- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Sizing Up Fortuna Mining After 70% Rally and New Mineral Discovery in 2025

Reviewed by Bailey Pemberton

- If you have ever wondered whether Fortuna Mining is offering real value at its current price, you are definitely not alone. Now might be the perfect moment to size things up.

- The stock has advanced a massive 70.9% year-to-date and an impressive 69.1% over the last 12 months, though it has dipped modestly in recent weeks.

- One driver behind these dramatic moves was Fortuna’s announcement of a significant new mineral discovery in one of its core properties. This news has energized both analysts and retail investors. In addition, the company recently secured an exploration permit update that could pave the way for future growth opportunities and keep attention firmly on its projects.

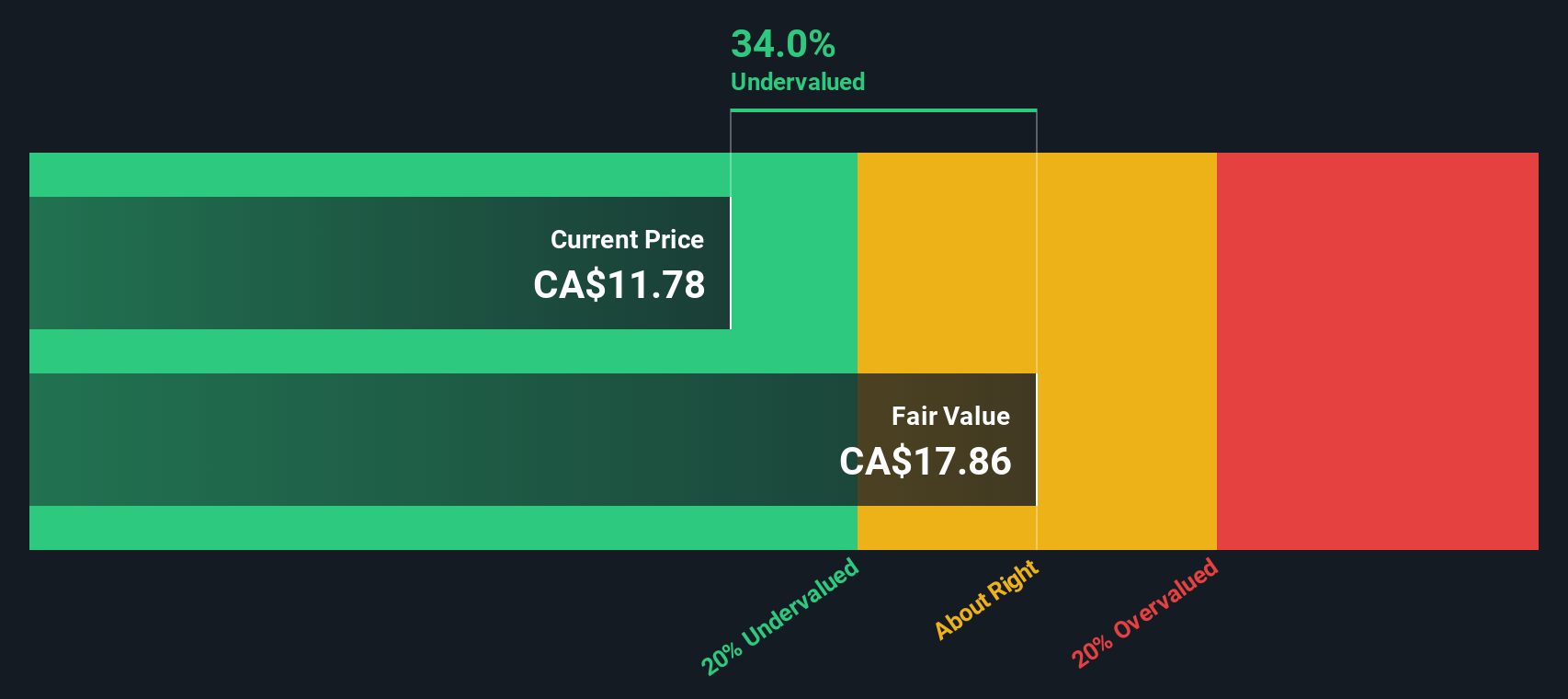

- When we run the numbers, Fortuna Mining earns a 4 out of 6 on our valuation score, meaning it looks undervalued on most checks. However, as we’ll see, understanding the full story is about more than just ratios and models.

Approach 1: Fortuna Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its expected future cash flows and discounting them back to today's value. This approach gives investors a sense of what the business could be worth based on the income it is expected to generate.

For Fortuna Mining, the DCF model uses the 2 Stage Free Cash Flow to Equity method. The most recently reported Free Cash Flow stands at $189.7 million, and analysts forecast that annual free cash flow could reach $293.5 million by 2027. Projections for the next decade, which extend past 2027 using extrapolations, show further growth and gradual stabilization in annual free cash flows.

Using these projections, the DCF model estimates an intrinsic value for Fortuna Mining of $19.23 per share. This is a 41.5% discount compared to its current trading price, indicating the stock could be significantly undervalued based on forward-looking cash flow assumptions.

In summary, according to the DCF analysis, Fortuna Mining appears attractively priced for long-term investors who believe in the underlying business fundamentals and the reliability of these cash flow projections.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fortuna Mining is undervalued by 41.5%. Track this in your watchlist or portfolio, or discover 854 more undervalued stocks based on cash flows.

Approach 2: Fortuna Mining Price vs Earnings

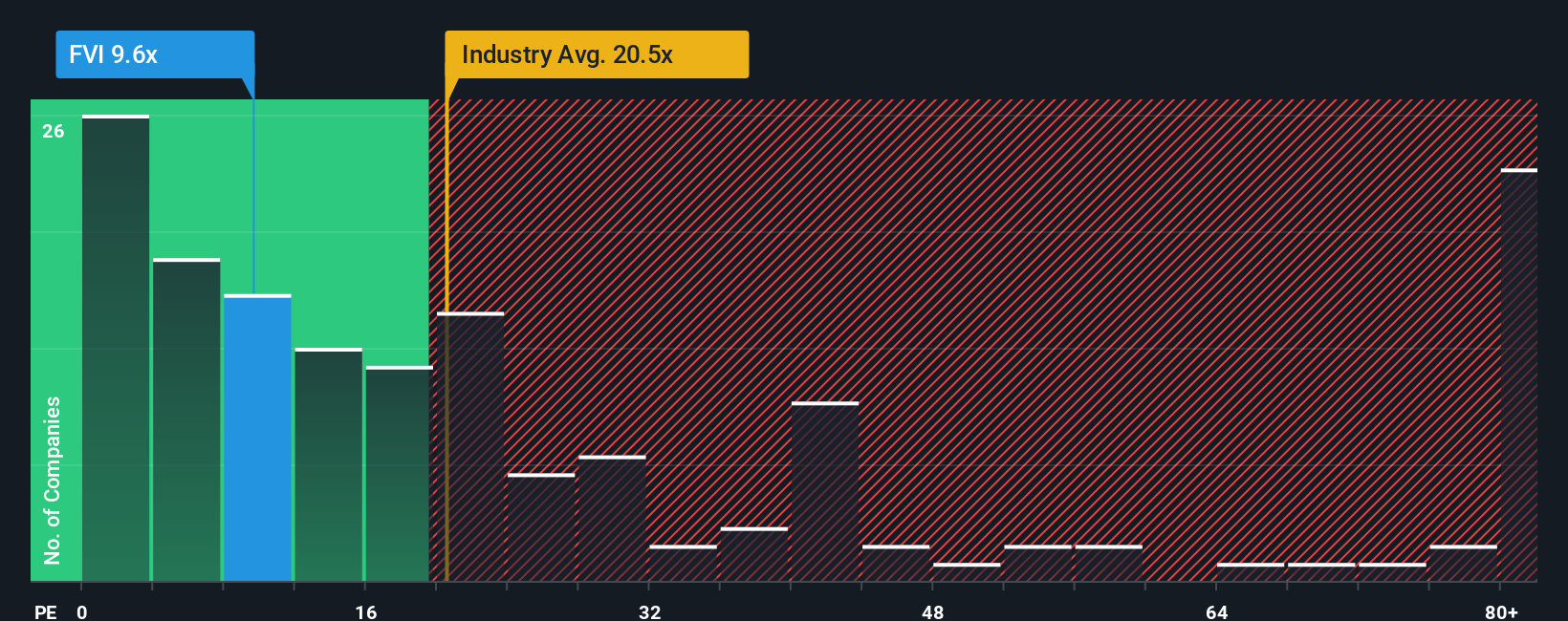

The Price-to-Earnings (PE) ratio is widely used to value profitable companies like Fortuna Mining because it quickly relates market value to actual earnings. This allows investors to assess what they are paying for each dollar of profit generated. For successful and well-established businesses, the PE ratio can complement long-term models such as DCF by reflecting how the market values growth potential, risks, and profitability in the present.

However, it is important to remember that a “normal” or “fair” PE ratio is influenced by several factors. Companies expected to grow faster typically command higher PE ratios, while those with greater perceived risks tend to trade at lower multiples. Industry characteristics and overall market sentiment also play significant roles in determining what investors consider a reasonable valuation.

Currently, Fortuna Mining trades at a PE ratio of 10.02x. This is noticeably below the Metals and Mining industry average of 20.42x and lower than the average of its peers at 17.94x. At first glance, this appears to signal undervaluation. To provide more context, Simply Wall St uses a proprietary "Fair Ratio" metric. This metric considers factors such as Fortuna’s earnings growth prospects, profit margins, specific industry characteristics, risk profile, and market capitalization, making it a more tailored benchmark than simple peer or industry comparisons.

When analyzing Fortuna Mining’s valuation using the Fair Ratio, the assessment reveals that its current market multiple is quite close to what would be expected given its financial and growth profile. As such, the stock appears priced about right based on this more holistic measure, rather than simply undervalued or overvalued by comparison alone.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fortuna Mining Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. In simple terms, a Narrative is your personal story or reasoning behind Fortuna Mining's numbers. It connects your view of the company's future to explicit financial forecasts, ultimately arriving at your own fair value estimate.

Narratives empower investors by linking the company’s unique business story to projected revenue, earnings, and profit margins. This allows you to bridge the gap between “what might happen” and “what it’s worth.” On the Simply Wall St platform’s Community page, millions of investors use this easy and accessible tool to write and share narratives, compare assumptions, and spot new investment angles in real time.

By building your own Narrative, you can decide whether Fortuna Mining’s current price represents a buying opportunity or calls for caution based on the fair value your own story creates. Narratives are dynamic. Whenever news or earnings updates come in, your forecast and fair value update automatically, keeping your investment decisions up to date.

For example, with Fortuna Mining, one investor might focus on rising gold prices and efficient new projects to estimate a fair value as high as CA$13.65 per share. Another might see cost pressures and asset concentration as risks, setting their fair value closer to CA$8.01. Your perspective shapes your investment decisions, and Narratives make that process visible and actionable.

Do you think there's more to the story for Fortuna Mining? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives