- Canada

- /

- Metals and Mining

- /

- TSXV:ESK

Geodrill Leads The Charge On TSX With 2 Other Penny Stocks

Reviewed by Simply Wall St

As investors closely monitor inflation trends and central bank meetings, the Canadian market faces potential volatility after a strong rally. Amidst these conditions, identifying stocks with solid financials becomes crucial for navigating uncertain times. Penny stocks, though often associated with smaller or newer companies, can offer unique growth opportunities when backed by robust fundamentals. In this article, we explore several penny stocks that stand out for their financial strength and potential to thrive in the current economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.23 | CA$56.39M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$22.99M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.30 | CA$2.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.295 | CA$44.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.24 | CA$824.97M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.97 | CA$19.22M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.33 | CA$376.27M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.75 | CA$190.33M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.97 | CA$187.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.71 | CA$8.84M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, with a market cap of CA$162.71 million, offers mineral exploration drilling services to mining companies across West Africa, Egypt, Chile, and Peru.

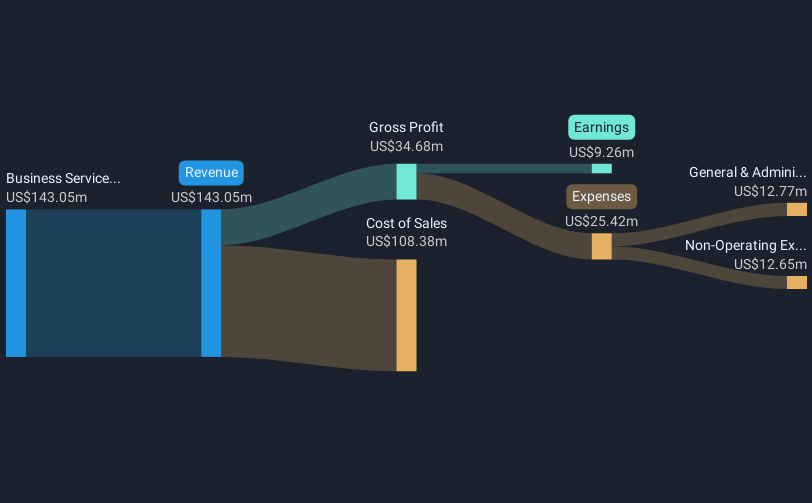

Operations: Geodrill's revenue primarily comes from its Business Services segment, which generated $166.31 million.

Market Cap: CA$162.71M

Geodrill Limited has demonstrated significant earnings growth, with a 383.6% increase over the past year, surpassing industry averages. The company maintains high-quality earnings and has not experienced shareholder dilution recently. Its financial health is robust, with short-term assets exceeding liabilities and cash reserves surpassing total debt. Despite these strengths, Geodrill's Return on Equity remains low at 10%, and its debt-to-equity ratio has increased over five years. Revenue growth is forecasted at a modest 4.54% annually, while analysts expect the stock price to rise by 32.4%. Recent earnings reports show steady sales growth and improved profit margins.

- Click here to discover the nuances of Geodrill with our detailed analytical financial health report.

- Assess Geodrill's future earnings estimates with our detailed growth reports.

Element 29 Resources (TSXV:ECU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Element 29 Resources Inc. is involved in the exploration and development of mineral resource properties in Peru, with a market capitalization of CA$70.40 million.

Operations: Element 29 Resources Inc. currently does not report any revenue segments.

Market Cap: CA$70.4M

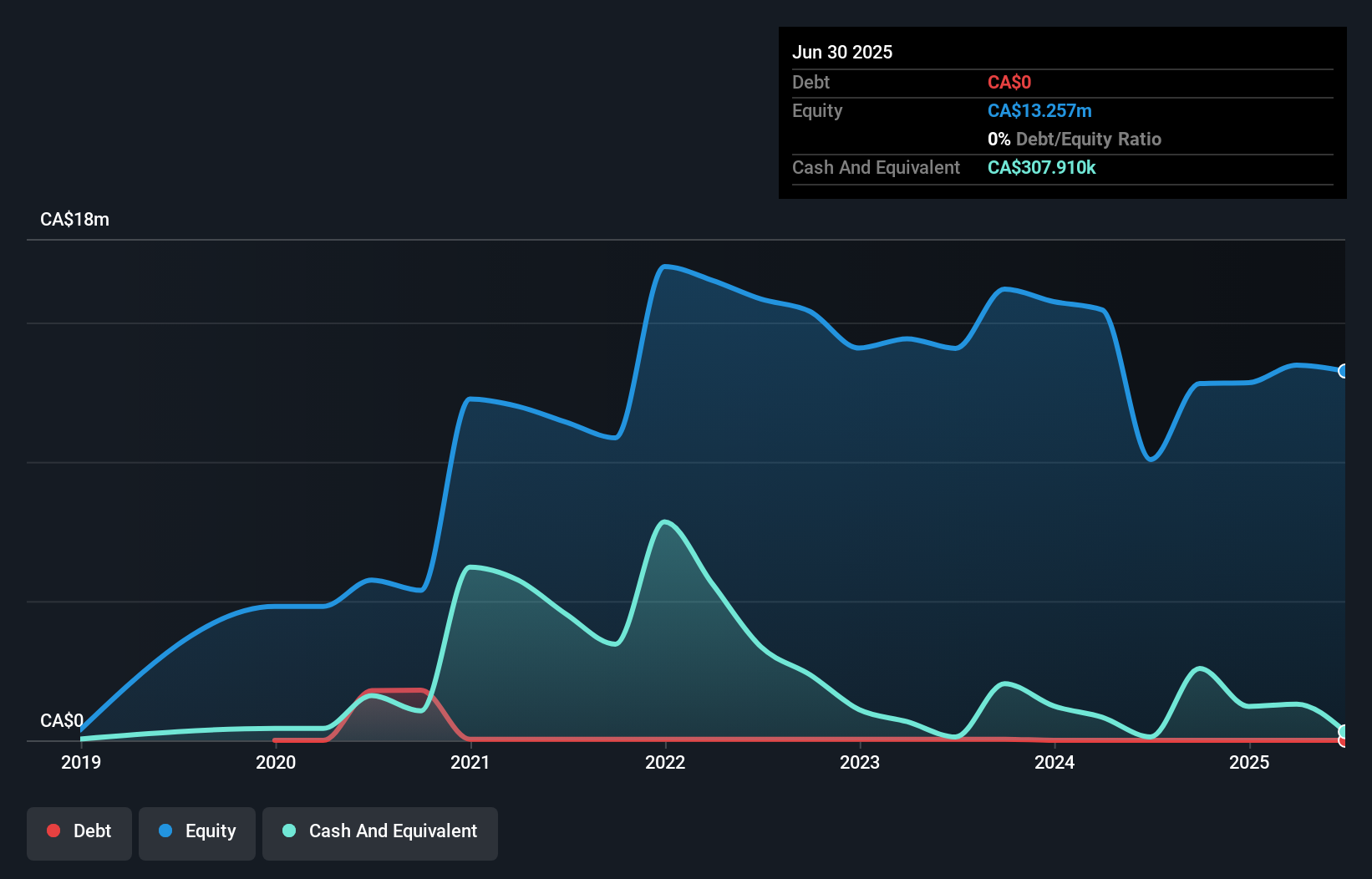

Element 29 Resources Inc. is a pre-revenue company focused on mineral exploration in Peru, with recent efforts highlighting potential resource expansion at its Elida deposit. The company remains debt-free and has successfully raised CA$6.32 million through private placements, which included insider participation, to support its exploration activities. Despite reporting net losses for the second quarter of 2025, these losses have decreased significantly from the previous year. Element 29's management team and board are relatively new, with average tenures under two years, suggesting ongoing organizational restructuring as they advance their drilling programs.

- Navigate through the intricacies of Element 29 Resources with our comprehensive balance sheet health report here.

- Learn about Element 29 Resources' historical performance here.

Eskay Mining (TSXV:ESK)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Eskay Mining Corp. is a natural resource company focused on acquiring and exploring mineral properties in British Columbia, Canada, with a market cap of CA$69.03 million.

Operations: Eskay Mining Corp. does not report any revenue segments as it is primarily focused on the exploration and acquisition of mineral properties in British Columbia, Canada.

Market Cap: CA$69.03M

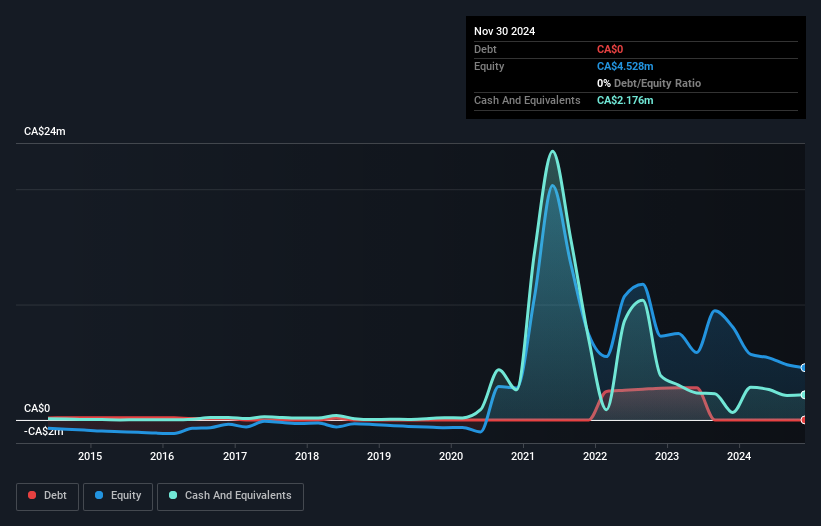

Eskay Mining Corp. is a pre-revenue company engaged in mineral exploration in British Columbia, Canada, with a market cap of CA$69.03 million. Recent private placements raised over CA$3 million to fund its exploration activities, offering investors common shares and warrants. The company remains debt-free and has reduced its net losses over the past five years by 18.3% annually, though it still reports losses. Eskay's seasoned management team and board have extensive experience, averaging 11.9 and 15.8 years respectively, while ongoing prospecting efforts at the Eskay Project show promising mineralization potential despite high share price volatility.

- Take a closer look at Eskay Mining's potential here in our financial health report.

- Gain insights into Eskay Mining's past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Dive into all 411 of the TSX Penny Stocks we have identified here.

- Seeking Other Investments? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eskay Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ESK

Eskay Mining

A natural resource company, engages in the acquisition and exploration of mineral properties in British Columbia, Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives