- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Fortuna Mining (TSX:FVI): Evaluating Valuation After Strong Share Price Momentum

Reviewed by Simply Wall St

Fortuna Mining (TSX:FVI) has recently seen some movement in its stock price, prompting investors to take a closer look at its performance. The company’s returns over the past month and the past 3 months offer some interesting context.

See our latest analysis for Fortuna Mining.

Fortuna Mining’s share price momentum has been striking lately, with a robust 31.4% gain over the past three months and a year-to-date share price return of nearly 76%. Momentum is definitely in play, and with the 1-year total shareholder return sitting at 69.2% and the three-year figure topping 191%, long-term investors have seen substantial rewards. This makes recent price shifts especially notable given that upward trend.

If Fortuna’s recent run has you curious about other growth opportunities, now’s a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

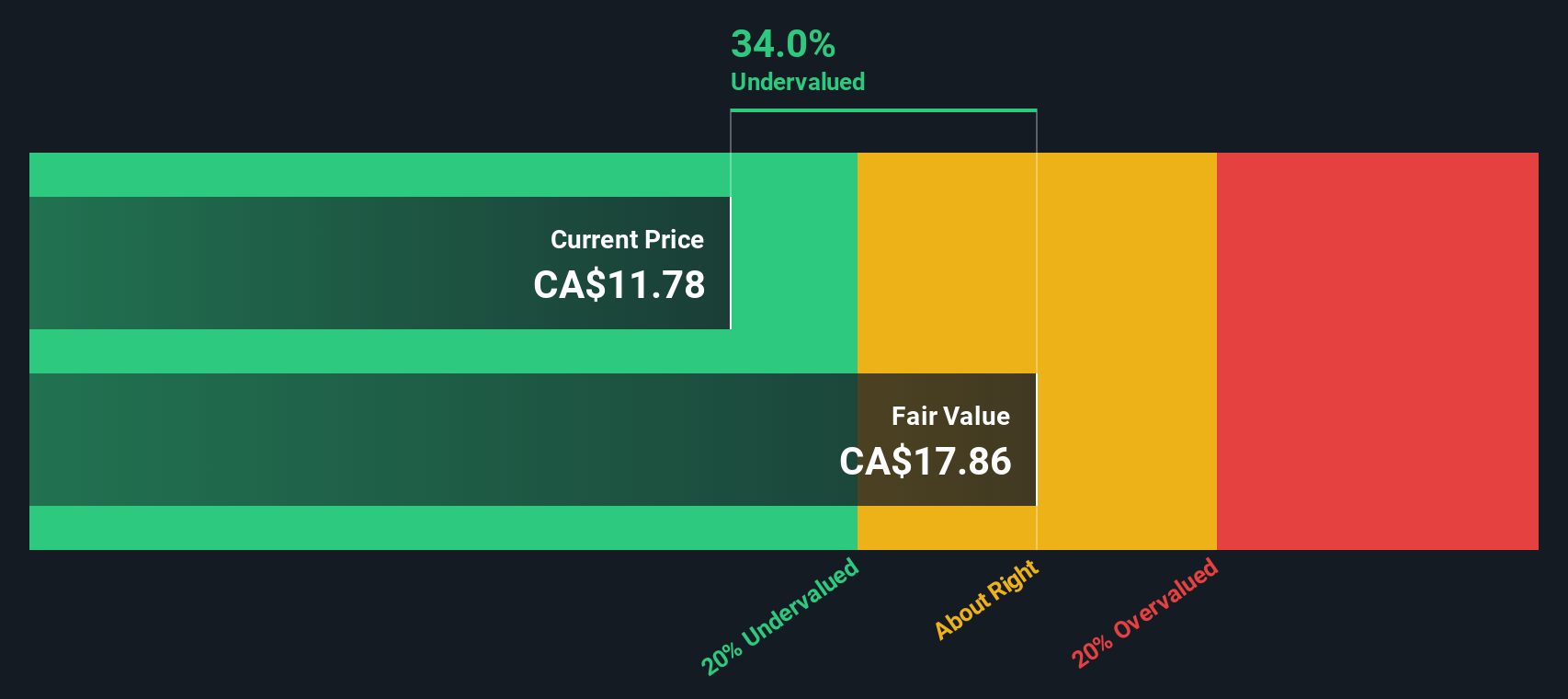

With shares having climbed so rapidly, investors may be wondering if Fortuna Mining is still trading at an attractive valuation, or if the recent gains reflect expectations for future growth that are already reflected in the stock price.

Most Popular Narrative: 15.1% Undervalued

Fortuna Mining’s most widely followed narrative places its fair value well above the recent close. This suggests that the market may be underestimating the company’s prospects despite the recent price surge.

Expansion at Seguela and the development of Diamba Sud position Fortuna to restore and surpass its previous production levels. These initiatives aim for higher-margin and longer-life ounces, aligning with anticipated increases in global demand for gold and other strategic metals. This supports future revenue and cash flow growth.

Want to uncover the assumptions behind this bullish price target? From projected profit margins to global expansion bets, the fair value is built on ambitious financial forecasts. Click and see which numbers could rewrite Fortuna’s investment story.

Result: Fair Value of $13.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks at key expansion projects or persistent high costs could challenge Fortuna Mining’s outlook and add uncertainty to the otherwise bullish narrative.

Find out about the key risks to this Fortuna Mining narrative.

Another View: What Does the DCF Model Say?

Looking at Fortuna Mining through the lens of our DCF model offers a more cautious take. The current share price of CA$11.59 sits above our estimate of fair value at CA$9.53. This suggests the stock may be overvalued by this method. Which approach better matches your own outlook on growth and risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Fortuna Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Fortuna Mining Narrative

If you think there’s more to Fortuna’s story, or you’d rather dig into the details yourself, you can build your own perspective in just a few minutes by using Do it your way

A great starting point for your Fortuna Mining research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next opportunity pass you by. There are strategies and trends other investors haven’t yet seized. Take control with these powerful tools:

- Unlock the potential for long-term income growth by scanning these 22 dividend stocks with yields > 3% boasting attractive yields above 3%.

- Seize the chance to participate in the artificial intelligence boom by checking out these 26 AI penny stocks before the crowd rushes in.

- Maximize value by targeting these 832 undervalued stocks based on cash flows that could be trading at a discount to their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives