- Canada

- /

- Metals and Mining

- /

- TSX:GMIN

Is G Mining Ventures Still a Good Value After a 186.8% Surge in 2025?

Reviewed by Bailey Pemberton

- Wondering if G Mining Ventures is a hidden gem or if its remarkable run means all the easy gains are behind us? Let’s dig in together and see what the numbers say about its value today.

- If you blinked, you might have missed it. The stock has soared an eye-popping 154.8% year-to-date and is up a jaw-dropping 186.8% in the past year, showing there is plenty of momentum and changing sentiment at play.

- Lately, G Mining Ventures has been making headlines with its rapid project progress and positive exploration updates, fueling renewed optimism among investors. These developments have clearly caught the market’s attention, helping to explain the recent big moves in price.

- On our core valuation score, G Mining Ventures clocks in at 3 out of 6, indicating the market sees real growth while still leaving room for debate. Next, we will break down what this actually means using several valuation approaches. Stick around, because there is an even smarter way to think about fair value that we will reveal by the end of the article.

Approach 1: G Mining Ventures Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth by projecting its future cash flows and then discounting them back to their present value. This method provides a way to gauge what the company might be worth based on its expected ability to generate cash in the years ahead.

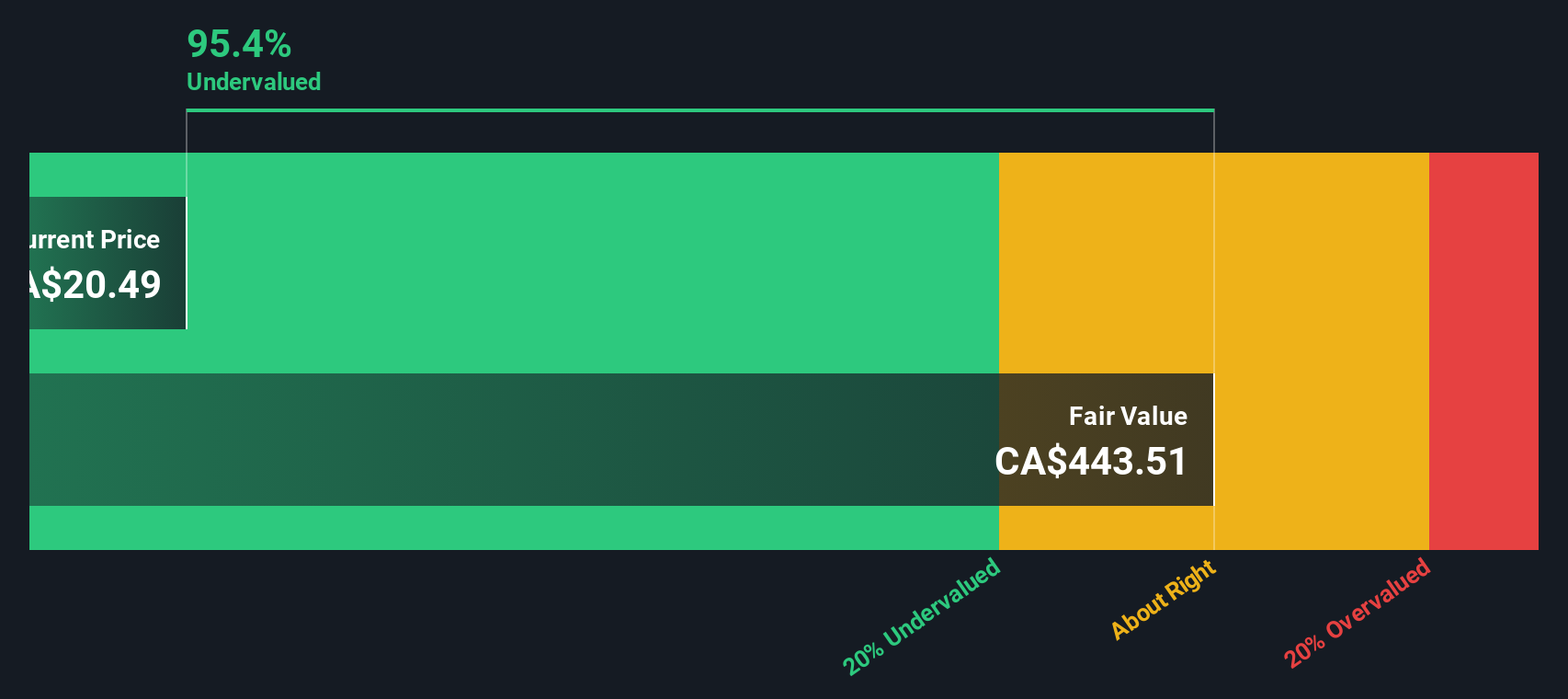

For G Mining Ventures, the most recent Free Cash Flow (FCF) was -$461.4 Million, reflecting significant investment and operational ramp-up. Looking forward, analysts estimate negative FCF for the next several years. From 2028, the picture brightens considerably, with FCF forecast to reach $731.3 Million. Over the next ten years, projections ramp up dramatically, with Simply Wall St extrapolating FCF to as high as $7.8 Billion by 2035.

Using this model, the estimated intrinsic value for G Mining Ventures works out to $691.1 Million. Currently, the DCF model implies that the stock is 95.7% undervalued compared to the share price, signaling substantial upside if these forecasts play out.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests G Mining Ventures is undervalued by 95.7%. Track this in your watchlist or portfolio, or discover 883 more undervalued stocks based on cash flows.

Approach 2: G Mining Ventures Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular valuation tool for profitable companies, as it quickly shows how much investors are paying today for each dollar of future earnings. It is especially useful for assessing companies with established or improving profitability, and G Mining Ventures now fits into this profitable category.

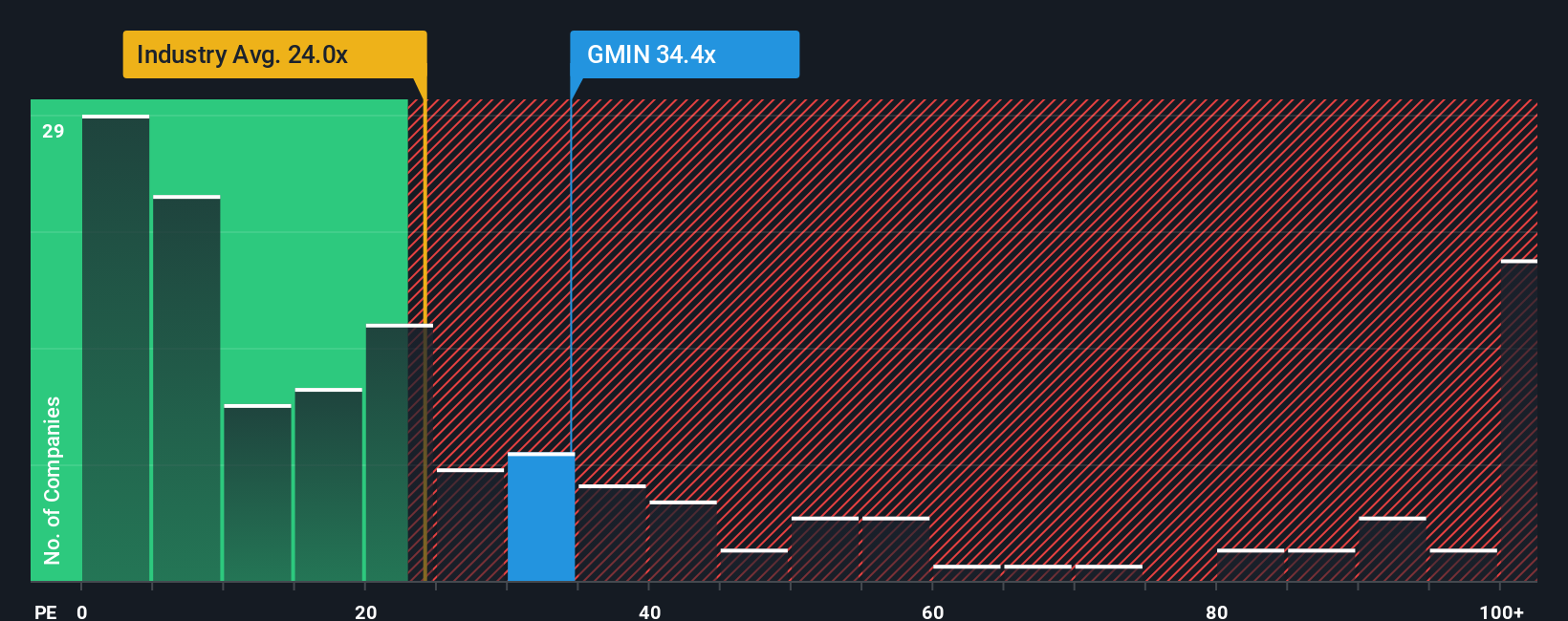

Of course, what counts as a “fair” PE ratio depends on a few key factors. Companies with higher earnings growth or lower risks can often justify a higher PE, while those with more uncertainty or limited growth should trade at a discount. Industry context matters too, as averages vary widely between sectors.

G Mining Ventures is currently valued at a PE ratio of 33.0x. For comparison, the average for Metals and Mining stocks is 22.7x, and direct peers trade at 20.3x. This suggests G Mining is priced higher than its industry and peer group, likely reflecting market optimism and growth expectations.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike a simple peer or industry average approach, the Fair Ratio incorporates a wide range of factors, including the company’s unique earnings growth prospects, profit margins, risks, industry characteristics, and market capitalization. For G Mining Ventures, the Fair Ratio has been calculated at 31.2x, a value that is tailored specifically to its profile and future outlook.

Comparing the Fair Ratio of 31.2x to G Mining’s actual PE ratio of 33.0x, we see that the current price is just above our calculated fair value. While the gap is not dramatic, it does suggest the stock is slightly ahead of where our fundamentals-based model would put it.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your G Mining Ventures Narrative

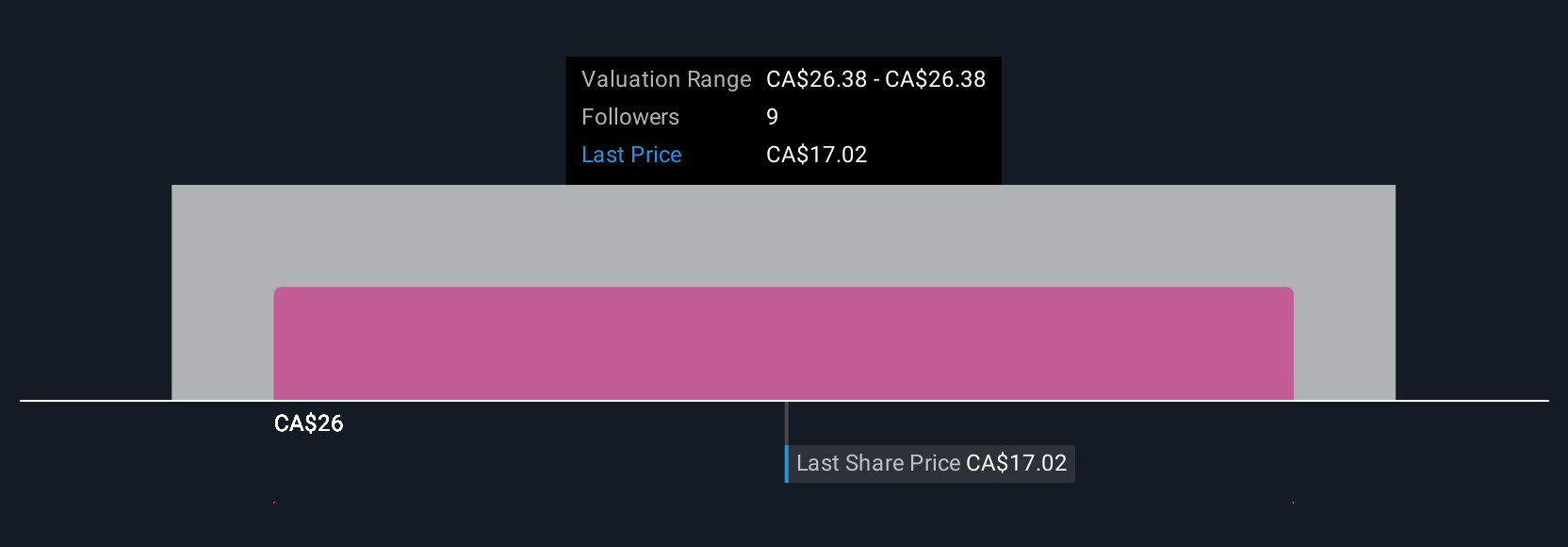

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful approach that lets you frame your own story for a company, connecting your unique perspective about G Mining Ventures to what you think its fair value and future prospects could be. Instead of just relying on static numbers, Narratives help you link the company’s strategic story with a financial forecast, which leads directly to a fair value estimate.

On Simply Wall St’s Community page, investors like you can easily build and share these Narratives, making them one of the platform’s most user-friendly tools. These are all updated automatically as new data, news, or earnings arrive. Narratives empower better decision making by comparing fair value to the current price, so you can decide when you feel comfortable to buy or sell based on your outlook. For example, some investors see breakout growth and assign G Mining Ventures a much higher fair value, while others expect a slower ramp up and value the stock lower. Narratives embrace these different perspectives, providing a clear, dynamic lens through which to make your next move.

Do you think there's more to the story for G Mining Ventures? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GMIN

G Mining Ventures

A mining company, engages in the acquisition, exploration, and development of precious metal projects.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives