- Canada

- /

- Metals and Mining

- /

- TSX:GLO

Why Global Atomic (TSX:GLO) Is Down 22.9 Percent After Announcing a C$20 Million Equity Raise

Reviewed by Sasha Jovanovic

- Global Atomic Corporation has announced a composite units offering in the amount of C$20,000,580, offering 32,259,000 equity/derivative units at C$0.62 per unit.

- This significant capital raise may signal the company's intent to fund upcoming projects or expand its operational capabilities in the near future.

- As the company moves to secure funding through this sizable offering, we’ll explore what this means for its future capital needs and growth prospects.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Global Atomic's Investment Narrative?

To be a shareholder in Global Atomic right now, you need to believe in the company’s capacity to execute on ambitious uranium production plans while weathering short-term losses and persistent dilution. The recent C$20 million composite units offering adds another layer to the story, directly impacting near-term dynamics by bringing fresh capital just as the Dasa Project nears key milestones. While this capital infusion shores up funding for project development, it also increases the number of shares on the market at a strikingly lower price than last year’s financing rounds, which could weigh on future share price recovery. The biggest near-term catalysts remain progress at Dasa and turning offtake agreements into revenue, while ongoing net losses and repeated shareholder dilution are front and center as risks. Investors should watch how efficiently this new funding translates into tangible project momentum.

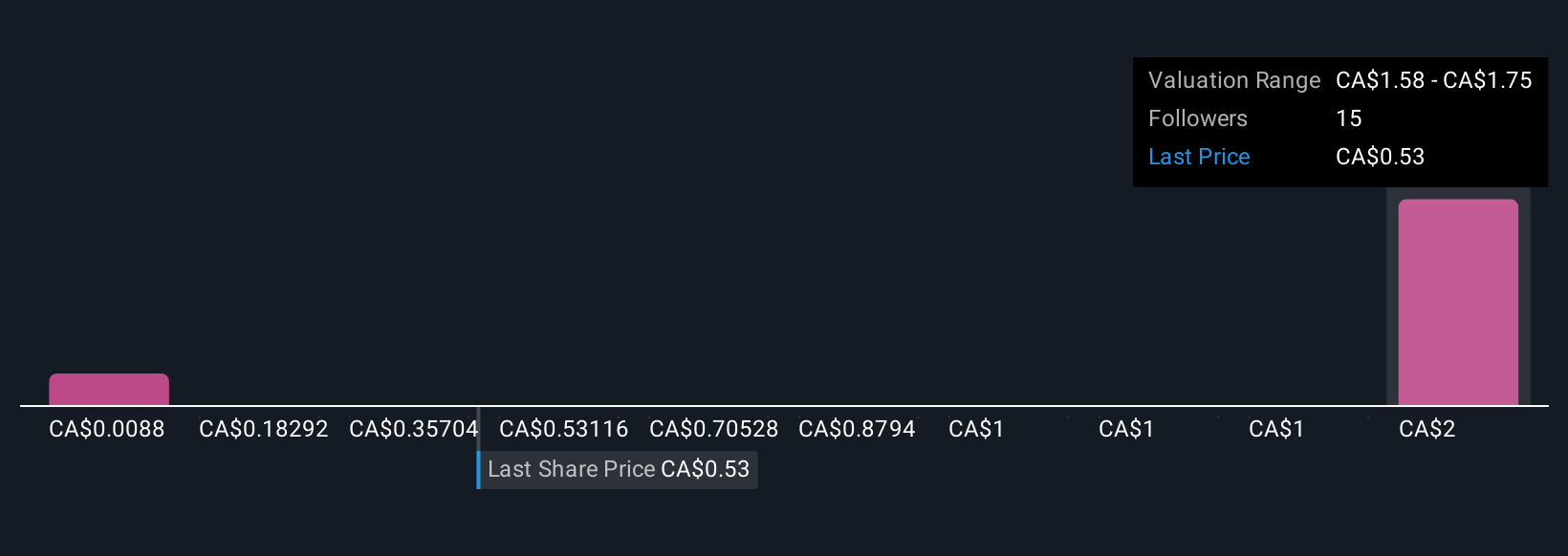

On the other hand, the frequency and size of these capital raises should give investors pause. Upon reviewing our latest valuation report, Global Atomic's share price might be too optimistic.Exploring Other Perspectives

Explore 4 other fair value estimates on Global Atomic - why the stock might be worth over 3x more than the current price!

Build Your Own Global Atomic Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Global Atomic research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Global Atomic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Global Atomic's overall financial health at a glance.

No Opportunity In Global Atomic?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GLO

Global Atomic

Engages in the acquisition, exploration, and development of uranium properties in Africa.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success