- Canada

- /

- Metals and Mining

- /

- TSX:ASM

3 Promising TSX Penny Stocks With Market Caps Up To CA$500M

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of easing trade tensions and steady interest rates, investors are keenly assessing opportunities that align with these evolving conditions. Penny stocks, while an old term, remain relevant as they often represent smaller or newer companies that can offer unique growth prospects at lower price points. By focusing on those with strong financials and clear growth potential, investors might uncover promising opportunities in this often-overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.81 | CA$81.93M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.24 | CA$99.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.60 | CA$372.57M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.03 | CA$542.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.81 | CA$449.65M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.63 | CA$3.6M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.60 | CA$539.99M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.63 | CA$128.41M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.45 | CA$14.18M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.30 | CA$49.19M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 902 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Avino Silver & Gold Mines (TSX:ASM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avino Silver & Gold Mines Ltd. focuses on acquiring, exploring, and advancing mineral properties in Mexico with a market cap of CA$455.18 million.

Operations: Avino Silver & Gold Mines Ltd. has not reported any specific revenue segments.

Market Cap: CA$455.18M

Avino Silver & Gold Mines Ltd. has demonstrated substantial earnings growth, with a 778.6% increase over the past year, surpassing industry averages. The company reported first-quarter 2025 sales of US$18.84 million and net income of US$5.62 million, reflecting improved profitability and operational efficiency compared to the previous year. Avino's debt is well-managed, with cash exceeding total debt and strong coverage by operating cash flow and EBIT. The management team is experienced, contributing to stable operations despite low return on equity at 9.9%. Recent filings for a $100 million shelf registration indicate potential capital raising activities ahead.

- Click here and access our complete financial health analysis report to understand the dynamics of Avino Silver & Gold Mines.

- Assess Avino Silver & Gold Mines' future earnings estimates with our detailed growth reports.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Geodrill Limited, along with its subsidiaries, offers mineral exploration drilling services to mining companies in West Africa, Egypt, Chile, and Peru, with a market cap of CA$161.77 million.

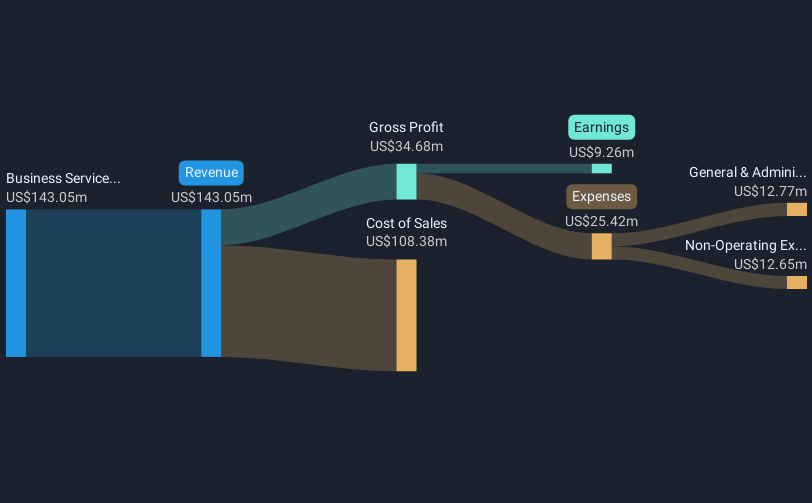

Operations: The company generates revenue primarily from its Business Services segment, amounting to $157.14 million.

Market Cap: CA$161.77M

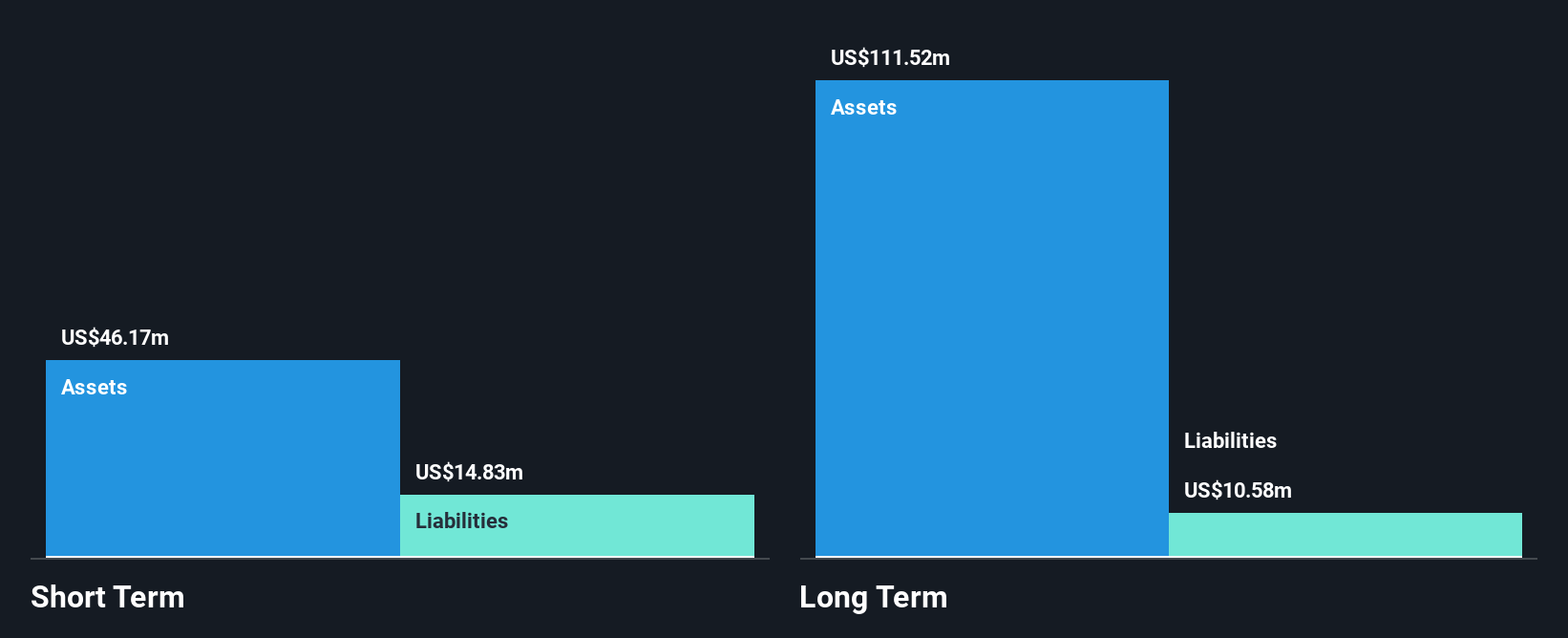

Geodrill Limited has shown robust financial performance, with first-quarter 2025 sales increasing to US$48.75 million from the previous year's US$34.67 million and net income rising to US$5.61 million. The company's short-term assets of $105.8M comfortably cover both its short-term and long-term liabilities, indicating strong liquidity management. Geodrill's debt is well-covered by operating cash flow, and it maintains more cash than total debt, enhancing financial stability despite an increased debt-to-equity ratio over five years. With a price-to-earnings ratio of 9x below the Canadian market average, Geodrill presents a potentially attractive valuation for investors seeking value in penny stocks.

- Click here to discover the nuances of Geodrill with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Geodrill's future.

Loncor Gold (TSX:LN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Loncor Gold Inc. is a gold exploration company focused on acquiring, exploring, and developing precious metal projects in the Democratic Republic of the Congo, with a market cap of CA$137.61 million.

Operations: Loncor Gold Inc. has not reported any revenue segments.

Market Cap: CA$137.61M

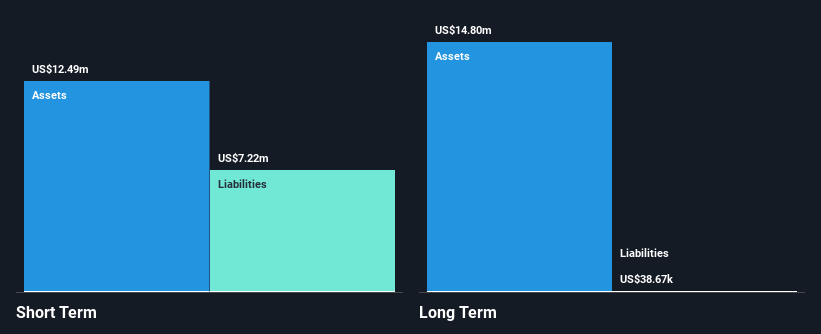

Loncor Gold Inc., a pre-revenue gold exploration company, is focused on its Adumbi deposit in the Democratic Republic of the Congo. Recent results from borehole LADD029 showed promising mineralization, with intersections including 22.31 metres grading 3.05 g/t gold and other significant sections. Despite a net loss of US$0.82 million in Q1 2025, Loncor's strategic drilling efforts aim to expand its resource base into a Tier 1 project. The company recently announced a private placement to raise up to CA$5 million, which could bolster its financial position amid current liabilities exceeding short-term assets by US$0.59 million.

- Jump into the full analysis health report here for a deeper understanding of Loncor Gold.

- Examine Loncor Gold's past performance report to understand how it has performed in prior years.

Where To Now?

- Discover the full array of 902 TSX Penny Stocks right here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 23 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives