- Canada

- /

- Metals and Mining

- /

- TSX:GAU

What Galiano Gold (TSX:GAU)'s Expanded Abore Drilling Could Mean for Future Resource Potential

Reviewed by Sasha Jovanovic

- Galiano Gold recently announced an expansion of its 2025 Abore drilling program at the Asanko Gold Mine in Ghana, following ongoing success confirming multiple significant high-grade gold intercepts below the existing mineral resource.

- The latest drilling has led to an additional budget of US$3.1 million for a further 11,000 meters, with new high-grade zones confirmed that could support future underground mining potential and an upcoming mineral resource update in early 2026.

- We'll explore how the expanded Abore drilling and confirmation of high-grade gold zones could reshape Galiano Gold's investment outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Galiano Gold Investment Narrative Recap

To be a shareholder in Galiano Gold, you need to believe in the company’s ability to grow its mineral resources and extend the life of its key asset, the Asanko Gold Mine, despite being reliant on a single project in Ghana. The recent expansion of the Abore drilling program, driven by consistent high-grade gold intercepts, directly supports the most important near-term catalyst, resource growth at Abore, while helping address the critical risk of limited organic exploration, though operational and regulatory risks remain material.

Among the recent announcements, the August 21, 2025, release of exceptional drill results at Abore is most closely related, as it laid the groundwork for the latest drilling success and program expansion. This continuity of positive exploration news at Abore reinforces the theme that future production visibility is tied to ongoing resource conversion and grade confirmation at this deposit.

By contrast, investors should be mindful that continued reliance on the Asanko Gold Mine leaves Galiano exposed to...

Read the full narrative on Galiano Gold (it's free!)

Galiano Gold is forecast to achieve $612.9 million in revenue and $157.4 million in earnings by 2028. This outlook is based on analysts projecting a 25.6% annual revenue growth rate and an earnings increase of $162.8 million from current earnings of $-5.4 million.

Uncover how Galiano Gold's forecasts yield a CA$4.78 fair value, a 50% upside to its current price.

Exploring Other Perspectives

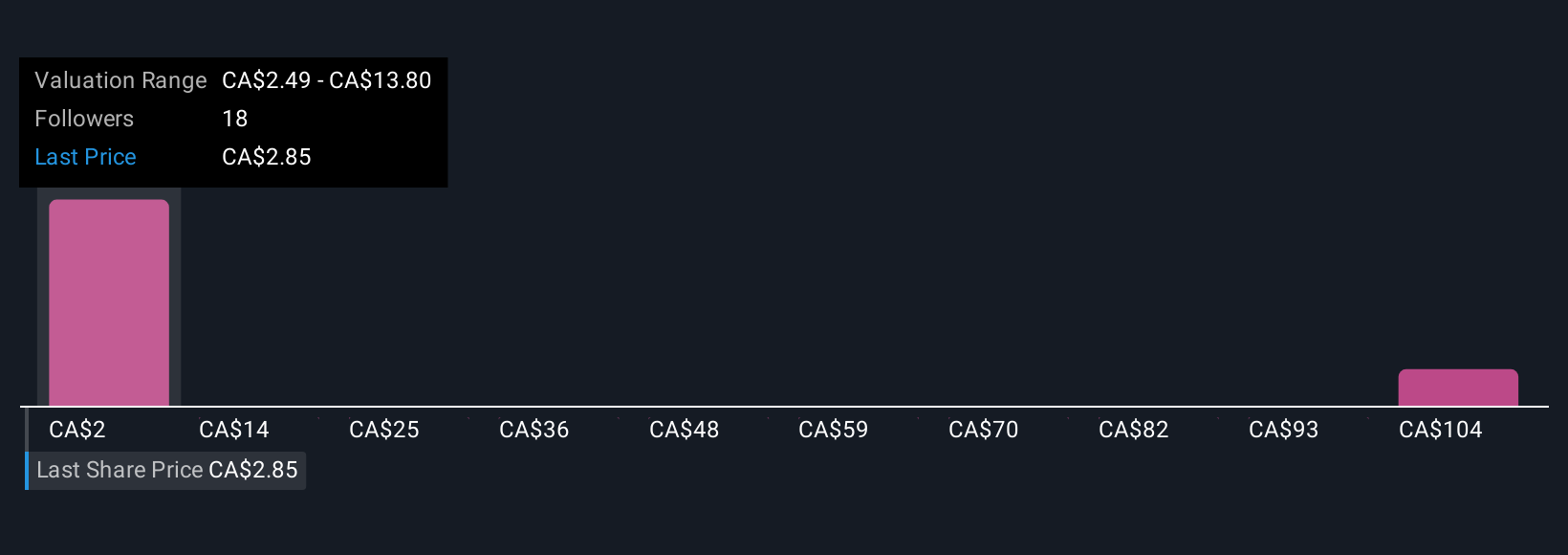

Seven fair value estimates from the Simply Wall St Community range from CA$2.49 to CA$59.63, reflecting wide divergence in outlooks. With resource expansion at Abore now a key catalyst, consider how differing expectations for drilling success or operational stability can shape the outlook for Galiano’s future performance.

Explore 7 other fair value estimates on Galiano Gold - why the stock might be worth 22% less than the current price!

Build Your Own Galiano Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Galiano Gold research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Galiano Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Galiano Gold's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GAU

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success