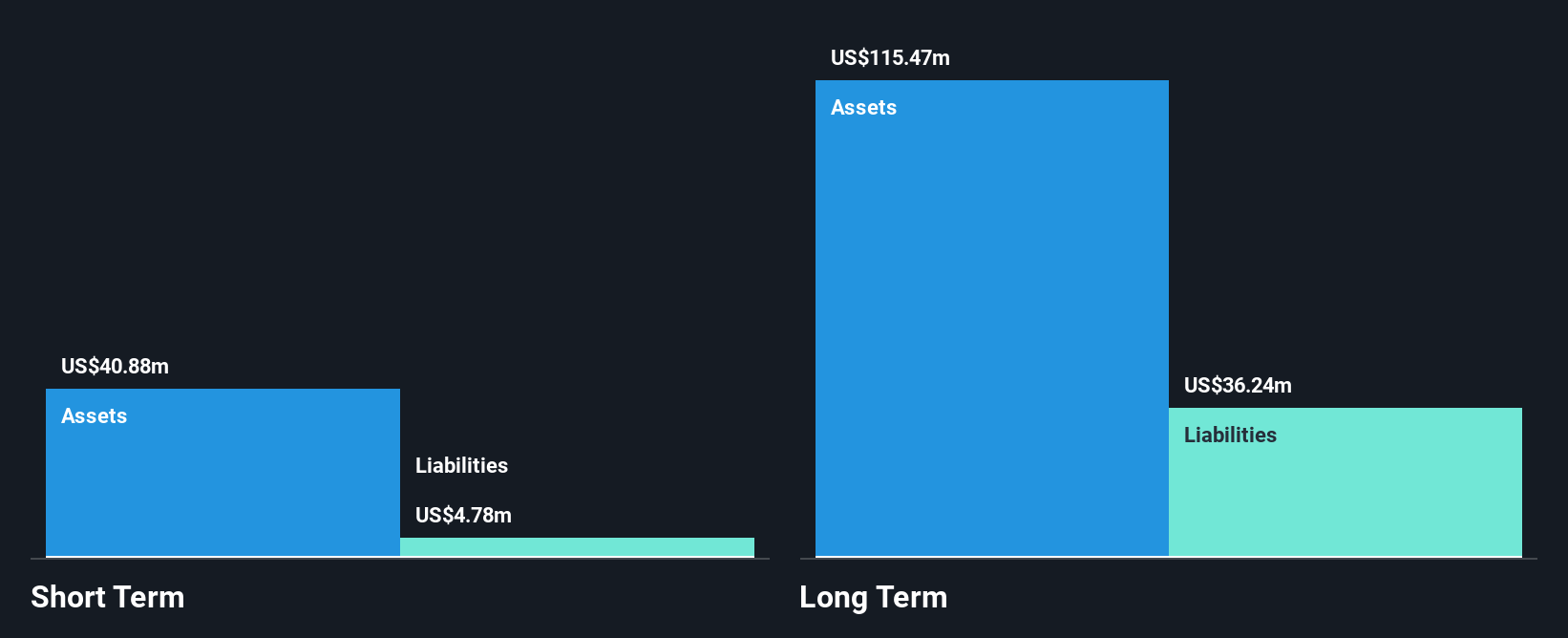

EMX Royalty Corporation, with a market cap of CA$301.56 million, has been navigating its unprofitable status by maintaining a positive free cash flow and sufficient cash runway for over three years. Despite earnings declines averaging 41.8% annually over the past five years, recent revenue growth to US$12.25 million for the first half of 2024 suggests some operational improvements. The company has not experienced significant shareholder dilution recently and maintains a satisfactory net debt to equity ratio of 6.2%. Recent executive changes, including appointing Stefan Wenger as CFO, could strategically enhance financial oversight and corporate governance effectiveness.

- Navigate through the intricacies of EMX Royalty with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into EMX Royalty's future.

Summing It All Up

- Investigate our full lineup of 947 TSX Penny Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EMX Royalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:EMX

EMX Royalty

Explores for and generates royalties from metals and minerals properties.