- Canada

- /

- Metals and Mining

- /

- TSX:FOM

Why Foran Mining (TSX:FOM) Is Up 11.6% After Surpassing Milestones at McIlvenna Bay Project

Reviewed by Sasha Jovanovic

- Foran Mining Corporation recently announced that construction at its 100% owned McIlvenna Bay project in Saskatchewan reached 64% completion as of September 30, 2025, remaining on schedule for commercial production in mid-2026 and continuing within budget.

- This update highlights record quarterly underground development and key project milestones, further reducing operational risk as the project advances toward production.

- Next, we’ll explore how achieving major construction milestones at McIlvenna Bay may shape Foran Mining’s overall investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Foran Mining's Investment Narrative?

To own shares in Foran Mining right now, you have to be confident that McIlvenna Bay remains on track for production and that the company can successfully transition from project developer to cash-generating miner. The recent construction update confirms the project is progressing steadily, achieving major underground and surface milestones ahead of mid-2026 commercial production. This de-risks one of the company’s most important short-term catalysts, reducing the likelihood of significant delays or cost overruns that could negatively affect sentiment. Prior analysis pointed to execution risk at McIlvenna Bay, such as keeping to budget and meeting timelines, as the biggest concern. The strong Q3 progress and safety records ease those fears, though upcoming production ramp-up and future capital needs, especially after the recent equity raise, remain factors to watch. If these achievements continue, the risk profile for Foran in the lead-up to production could soften, but market reaction so far suggests investors are waiting for even more concrete results before re-rating the shares.

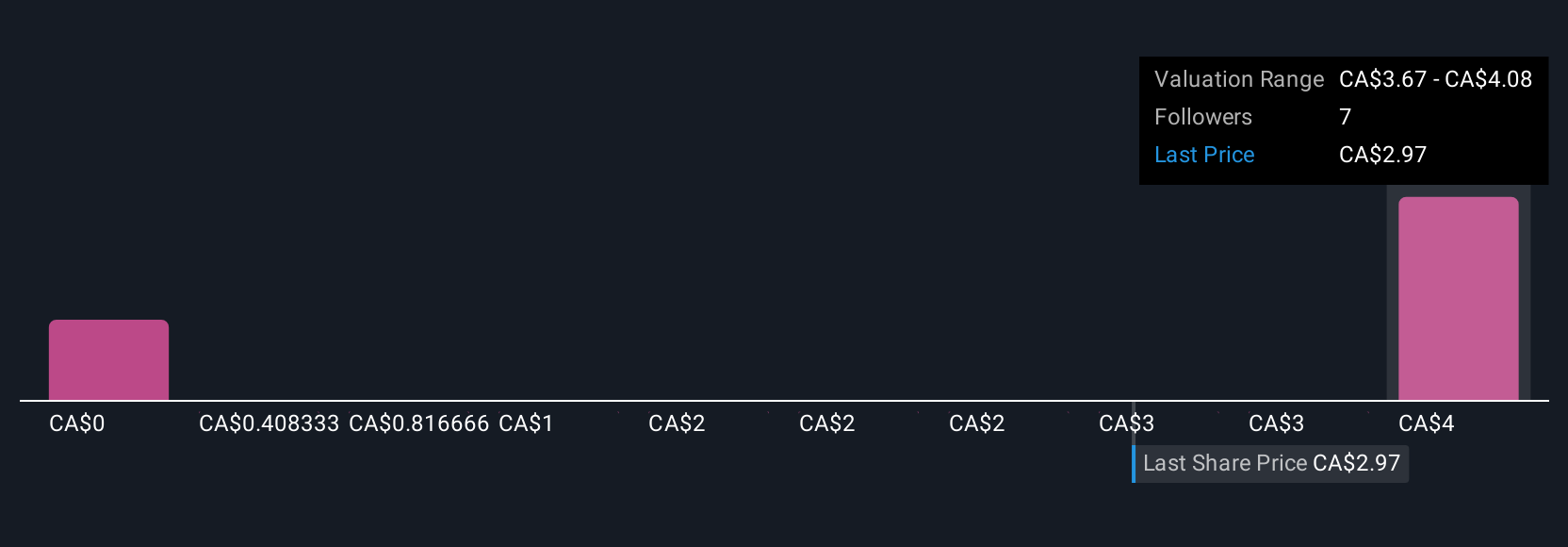

But, results can change quickly if future underground development faces unexpected snags investors should be aware of. Foran Mining's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 4 other fair value estimates on Foran Mining - why the stock might be worth less than half the current price!

Build Your Own Foran Mining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Foran Mining research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Foran Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Foran Mining's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FOM

Foran Mining

Engages in the acquisition, exploration, and development of mineral properties.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives