- Canada

- /

- Metals and Mining

- /

- TSX:FVL

Freegold Ventures (TSE:FVL) Is In A Strong Position To Grow Its Business

We can readily understand why investors are attracted to unprofitable companies. By way of example, Freegold Ventures (TSE:FVL) has seen its share price rise 1,300% over the last year, delighting many shareholders. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given its strong share price performance, we think it's worthwhile for Freegold Ventures shareholders to consider whether its cash burn is concerning. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Freegold Ventures

When Might Freegold Ventures Run Out Of Money?

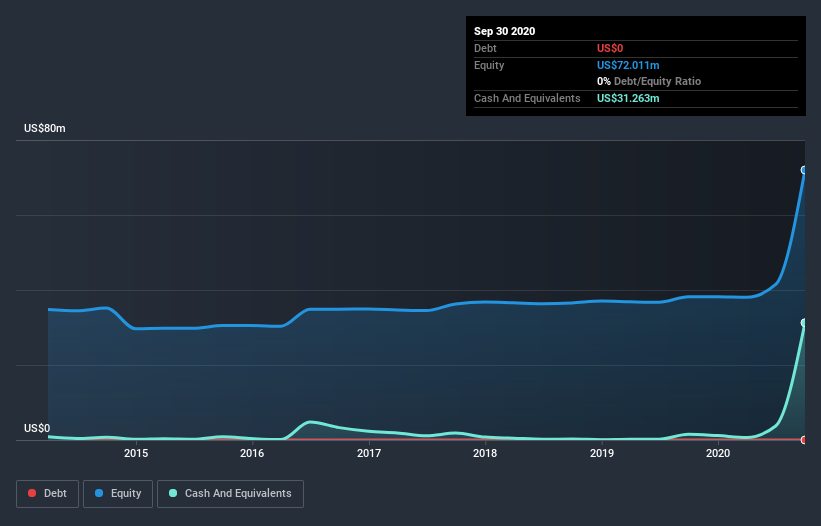

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at September 2020, Freegold Ventures had cash of US$31m and such minimal debt that we can ignore it for the purposes of this analysis. Importantly, its cash burn was US$2.5m over the trailing twelve months. That means it had a cash runway of very many years as of September 2020. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Hard Would It Be For Freegold Ventures To Raise More Cash For Growth?

Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Freegold Ventures' cash burn of US$2.5m is about 1.4% of its US$183m market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About Freegold Ventures' Cash Burn?

Because Freegold Ventures is an early stage company, we don't have a great deal of data on which to form an opinion of its cash burn. Certainly, we'd be more confident in the stock if it was generating operating revenue. Having said that, we can say that its cash runway was a real positive. Overall, we think its cash burn seems perfectly reasonable, and we are not concerned by it. On another note, Freegold Ventures has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Freegold Ventures, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:FVL

Freegold Ventures

An exploration stage company, engages in the acquisition, exploration, and evaluation of precious and base metal properties in the United States and Canada.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth