As the Bank of Canada continues its easing cycle amid global economic uncertainties, Canadian markets are navigating a landscape shaped by geopolitical risks and moderated growth. In this context, penny stocks—despite their somewhat outdated moniker—remain a relevant area for investors seeking opportunities in smaller or newer companies. These stocks can offer surprising value and potential growth when supported by strong financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$61.7M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$621.92M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.87 | CA$95.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.43 | CA$12.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.87 | CA$459.71M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.78 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.99 | CA$19.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$182.21M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.57M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 457 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

NanoXplore (TSX:GRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NanoXplore Inc. is a graphene company that manufactures and supplies graphene powder for industrial markets in Australia, with a market cap of CA$397.52 million.

Operations: The company's revenue is generated from two primary segments: Battery Cells and Materials, contributing CA$0.57 million, and Advanced Materials, Plastics and Composite Products, which accounts for CA$134.79 million.

Market Cap: CA$397.52M

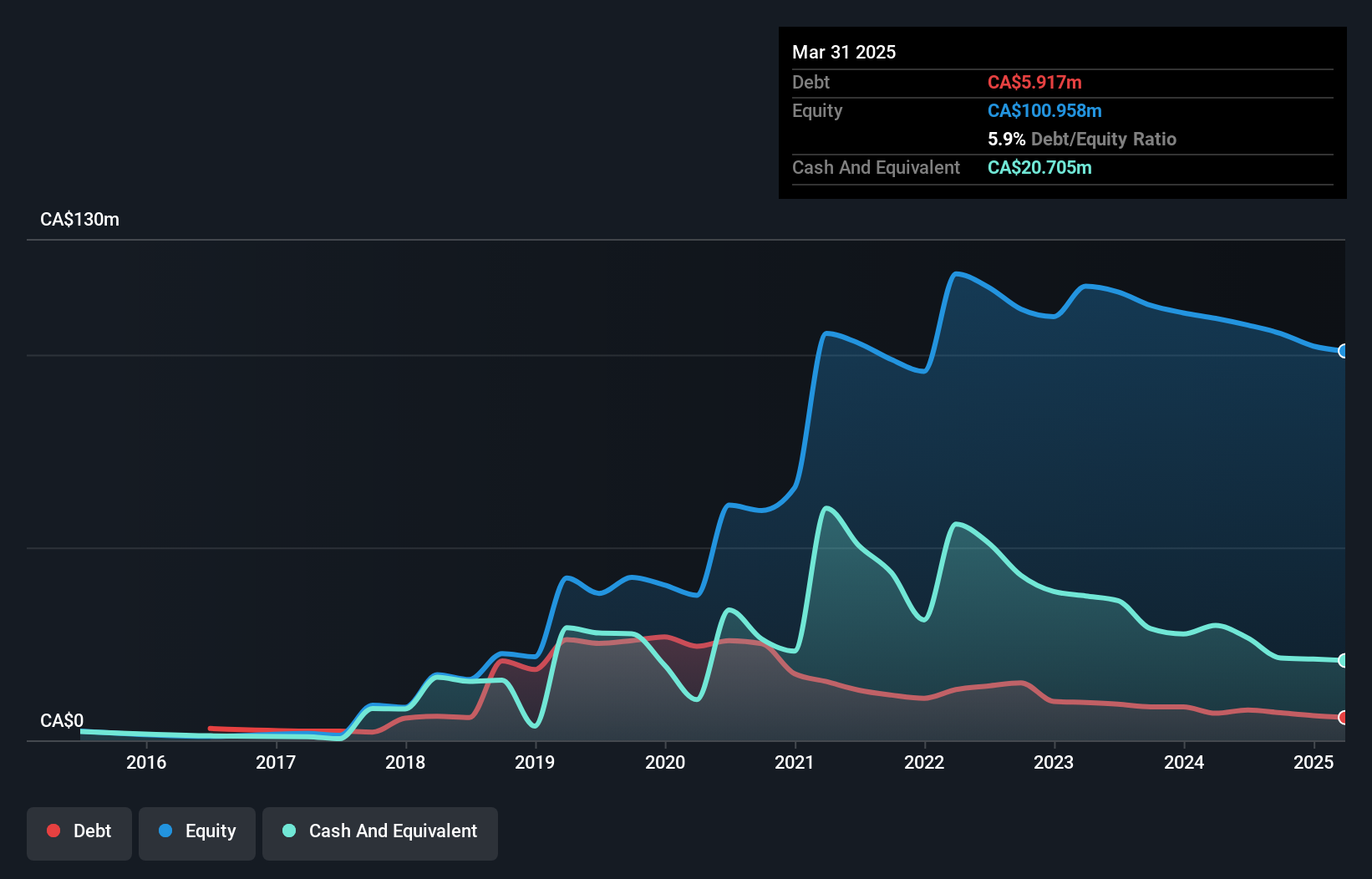

NanoXplore, with a market cap of CA$397.52 million, is navigating the penny stock landscape with a focus on graphene manufacturing. Despite being unprofitable, it has shown resilience by reducing its debt-to-equity ratio significantly over five years and maintaining more cash than total debt. The company's short-term assets cover both short and long-term liabilities comfortably. Recent earnings reports indicate a narrowing net loss, from CA$3.09 million to CA$1.75 million year-over-year for the third quarter, suggesting potential operational improvements amidst stable weekly volatility and no significant shareholder dilution recently observed.

- Take a closer look at NanoXplore's potential here in our financial health report.

- Gain insights into NanoXplore's outlook and expected performance with our report on the company's earnings estimates.

Kenorland Minerals (TSXV:KLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kenorland Minerals Ltd. focuses on acquiring and exploring mineral properties in North America, with a market cap of CA$154.28 million.

Operations: The company generates revenue primarily from the exploration of mineral properties, amounting to CA$3.20 million.

Market Cap: CA$154.28M

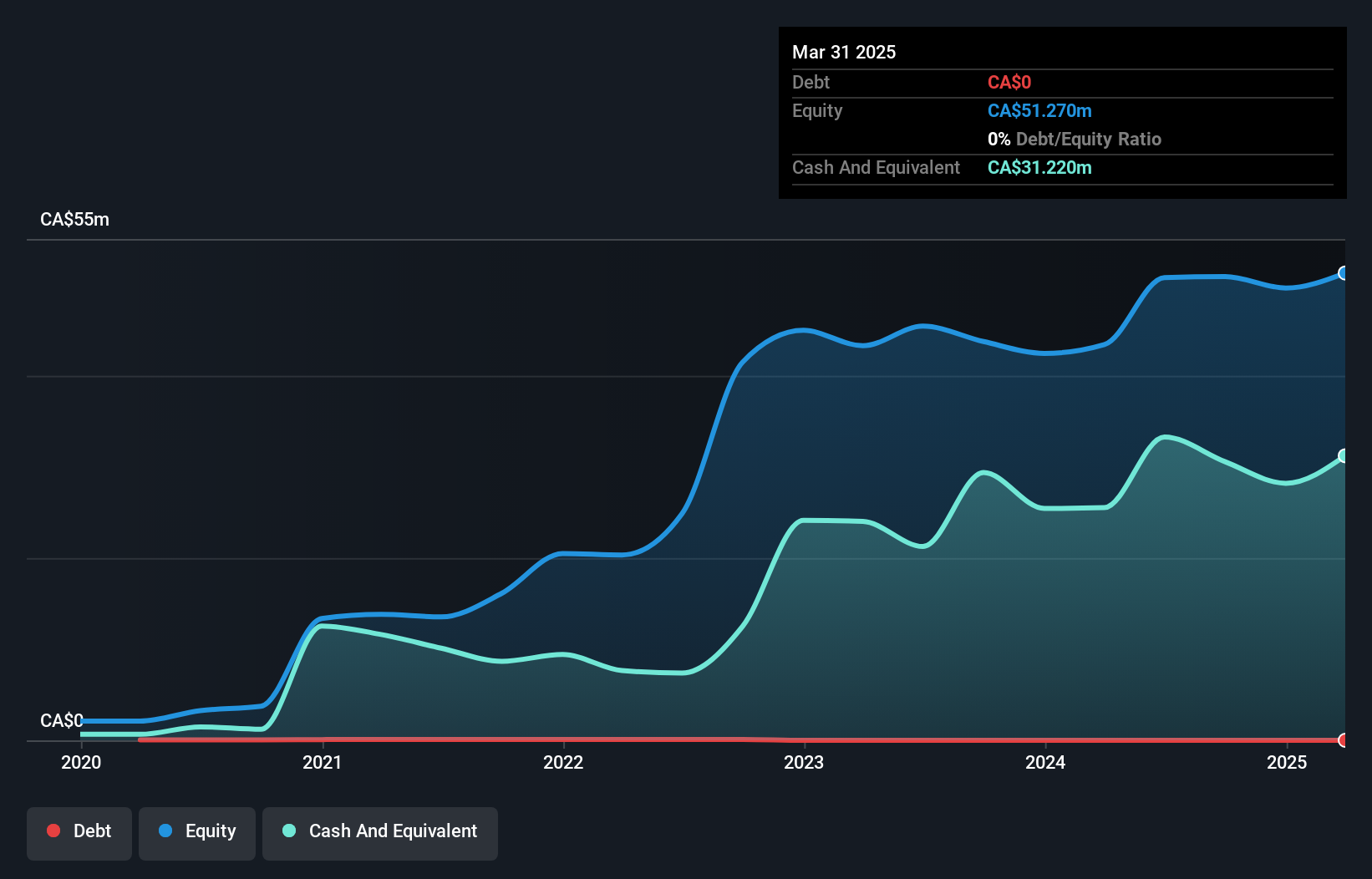

Kenorland Minerals, with a market cap of CA$154.28 million, is actively expanding its mineral exploration footprint in North America. Recent acquisitions include a 100% interest in substantial mineral claims adjacent to the Atlantic Project in New Brunswick, enhancing its potential for significant gold and polymetallic discoveries. The company reported first-quarter sales of CA$1.49 million but remains pre-revenue by international standards. Despite being unprofitable, Kenorland benefits from a debt-free balance sheet and strong short-term assets exceeding liabilities, providing financial stability as it pursues further exploration opportunities highlighted by promising drill results at the Frotet Project in Quebec.

- Get an in-depth perspective on Kenorland Minerals' performance by reading our balance sheet health report here.

- Assess Kenorland Minerals' previous results with our detailed historical performance reports.

Western Energy Services (TSX:WRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Western Energy Services Corp. is an oilfield service company operating in Canada and the United States, with a market cap of CA$69.38 million.

Operations: The company's revenue is derived from its Contract Drilling segment, which generated CA$165.20 million, and its Production Services segment, contributing CA$65.30 million.

Market Cap: CA$69.38M

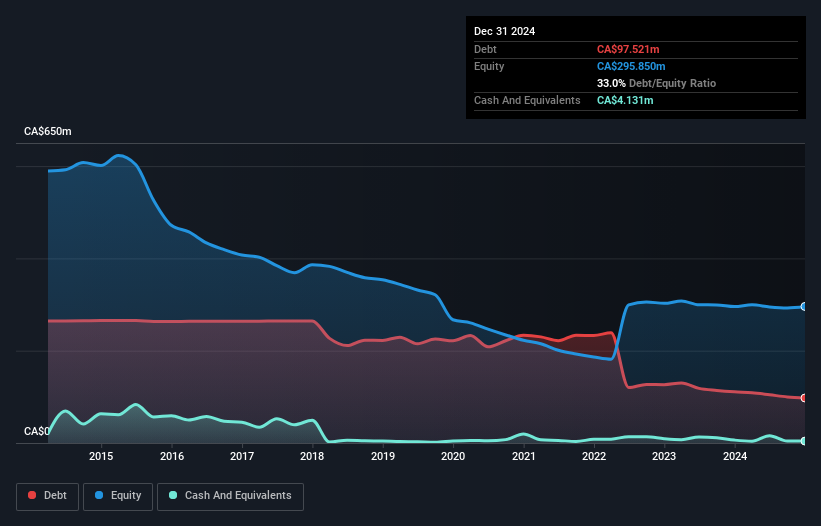

Western Energy Services Corp., with a market cap of CA$69.38 million, operates in the oilfield services sector across Canada and the U.S. Despite being unprofitable, it has reduced losses by 51.6% annually over five years and maintains a satisfactory net debt to equity ratio of 33.5%. Recent first-quarter earnings show improved sales at CA$69.01 million, up from CA$61.98 million last year, with net income rising to CA$2.26 million. The company benefits from stable weekly volatility and sufficient cash runway exceeding three years due to positive free cash flow growth, while trading below its estimated fair value.

- Click to explore a detailed breakdown of our findings in Western Energy Services' financial health report.

- Evaluate Western Energy Services' prospects by accessing our earnings growth report.

Key Takeaways

- Explore the 457 names from our TSX Penny Stocks screener here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NanoXplore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GRA

NanoXplore

A graphene company, manufactures and supplies graphene powder for use in industrial markets in Australia.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives