- Canada

- /

- Metals and Mining

- /

- TSX:GGD

GoGold Resources (TSX:GGD): Reassessing Valuation After Surging 2025 Sales and Earnings Growth

Reviewed by Simply Wall St

GoGold Resources (TSX:GGD) just doubled its annual sales to about USD 72.5 million and lifted net income more than tenfold. This shift naturally has investors rechecking their thesis on this silver and gold producer.

See our latest analysis for GoGold Resources.

Despite that jump in profitability, GoGold’s 1 day share price return of negative 1.41 percent and 7 day share price return of negative 5.10 percent show some near term cooling. However, its 1 month share price return of 23.45 percent and year to date share price return of 132.5 percent plus a 1 year total shareholder return of 149.11 percent suggest longer term momentum is still very much intact.

If this kind of turnaround story has your attention, it could be a good moment to scan the market for other fast growing stocks with high insider ownership that might be setting up for their next move.

With profits surging and the share price already up sharply this year, but still trading at a steep discount to analyst targets, is GoGold now a mispriced growth play, or is the market already baking in its next leg higher?

Most Popular Narrative Narrative: 96.5% Undervalued

According to RockeTeller, the narrative fair value sits far above GoGold Resources’ last close of CA$2.79, implying dramatic upside if its long range plan delivers.

GoGold Resources has significant upside potential with its Los Ricos projects driving future production growth. At $100 silver, the estimated stock price could reach around $46.47/share, making it a compelling high risk, high reward opportunity for silver investors.

Curious how a mid cap miner gets mapped to a potential multi bagger outcome? The secret is an aggressive production ramp and rich cash flow multiples working together.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside hinges on timely Los Ricos South permits and on financing terms that avoid heavy dilution if construction costs rise.

Find out about the key risks to this GoGold Resources narrative.

Another View: Market Multiples Flash a Warning

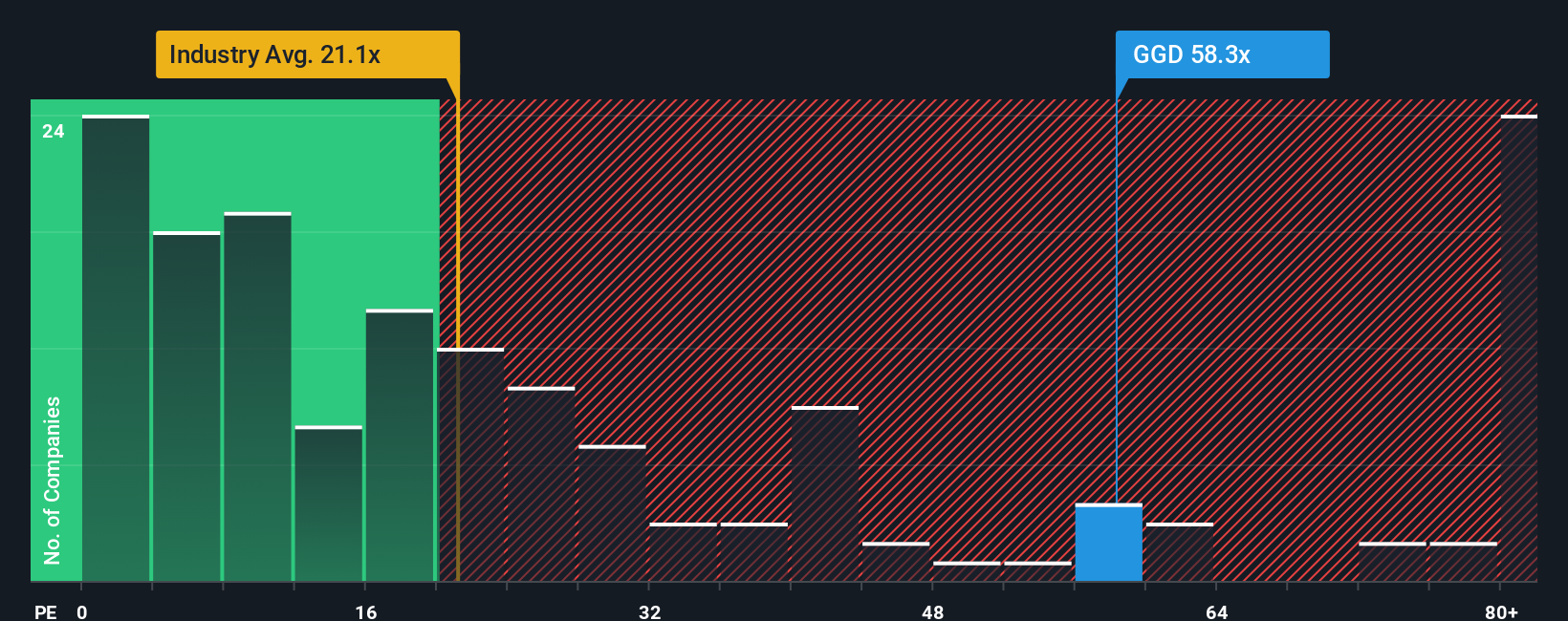

Those narrative fair values lean heavily bullish, but the market is already paying up for GoGold. Its price to earnings ratio sits around 50.5 times versus 21.4 times for the Canadian metals and mining sector and 64.5 times for peers, leaving less obvious margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GoGold Resources Narrative

If you see the story differently or want to dive into the numbers yourself, you can build a personalized thesis in minutes with Do it your way.

A great starting point for your GoGold Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at GoGold. Use Simply Wall Street’s powerful screener to uncover opportunities most investors overlook and stay one step ahead of potential market moves.

- Identify emerging market leaders early by using these 3631 penny stocks with strong financials that already show solid financial strength and real business traction.

- Align your portfolio with innovation by targeting these 24 AI penny stocks involved in developments in artificial intelligence and automation.

- Focus on quality at attractive prices with these 910 undervalued stocks based on cash flows that generate strong cash flows while trading at comparatively modest valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GGD

GoGold Resources

Engages in the exploration, development, and production of silver, gold, and copper primarily in Mexico It owns the Los Ricos property, which includes Los Ricos South and Los Ricos North projects, that covers 45 concessions with an area of approximately 24,000 hectares situated in the Jalisco State, Mexico; and the Parral Tailings project located in the city of Parral.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion