- Canada

- /

- Healthcare Services

- /

- TSX:QIPT

Geodrill And 2 Other TSX Penny Stocks To Consider

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by steady interest rates and geopolitical uncertainties, investors are exploring various opportunities to optimize their portfolios. Penny stocks, though an outdated term, continue to represent smaller or less-established companies that can offer intriguing value propositions. By focusing on those with strong financials and clear growth potential, investors may uncover promising opportunities in this often overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.64 | CA$64.74M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.68 | CA$621.92M | ✅ 3 ⚠️ 4 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.03 | CA$2.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.90 | CA$464.41M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.79 | CA$525.59M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.89 | CA$17.64M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.11 | CA$157.85M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$180.24M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.15 | CA$6.57M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 460 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, along with its subsidiaries, offers mineral exploration drilling services to mining companies in regions including West Africa, Egypt, Chile, and Peru, with a market cap of CA$167.43 million.

Operations: Geodrill generates revenue primarily from its business services segment, amounting to $157.14 million.

Market Cap: CA$167.43M

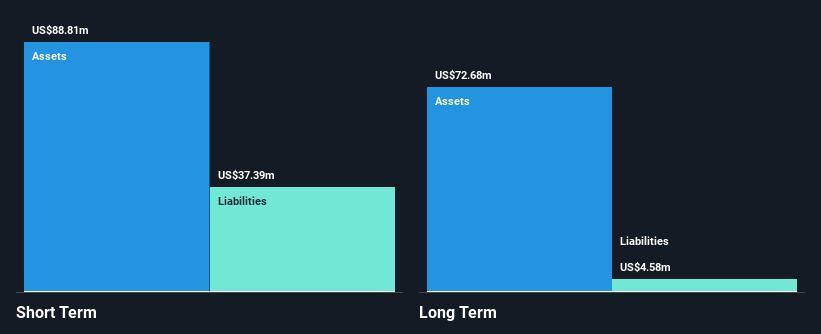

Geodrill Limited has demonstrated a solid financial position, with short-term assets of $105.8M surpassing both short-term and long-term liabilities, indicating strong liquidity. The company has transitioned to profitability recently, reporting a net income of US$5.61 million for Q1 2025 compared to US$2.1 million the previous year. Its price-to-earnings ratio of 9.5x suggests it may be undervalued relative to the broader Canadian market average of 15.4x. Geodrill's recent share repurchase program reflects confidence in its financial health and future prospects, while its seasoned management and board add stability to operations amidst industry volatility.

- Take a closer look at Geodrill's potential here in our financial health report.

- Understand Geodrill's earnings outlook by examining our growth report.

Quipt Home Medical (TSX:QIPT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Quipt Home Medical Corp., with a market cap of CA$114.26 million, operates through its subsidiaries to provide durable and home medical equipment and supplies in the United States.

Operations: The company generates revenue of $240.85 million from its provision of durable and home medical equipment and supplies in the United States.

Market Cap: CA$114.26M

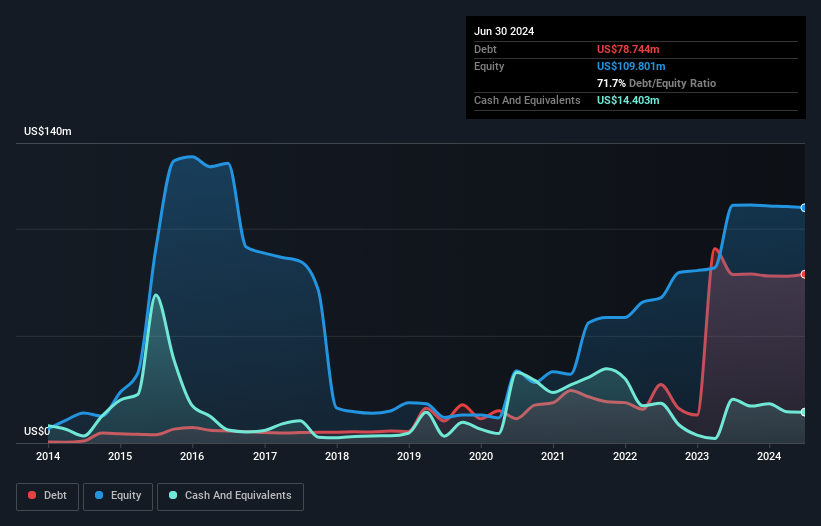

Quipt Home Medical Corp., with a market cap of CA$114.26 million, is currently unprofitable and faces challenges in achieving profitability over the next three years. Despite this, it trades at a significant discount to its estimated fair value and maintains a stable cash runway for more than three years due to positive free cash flow growth. The company's net debt to equity ratio is high at 61.6%, but it has improved from previous levels. Recent interest from Forager Capital Management, offering $3.10 per share—a substantial premium—highlights potential acquisition interest despite Quipt's volatile share price and financial losses.

- Click to explore a detailed breakdown of our findings in Quipt Home Medical's financial health report.

- Review our growth performance report to gain insights into Quipt Home Medical's future.

Tornado Infrastructure Equipment (TSXV:TGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tornado Infrastructure Equipment Ltd., with a market cap of CA$231.95 million, operates in North America through its subsidiaries by designing, fabricating, manufacturing, and selling hydrovac trucks.

Operations: The company's revenue is primarily derived from the United States, contributing CA$102.44 million, followed by Canada with CA$36.20 million.

Market Cap: CA$231.95M

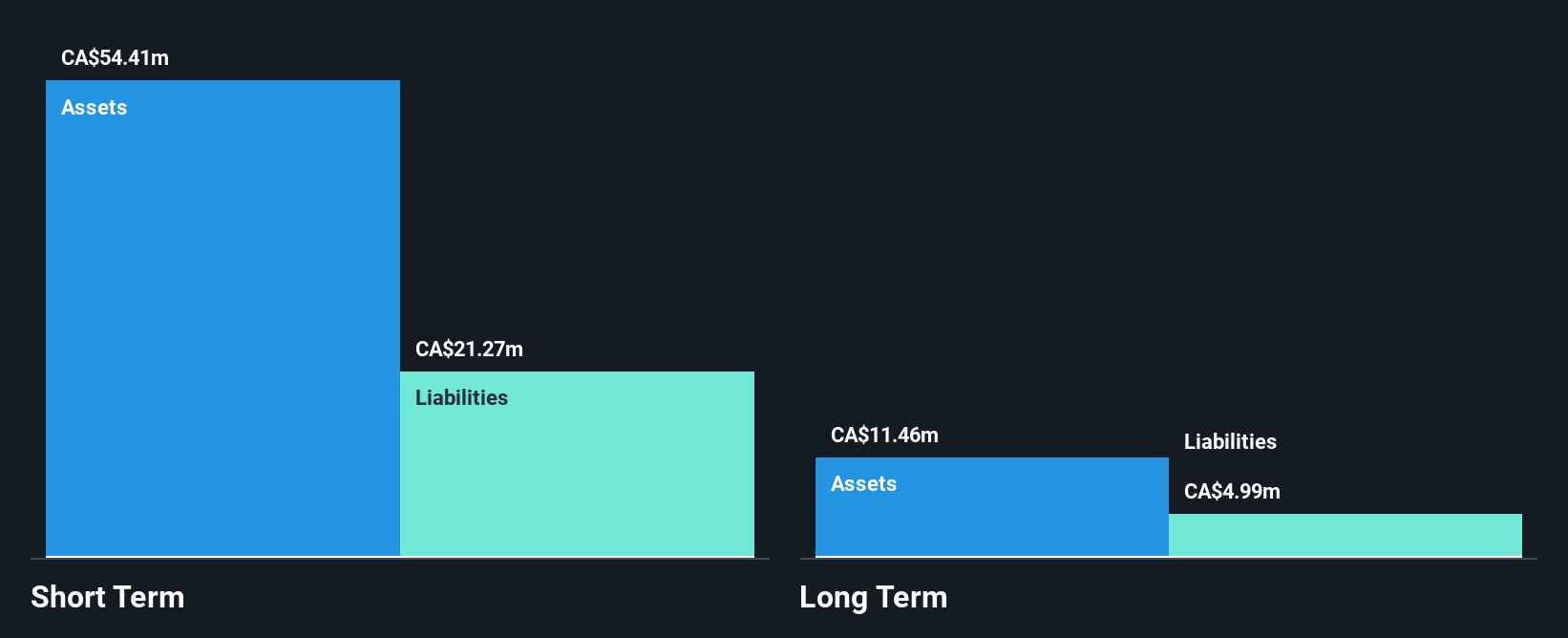

Tornado Infrastructure Equipment Ltd., with a market cap of CA$231.95 million, demonstrates strong financial health and growth potential. The company has achieved a significant earnings growth of 19.3% over the past year, outpacing the machinery industry average. Tornado's strategic initiatives, including its acquisition of CustomVac and expansion in North America, are expected to enhance revenue streams and operational efficiencies. With short-term assets exceeding liabilities and more cash than debt, financial stability is evident. Recent earnings reports show consistent sales growth and improved net income, supported by favorable currency impacts on U.S.-based revenues enhancing gross margins further.

- Unlock comprehensive insights into our analysis of Tornado Infrastructure Equipment stock in this financial health report.

- Examine Tornado Infrastructure Equipment's earnings growth report to understand how analysts expect it to perform.

Summing It All Up

- Investigate our full lineup of 460 TSX Penny Stocks right here.

- Ready For A Different Approach? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quipt Home Medical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QIPT

Quipt Home Medical

Through its subsidiaries, engages in the provision of durable and home medical equipment and supplies in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives