- Canada

- /

- Metals and Mining

- /

- TSX:GGD

GoGold Resources (TSX:GGD): Does the C$125 Million Financing Unlock New Value?

Reviewed by Simply Wall St

GoGold Resources (TSX:GGD) has announced a C$125 million bought deal financing, aimed at advancing its Los Ricos projects in Mexico. This material funding move is expected to reinforce the company’s financial standing and support ongoing development.

See our latest analysis for GoGold Resources.

GoGold Resources has seen remarkable momentum this year, with a year-to-date share price return of 118.33% and a one-year total shareholder return of 111.29%. Following the recent C$125 million financing news, the stock’s short-term performance has been volatile. However, the long-term trend signals robust investor enthusiasm for potential growth in its Mexican projects.

If GoGold’s latest move has you thinking bigger, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With the stock still trading at a notable discount to analyst targets despite recent gains, the key question is whether GoGold is now undervalued or if the market has already priced in future project success. Could this be a real buying opportunity?

Most Popular Narrative: 96.7% Undervalued

GoGold Resources’ current share price of CA$2.62 sits well below the narrative fair value, suggesting the market is missing major upside. The rationale is rooted in aggressive projections for free cash flow and sector-leading operating costs that could transform the company's profitability outlook.

Bull Case (LRS + Early LRN + Tailings): If you assume LRS is running, LRN adds part output by around 2030, and there is tailings income (approximately US$36M), free cash flow might approach US$1.5-2.0B per year under high silver. Using the same shares:

• 10× leads to US$15-20B, which is approximately US$38-51 per share • 15× leads to US$22.5-30B, which is approximately US$57-76 per share • 20× leads to US$30-40B, which is approximately US$76-102 per share

Want to know why free cash flow is the story here? The narrative hinges on industry-low costs and output forecasts few are daring enough to publish. Which future assumptions drive those explosive fair value targets? Unpack the full model behind this number and see what pushes this stock far beyond the headline valuation.

Result: Fair Value of $80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, permitting delays and unexpected cost increases could quickly challenge even the most optimistic projections. These factors could potentially reshape GoGold’s upside narrative.

Find out about the key risks to this GoGold Resources narrative.

Another View: What Do the Earnings Ratios Say?

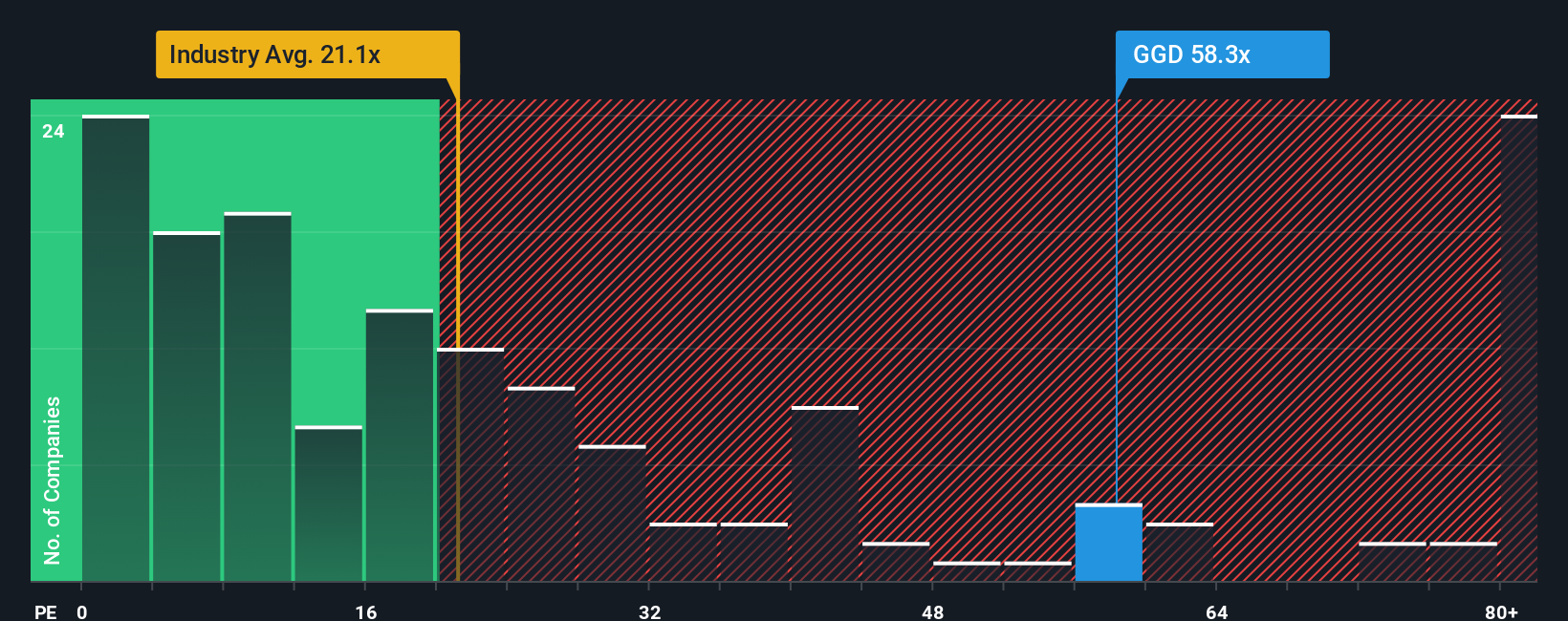

Stepping away from cash flow models, GoGold shares currently trade at 58.3 times earnings, compared to 21.1 for the Canadian sector and 51.5 for close peers. This is a clear warning signal: the stock is expensive on this basis, suggesting the market may already be pricing in significant future growth. Could that leave less upside than it seems?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GoGold Resources Narrative

If you have a different perspective or enjoy digging into the numbers on your own, building your personal thesis for GoGold can be done in just a few minutes. Do it your way

A great starting point for your GoGold Resources research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunities pass you by. Expand your search with curated strategies designed to spark your next big investment move on Simply Wall St.

- Unlock the potential of strong cash flows and value by targeting these 877 undervalued stocks based on cash flows that show promise beyond their market price.

- Catch the wave of innovation by researching these 27 AI penny stocks that are shaping industries with artificial intelligence breakthroughs and real-world applications.

- Maximize your passive income ambitions and boost portfolio stability through these 14 dividend stocks with yields > 3% yielding over 3% annually.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GGD

GoGold Resources

Engages in the exploration, development, and production of silver, gold, and copper primarily in Mexico.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives