- Canada

- /

- Capital Markets

- /

- TSX:DC.A

TSX Penny Stocks With Market Caps Over CA$70M

Reviewed by Simply Wall St

Despite rising tariff rates, the Canadian market has shown resilience with inflation and economic data remaining stable, even as oil prices have moved lower this year. In such a climate, identifying stocks with strong financials is crucial for investors seeking opportunities beyond the mainstream. Penny stocks, often overlooked but still significant when backed by robust balance sheets, offer a unique blend of affordability and potential growth. Here we explore several noteworthy penny stocks that stand out for their financial strength and long-term promise.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.66 | CA$67.77M | ✅ 3 ⚠️ 3 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Foraco International (TSX:FAR) | CA$1.76 | CA$177.53M | ✅ 4 ⚠️ 1 View Analysis > |

| Findev (TSXV:FDI) | CA$0.42 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.775 | CA$518.93M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.54 | CA$174.09M | ✅ 2 ⚠️ 1 View Analysis > |

| Avino Silver & Gold Mines (TSX:ASM) | CA$4.94 | CA$698.44M | ✅ 3 ⚠️ 1 View Analysis > |

| ACT Energy Technologies (TSX:ACX) | CA$4.84 | CA$158.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.94 | CA$185.15M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.65 | CA$10.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 454 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Dundee (TSX:DC.A)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dundee Corporation is a publicly owned investment manager with a market cap of CA$257.64 million.

Operations: The company generates revenue primarily from mining services, amounting to CA$1.65 million, and corporate activities totaling CA$3.46 million.

Market Cap: CA$257.64M

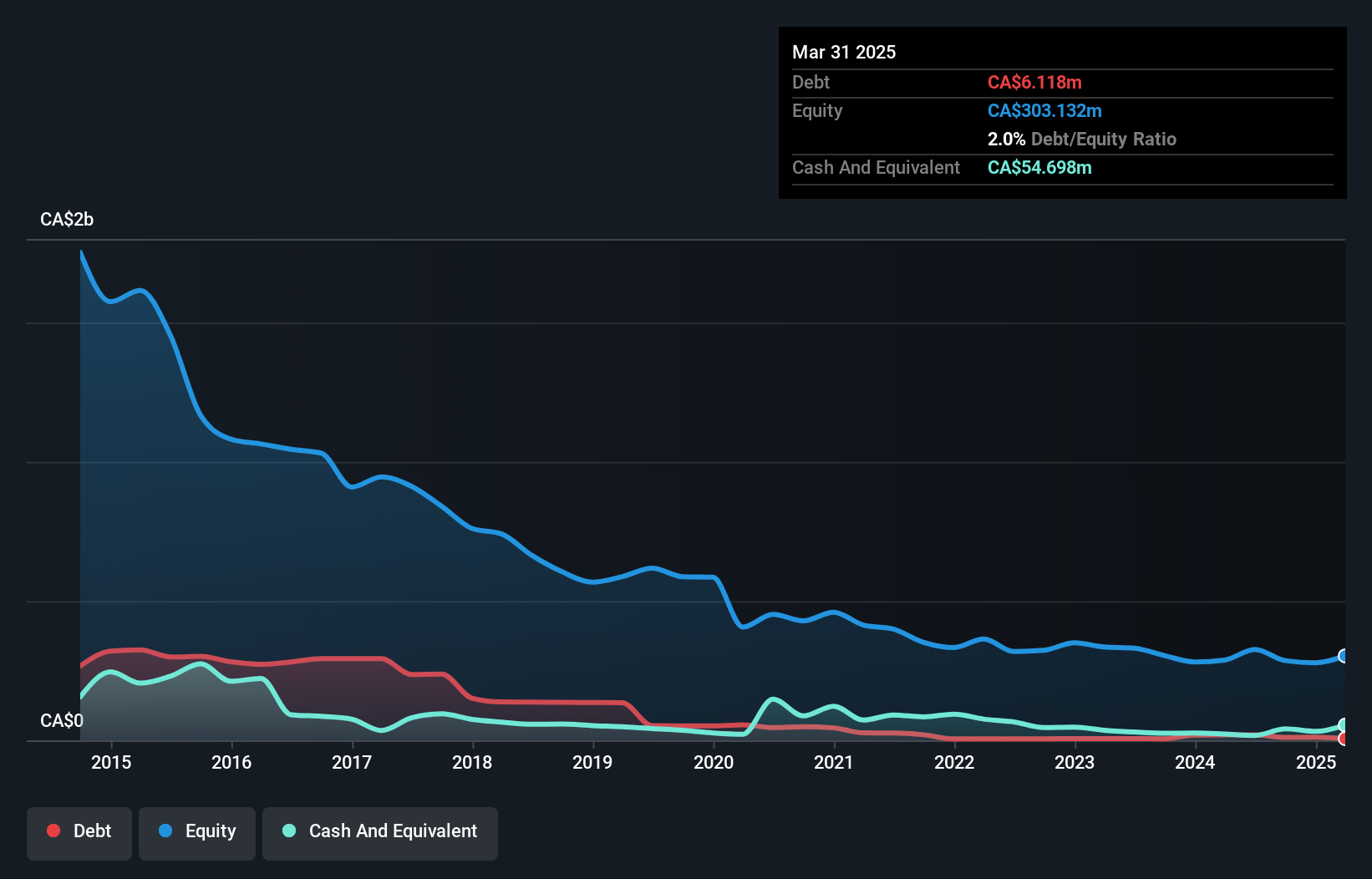

Dundee Corporation, with a market cap of CA$257.64 million, has shown financial resilience despite its small revenue base of CA$4 million. The company recently reported a significant net income increase to CA$24.49 million for Q1 2025, compared to CA$7.18 million the previous year, reflecting improved profitability and a high return on equity at 24.6%. Its short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity. Although Dundee's operating cash flow remains negative, its debt levels are low and well-managed with more cash than total debt, supported by an experienced management team averaging 5.8 years in tenure.

- Click here to discover the nuances of Dundee with our detailed analytical financial health report.

- Evaluate Dundee's historical performance by accessing our past performance report.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, with a market cap of CA$171.20 million, provides mineral exploration drilling services to mining companies in West Africa, Egypt, Chile, and Peru.

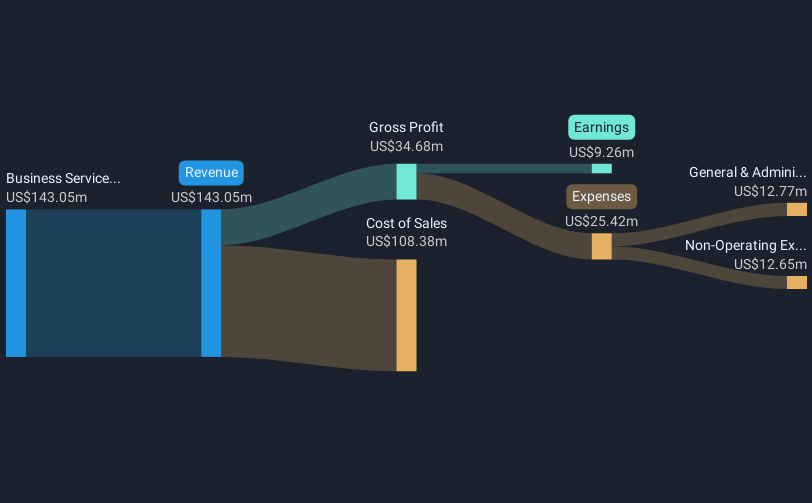

Operations: The company's revenue is derived entirely from its Business Services segment, totaling $157.14 million.

Market Cap: CA$171.2M

Geodrill Limited, with a market cap of CA$171.20 million, has demonstrated solid financial health with short-term assets of US$105.8 million surpassing both its short-term and long-term liabilities. The company reported first-quarter sales of US$48.75 million and net income of US$5.61 million, reflecting recent profitability and high-quality earnings. Its price-to-earnings ratio of 10x suggests it is undervalued compared to the broader Canadian market average. Geodrill's debt is well covered by operating cash flow at 164%, and interest payments are comfortably managed with EBIT coverage at 26.8x, indicating effective debt management amidst stable weekly volatility.

- Jump into the full analysis health report here for a deeper understanding of Geodrill.

- Understand Geodrill's earnings outlook by examining our growth report.

Globex Mining Enterprises (TSX:GMX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Globex Mining Enterprises Inc. focuses on acquiring, exploring, and developing mineral properties in North America, with a market cap of CA$77.97 million.

Operations: The company's revenue is primarily generated from its Metals & Mining segment, specifically Gold & Other Precious Metals, amounting to CA$1.58 million.

Market Cap: CA$77.97M

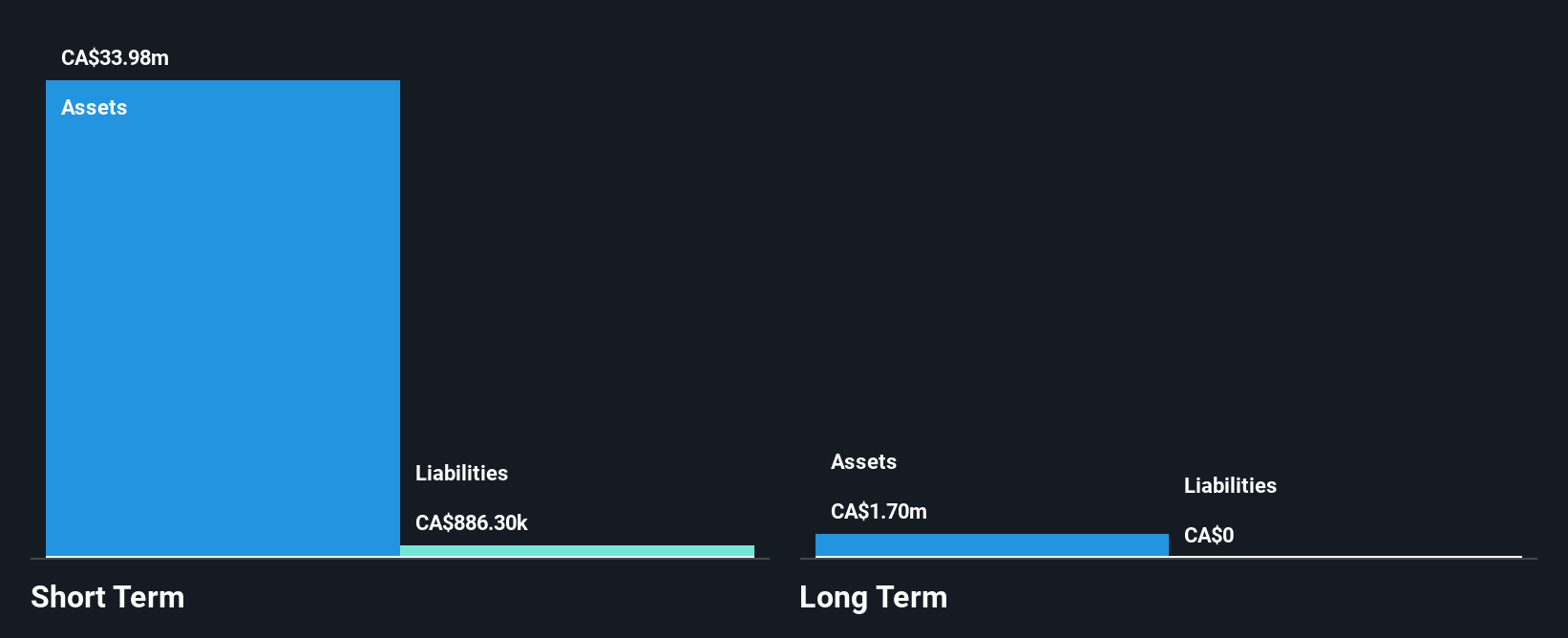

Globex Mining Enterprises, with a market cap of CA$77.97 million, is pre-revenue but has shown significant earnings growth over the past year at 151.1%, surpassing industry averages. The company remains debt-free and its short-term assets of CA$34 million comfortably cover liabilities. Recent developments include acquiring claims in Arizona's historic Gold Basin district and ongoing work on various projects like Mont Sorcier and Lac Escale, indicating potential for resource expansion. However, high-quality earnings are impacted by one-off gains, and return on equity is low at 6.2%.

- Get an in-depth perspective on Globex Mining Enterprises' performance by reading our balance sheet health report here.

- Understand Globex Mining Enterprises' track record by examining our performance history report.

Key Takeaways

- Navigate through the entire inventory of 454 TSX Penny Stocks here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DC.A

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives