- Canada

- /

- Metals and Mining

- /

- TSX:PRYM

TSX Penny Stocks Spotlight GoldMining And Two More Hidden Gems

Reviewed by Simply Wall St

The Canadian market has been navigating a period of heightened volatility, driven by trade tensions and tariff negotiations, which have kept investors on edge. Amidst this backdrop, penny stocks—often representing smaller or newer companies—offer a unique opportunity for those seeking affordable investments with growth potential. While the term "penny stocks" might seem outdated, their relevance persists as they can provide value through strong financial foundations and promising prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.62 | CA$61.7M | ✅ 4 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$1.60 | CA$68.71M | ✅ 4 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.15 | CA$562M | ✅ 4 ⚠️ 1 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.72 | CA$280.75M | ✅ 2 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.73 | CA$167.33M | ✅ 3 ⚠️ 1 View Analysis > |

| Alvopetro Energy (TSXV:ALV) | CA$4.57 | CA$166.42M | ✅ 3 ⚠️ 1 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$549.3M | ✅ 4 ⚠️ 3 View Analysis > |

| McCoy Global (TSX:MCB) | CA$2.48 | CA$70.12M | ✅ 3 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.46 | CA$13.18M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.17 | CA$42.09M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 930 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GoldMining Inc. is a mineral exploration company focused on acquiring, exploring, and developing gold and copper assets in the Americas, with a market cap of CA$221.51 million.

Operations: GoldMining Inc. does not report any specific revenue segments.

Market Cap: CA$221.51M

GoldMining Inc., a mineral exploration company with a market cap of CA$221.51 million, remains pre-revenue and unprofitable, reporting a net loss of CA$4.55 million for Q1 2025. Despite financial challenges, the company is debt-free and has initiated its largest exploration program at the Sao Jorge Project in Brazil, aiming to expand its mineral resource estimate through extensive drilling and geophysical surveys. GoldMining's management team is experienced, but the company's short cash runway poses potential liquidity concerns as it continues to invest heavily in exploration without significant revenue streams.

- Click here to discover the nuances of GoldMining with our detailed analytical financial health report.

- Evaluate GoldMining's prospects by accessing our earnings growth report.

Prime Mining (TSX:PRYM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Prime Mining Corp. focuses on acquiring, exploring, and developing mineral resource properties in Mexico and has a market cap of CA$215.30 million.

Operations: Prime Mining Corp. does not have any reported revenue segments as it is focused on the acquisition, exploration, and development of mineral resource properties in Mexico.

Market Cap: CA$215.3M

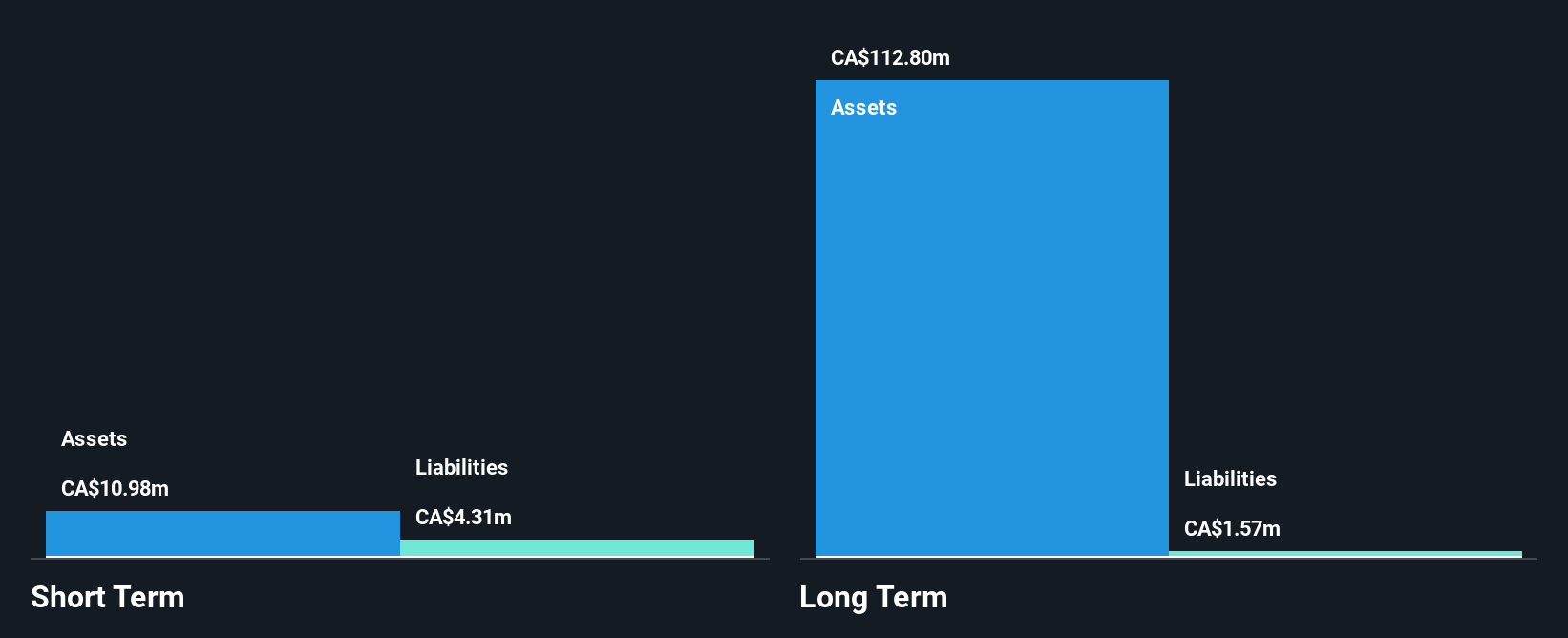

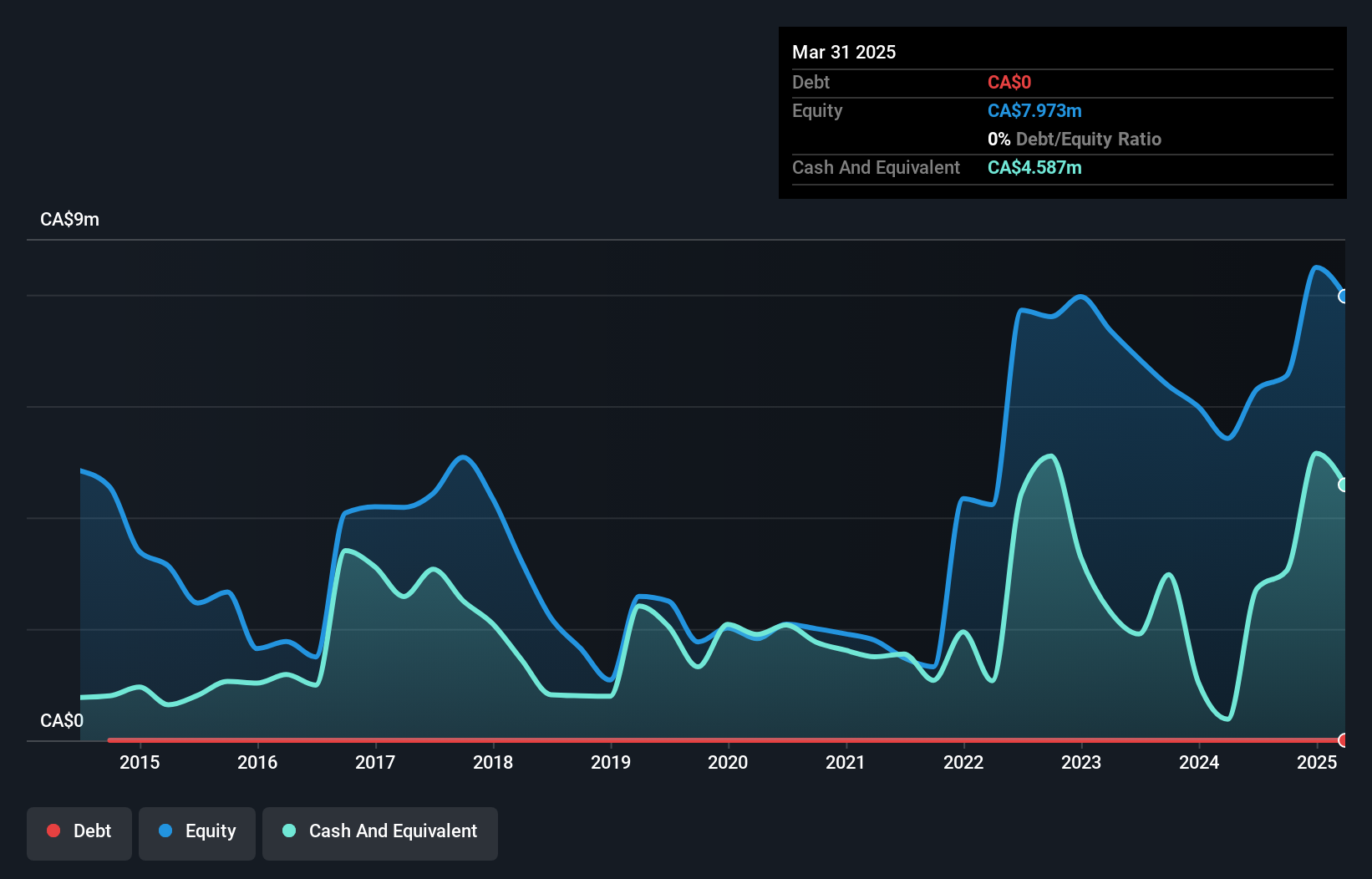

Prime Mining Corp. remains pre-revenue with a market cap of CA$215.30 million, focusing on its Los Reyes Project in Mexico. Recent drilling results at the Fresnillo and Mariposa targets show promising mineralization but are not yet included in the company's resource estimates. Despite reporting a net loss of CA$21.62 million for 2024, Prime is debt-free and maintains short-term assets exceeding its liabilities, though it faces cash runway challenges due to ongoing exploration expenditures without revenue generation. The management team has an average tenure of 3.5 years, indicating stability as they navigate these financial hurdles while targeting resource expansion.

- Jump into the full analysis health report here for a deeper understanding of Prime Mining.

- Examine Prime Mining's past performance report to understand how it has performed in prior years.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Lara Exploration Ltd. is involved in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile with a market cap of CA$88.98 million.

Operations: Lara Exploration Ltd. does not report specific revenue segments.

Market Cap: CA$88.98M

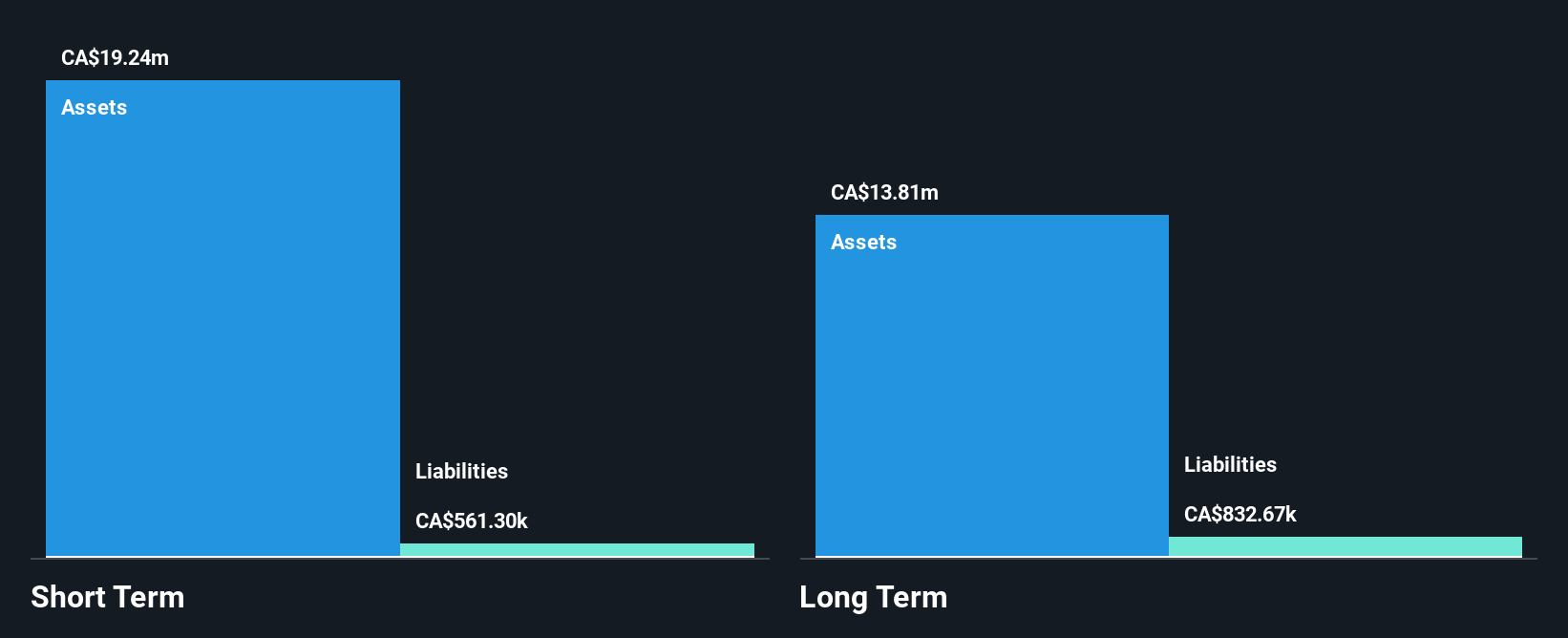

Lara Exploration Ltd., with a market cap of CA$88.98 million, is pre-revenue and unprofitable, experiencing increasing losses at 6.5% annually over the past five years. The company holds no debt and has short-term assets of CA$3.1 million, which exceed its short-term liabilities significantly. However, it faces cash runway challenges with less than a year remaining based on current free cash flow trends that historically decrease by 18% annually. The management team and board are both experienced, averaging over eight years in tenure each, but the stock's high volatility remains a concern for investors seeking stability in penny stocks.

- Take a closer look at Lara Exploration's potential here in our financial health report.

- Gain insights into Lara Exploration's past trends and performance with our report on the company's historical track record.

Turning Ideas Into Actions

- Unlock our comprehensive list of 930 TSX Penny Stocks by clicking here.

- Interested In Other Possibilities? Explore 22 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRYM

Prime Mining

Engages in the acquisition, exploration, and development of mineral resource properties in Mexico.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion