- Canada

- /

- Metals and Mining

- /

- TSXV:CUSN

3 Promising Penny Stocks On TSX With Market Caps Below CA$200M

Reviewed by Simply Wall St

The Canadian market has shown robust performance, increasing by 1.0% over the last week and climbing 27% over the past year, with earnings forecasted to grow by 16% annually. While the term "penny stocks" might seem outdated, these stocks still offer compelling opportunities for growth at lower price points when they are backed by strong financials. In this article, we explore three promising penny stocks on the TSX that combine solid balance sheets with potential for substantial returns, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Geodrill (TSX:GEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Geodrill Limited, along with its subsidiaries, offers mineral exploration drilling services to mining companies in West Africa, Egypt, Chile, and Peru and has a market cap of CA$129.70 million.

Operations: Geodrill generates revenue of $136.20 million from its business services segment, providing mineral exploration drilling services.

Market Cap: CA$129.7M

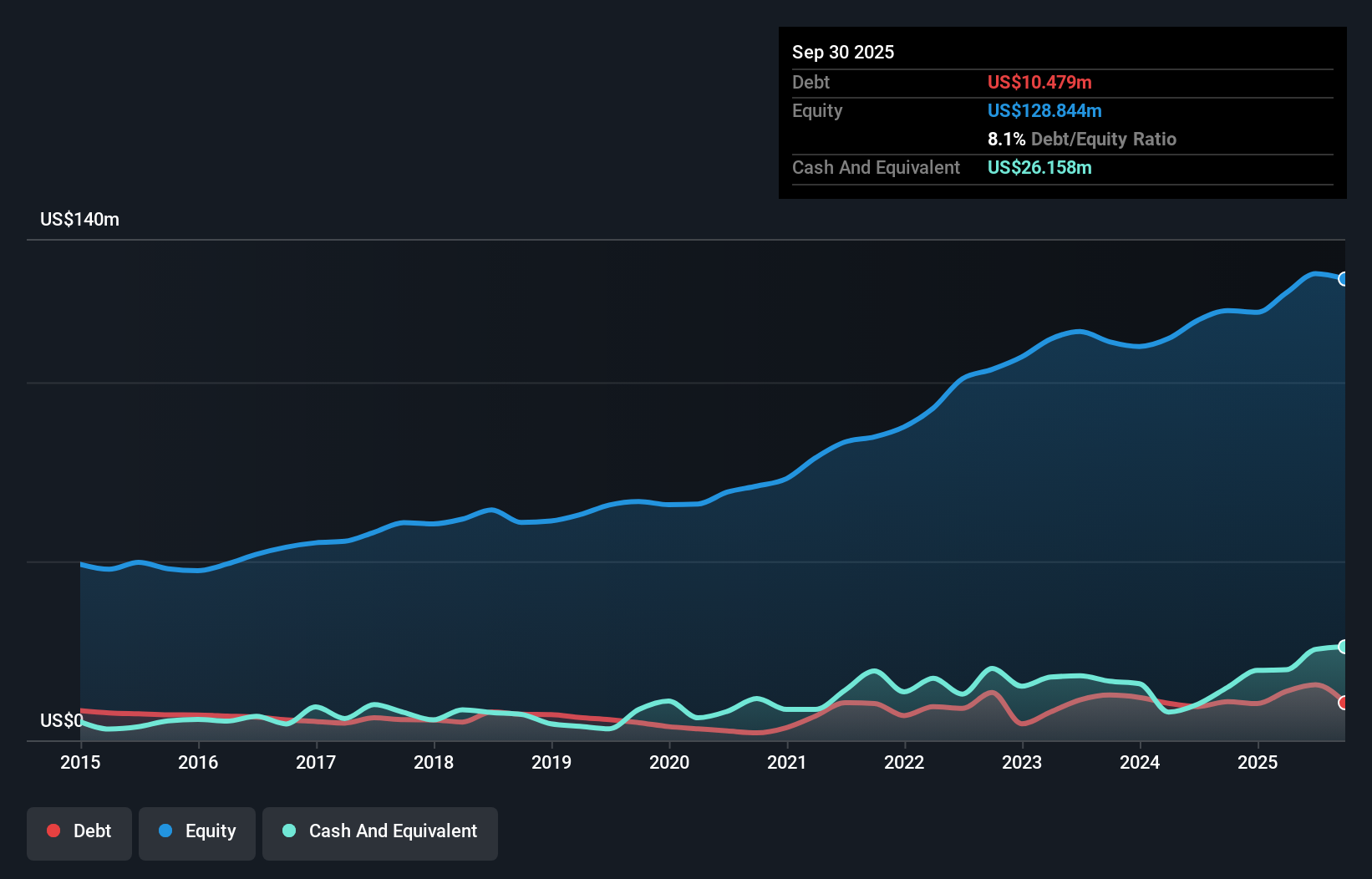

Geodrill Limited has demonstrated resilience in the volatile penny stock market, with a market cap of CA$129.70 million and substantial revenue generation of US$136.20 million from its drilling services. Despite recent negative earnings growth, the company reported improved second-quarter sales of US$41.18 million and net income rising to US$4.88 million from the previous year. Geodrill's financial stability is underpinned by more cash than debt, strong short-term asset coverage over liabilities, and seasoned management with significant tenure. However, challenges include lower profit margins compared to last year and a low return on equity at 2.2%.

- Click to explore a detailed breakdown of our findings in Geodrill's financial health report.

- Assess Geodrill's future earnings estimates with our detailed growth reports.

Cornish Metals (TSXV:CUSN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cornish Metals Inc. focuses on acquiring, evaluating, exploring, and developing mineral properties in the United Kingdom with a market cap of CA$72.26 million.

Operations: No revenue segments are reported.

Market Cap: CA$72.26M

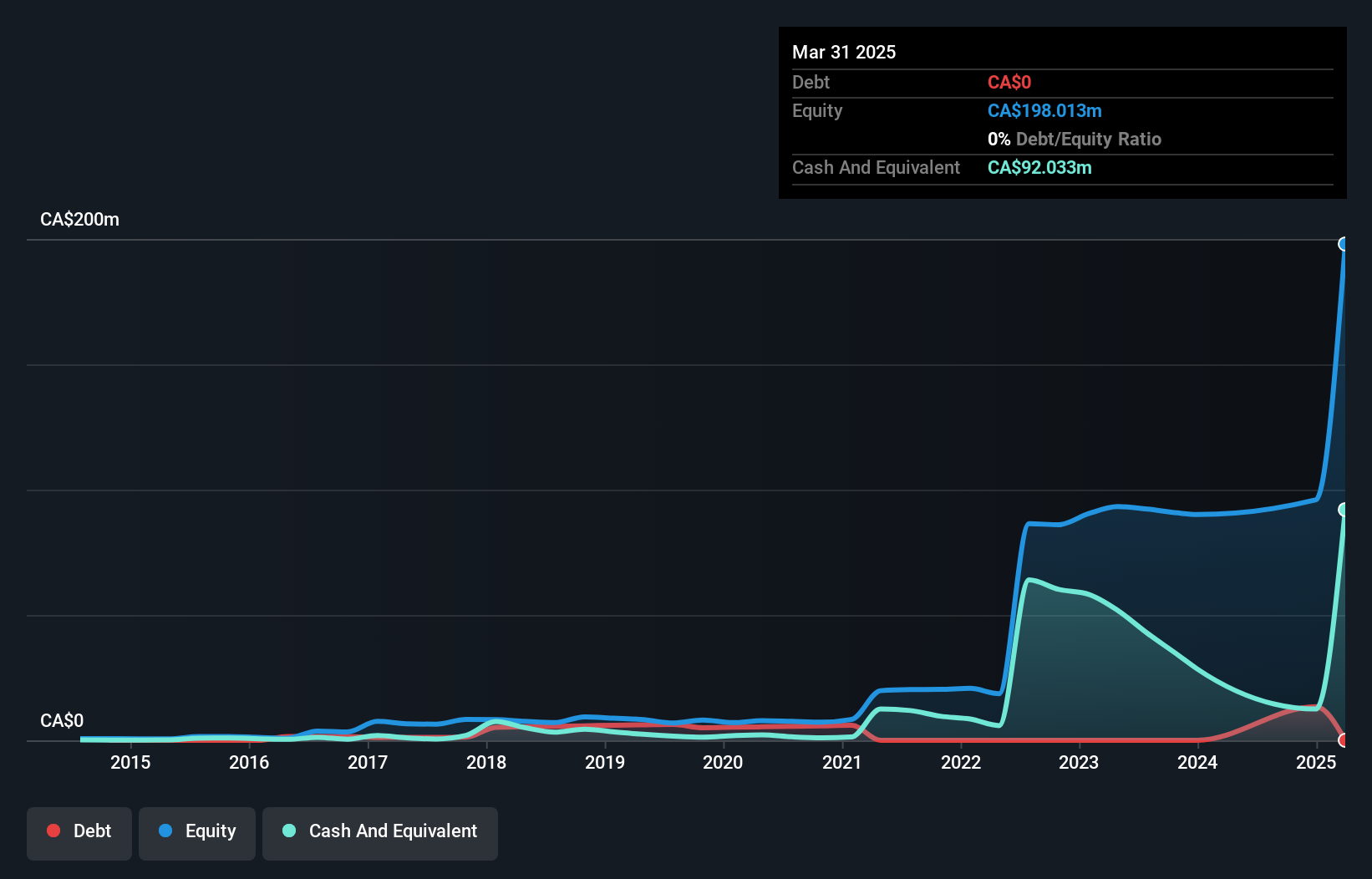

Cornish Metals Inc., with a market cap of CA$72.26 million, remains pre-revenue and unprofitable but has made strategic moves to bolster its position. The company recently secured a non-dilutive US$9.1 million credit facility to advance its South Crofty tin project, enhancing liquidity without shareholder dilution. Exploration results from the Wide Formation target have shown promising tin mineralization, supporting future resource expansion potential in Cornwall's historic mining region. Despite challenges such as forecasted earnings decline and limited revenue generation, Cornish Metals benefits from being debt-free and having experienced management guiding its strategic direction.

- Navigate through the intricacies of Cornish Metals with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Cornish Metals' future.

DMG Blockchain Solutions (TSXV:DMGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: DMG Blockchain Solutions Inc. is a Canadian company focused on blockchain and cryptocurrency operations, with a market cap of CA$84.40 million.

Operations: The company's revenue is primarily derived from its Data Processing segment, which generated CA$33.65 million.

Market Cap: CA$84.4M

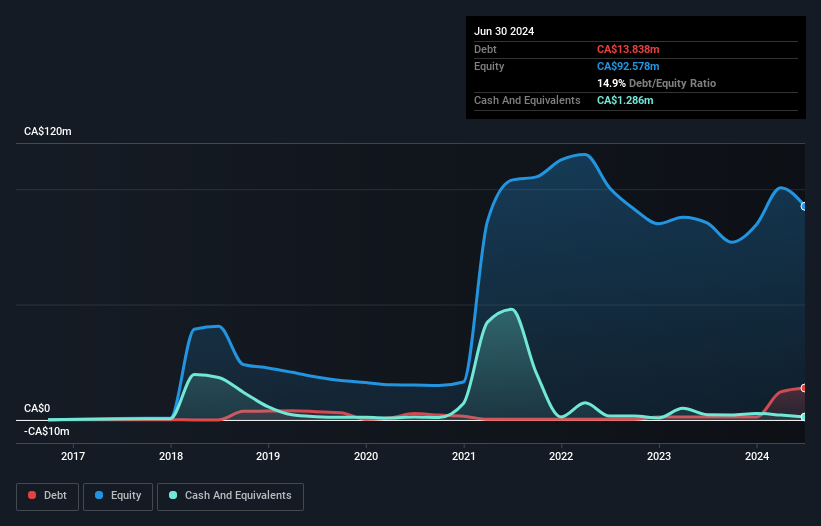

DMG Blockchain Solutions, with a market cap of CA$84.40 million, has shown significant progress by becoming profitable this year. The company reported revenue of CA$28 million for the first nine months of 2024, up from CA$22.29 million a year ago, reflecting growth in its Data Processing segment. Despite a net loss in Q3 2024, DMG's financial position is bolstered by well-covered debt and experienced management and board teams. Recent operational updates indicate steady Bitcoin mining activities with increased hashrate capacity, while strategic initiatives like the Systemic Trust Company aim to expand digital asset custody services for institutional clients.

- Jump into the full analysis health report here for a deeper understanding of DMG Blockchain Solutions.

- Learn about DMG Blockchain Solutions' future growth trajectory here.

Key Takeaways

- Access the full spectrum of 947 TSX Penny Stocks by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CUSN

Cornish Metals

Engages in the acquisition, evaluation, exploration, and development of mineral properties in the United Kingdom.

Adequate balance sheet and slightly overvalued.