- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Should You Reassess Franco-Nevada After Its 74% Rally and Recent Gold Price Surge?

Reviewed by Bailey Pemberton

If you are wondering what to do with Franco-Nevada stock right now, you are hardly alone. Over the past year, shares have delivered a stunning 74.0% gain. The most recent month has brought an extra jolt, with the price leaping 9.7%, and just this past week, the stock climbed 5.9%. That is hard to ignore in any market. Investors have been drawn in by both the company's robust business model and by shifts in the market’s perception of risk, especially amid recent developments in the commodities space that have re-energized mining and royalty stocks like Franco-Nevada.

But with all that momentum, is the stock actually undervalued or getting ahead of itself? Franco-Nevada's value score currently sits at 0 out of 6. This means that, according to standard valuation checks, it does not appear undervalued by any method we routinely track. The story does not stop there, though. Coming up, I will break down those common valuation yardsticks and highlight how Franco-Nevada stacks up, plus share a more insightful way to gauge its worth that goes beyond the usual numbers.

Franco-Nevada scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Franco-Nevada Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. For Franco-Nevada, this approach provides a coherent way to assess what the company is likely worth based on its ability to generate cash over time.

Franco-Nevada currently generates a Free Cash Flow (FCF) of $129.7 Million. Looking ahead, analysts project the FCF to grow, reaching up to $1.27 Billion by 2028. While analyst estimates are available for the next five years, later years' cash flows are extrapolated to maintain conservative projections. These figures, converted to dollars, highlight Franco-Nevada's ability to compound value through its core business model.

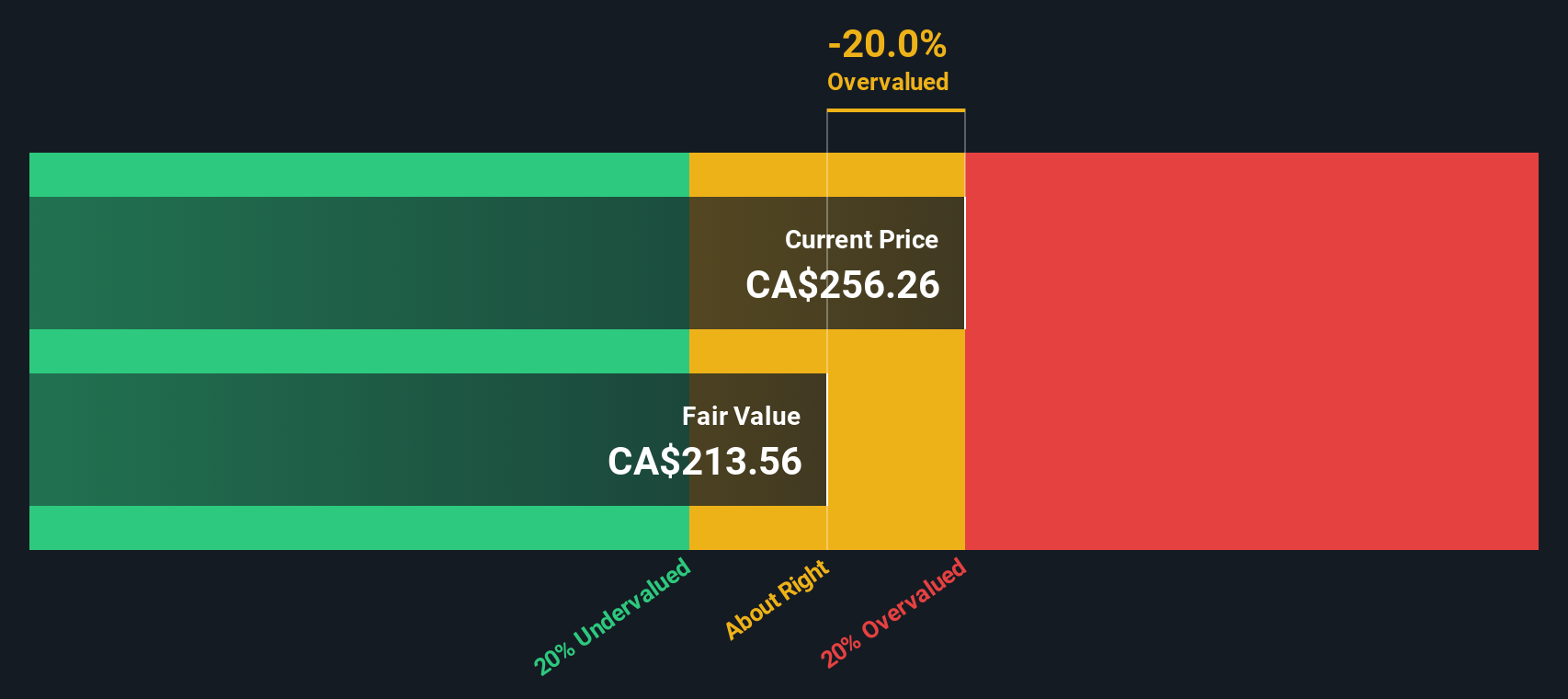

Using these projections, the DCF model calculates an intrinsic value of $230.64 per share. However, with the current trading price notably above this fair value, the model indicates that Franco-Nevada is about 31.2% overvalued at present. In other words, the excitement around the stock has pushed its price well above what its future cash flows would justify, according to this method.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Franco-Nevada may be overvalued by 31.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Franco-Nevada Price vs Earnings

The Price-to-Earnings (PE) ratio is a favored metric for valuing profitable companies like Franco-Nevada because it allows investors to compare what they are paying for a stock relative to the company’s actual earnings. It is particularly useful when evaluating companies with steady profits, as it provides a sense of how the market values their future growth and risk profile.

Not all PE ratios are created equal. Companies with higher growth prospects or lower perceived risk can command higher PE ratios, while those facing uncertainty or stagnation usually trade lower. A “normal” or “fair” PE takes these factors into account and sets a benchmark for what investors should reasonably expect.

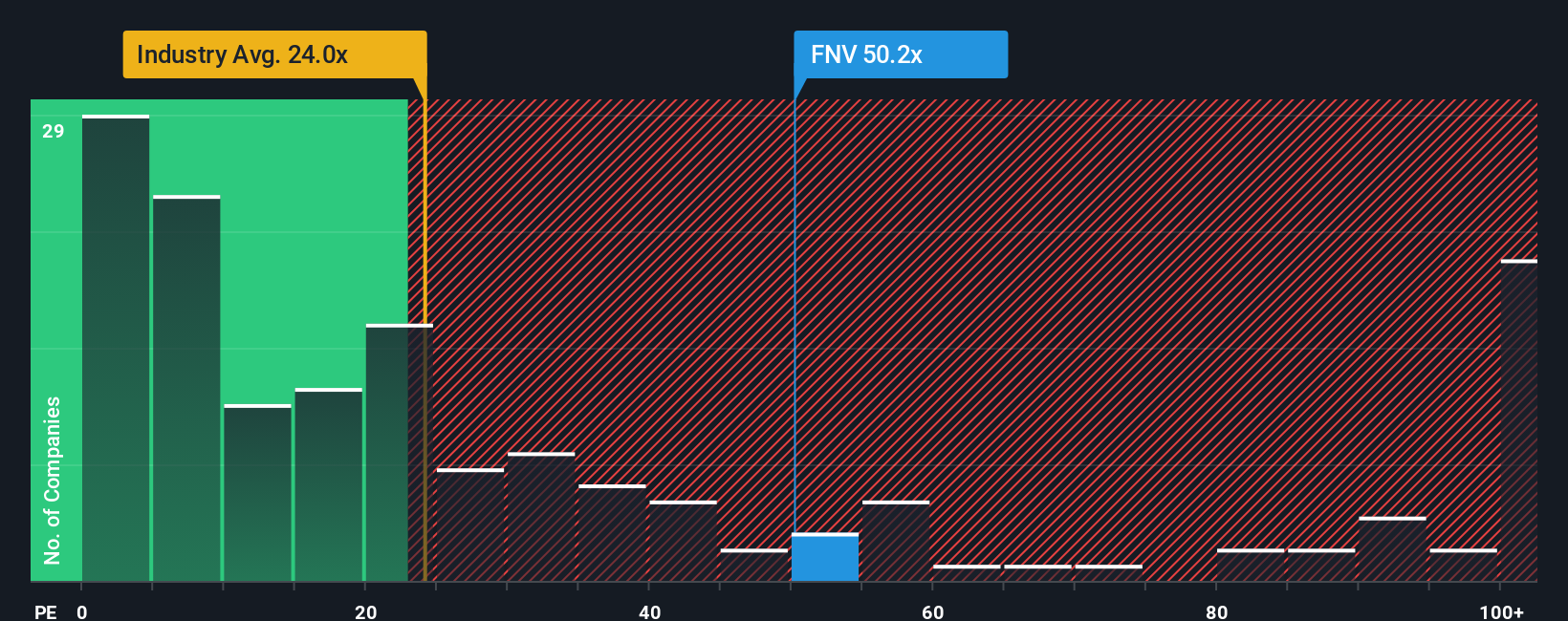

Right now, Franco-Nevada trades at a PE of 52.8x. This is well above both the metals and mining industry average of 23.7x and the average of its closest peers, which sits at 34.9x. While this might initially suggest overvaluation, it is important to dig deeper before making a judgment.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike basic peer or industry comparisons, the Fair Ratio evaluates Franco-Nevada’s PE in the context of its own earnings growth, profit margins, market cap, and the specific risks it faces. For Franco-Nevada, the Fair Ratio is 24.5x, reflecting a tailored benchmark based on these nuanced factors.

By comparing the current PE of 52.8x to the Fair Ratio of 24.5x, it becomes clear the stock is significantly more expensive than what the company’s fundamentals would suggest. This indicates that, at today’s price, Franco-Nevada looks overvalued on a price-to-earnings basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Franco-Nevada Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply the story or perspective you believe about a company—the “why” behind its numbers—combined with your own fair value, plus your assumptions around future revenue, earnings, and margins.

Rather than focusing on just a single price or ratio, Narratives let investors connect the dots between a company’s unique story, the expectations for its future growth, and what that means for fair value today. This makes valuation more meaningful and personalized to your own outlook.

On Simply Wall St’s Community page, millions of investors now use Narratives to walk through their reasoning, visualize the forecast, and calculate a fair value. This is all possible in an intuitive, dynamic tool. As new information emerges, Narratives update automatically so you can always see how your viewpoint stacks up in real time.

This means you can make smarter, more confident decisions by directly comparing your Narrative’s fair value to the current share price. You will know exactly when you think Franco-Nevada is a buy, hold, or sell, based on your own convictions and not just the latest headlines.

For instance, one investor might see sustained record gold prices and strategic acquisitions propelling revenue growth, justifying a price target as high as CA$313.25. Another investor may express caution about margin risks or regulatory headwinds and land at a much lower target near CA$264.96. Each Narrative transparently highlights its reasoning behind the numbers in just a sentence.

Do you think there's more to the story for Franco-Nevada? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives