- Canada

- /

- Metals and Mining

- /

- TSX:GEO

Shareholders May Not Be So Generous With Geodrill Limited's (TSE:GEO) CEO Compensation And Here's Why

In the past three years, the share price of Geodrill Limited (TSE:GEO) has struggled to generate growth for its shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. Shareholders may want to question the board on the future direction of the company at the upcoming AGM on 12 May 2021. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

Check out our latest analysis for Geodrill

How Does Total Compensation For Dave Harper Compare With Other Companies In The Industry?

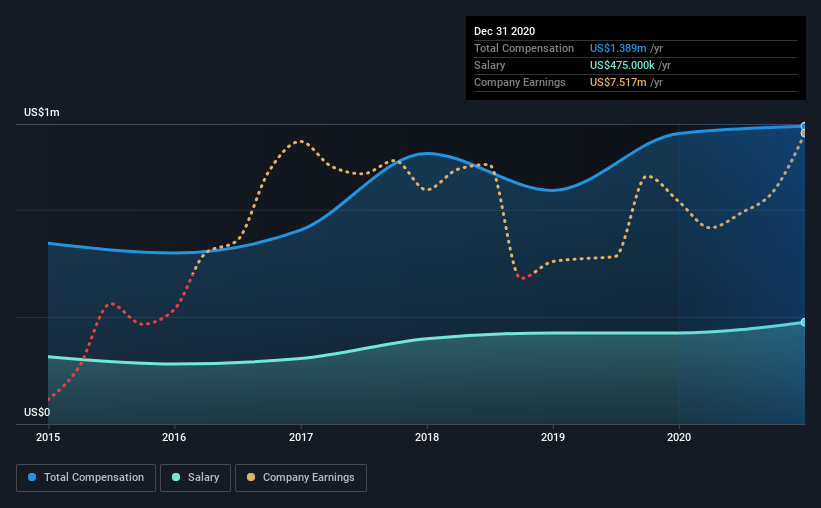

According to our data, Geodrill Limited has a market capitalization of CA$82m, and paid its CEO total annual compensation worth US$1.4m over the year to December 2020. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$475k.

On comparing similar-sized companies in the industry with market capitalizations below CA$245m, we found that the median total CEO compensation was US$120k. Hence, we can conclude that Dave Harper is remunerated higher than the industry median. Furthermore, Dave Harper directly owns CA$33m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$475k | US$425k | 34% |

| Other | US$914k | US$931k | 66% |

| Total Compensation | US$1.4m | US$1.4m | 100% |

Speaking on an industry level, nearly 95% of total compensation represents salary, while the remainder of 5% is other remuneration. Geodrill sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Geodrill Limited's Growth Numbers

Geodrill Limited has seen its earnings per share (EPS) increase by 18% a year over the past three years. In the last year, its revenue is down 5.6%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Geodrill Limited Been A Good Investment?

Given the total shareholder loss of 7.6% over three years, many shareholders in Geodrill Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. A huge lag in share price growth when earnings have grown may indicate there could be other issues that are affecting the company at the moment that the market is focused on. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. At the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 2 warning signs for Geodrill that you should be aware of before investing.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:GEO

Geodrill

Provides mineral exploration drilling services to the mining companies in West Africa, Egypt, Chile, and Peru.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion