The Canadian market is currently experiencing gains as global trade tensions ease, with recent trade agreements and discussions providing a more stable backdrop for investors. Amid these developments, the concept of penny stocks remains relevant, offering potential opportunities for growth in smaller or newer companies. These stocks can be attractive due to their affordability and the possibility of significant returns when backed by strong financials, making them an intriguing area for investors seeking hidden value.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.81 | CA$81.93M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.35 | CA$92.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Silvercorp Metals (TSX:SVM) | CA$4.97 | CA$1.11B | ✅ 5 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.02 | CA$563.85M | ✅ 4 ⚠️ 2 View Analysis > |

| Mandalay Resources (TSX:MND) | CA$4.75 | CA$456.27M | ✅ 3 ⚠️ 2 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.63 | CA$3.6M | ✅ 2 ⚠️ 5 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.59 | CA$530.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.53 | CA$129.43M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.495 | CA$13.32M | ✅ 2 ⚠️ 3 View Analysis > |

| BluMetric Environmental (TSXV:BLM) | CA$1.33 | CA$53.26M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 909 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, with a market cap of CA$177.53 million, offers drilling services across North America, South America, the Asia Pacific, the Middle East, Africa, and Europe.

Operations: The company generates revenue from its Water segment, contributing $41.38 million, and its Mining segment, which brings in $230.00 million.

Market Cap: CA$177.53M

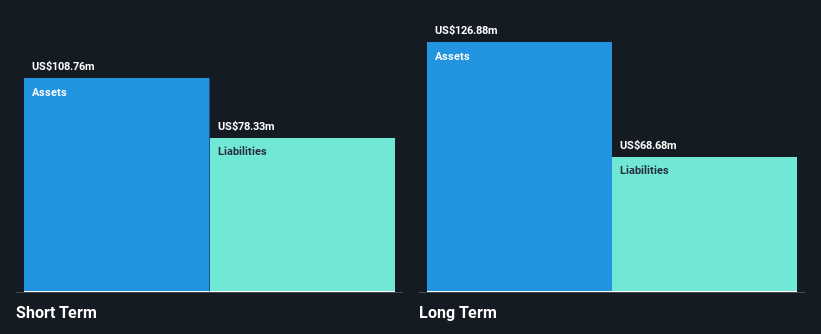

Foraco International SA, with a market cap of CA$177.53 million, has seen its earnings decline recently, reporting net income of US$1.54 million for Q1 2025 compared to US$8.85 million the previous year. Despite this setback, the company maintains high-quality past earnings and robust financial health with short-term assets exceeding both short and long-term liabilities. Its return on equity is strong at 21%, though it faces challenges with high debt levels and declining profit margins from 8.6% to 7.6%. Analysts are optimistic about future stock price growth, forecasting a significant increase in value.

- Take a closer look at Foraco International's potential here in our financial health report.

- Assess Foraco International's future earnings estimates with our detailed growth reports.

Gatekeeper Systems (TSXV:GSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Gatekeeper Systems Inc. designs, manufactures, markets, and sells video security solutions for mobile and transportation environments focused on children, passengers, and public safety in Canada and the United States with a market cap of CA$44.16 million.

Operations: The company generates CA$31.33 million in revenue from its Electronic Security Devices segment.

Market Cap: CA$44.16M

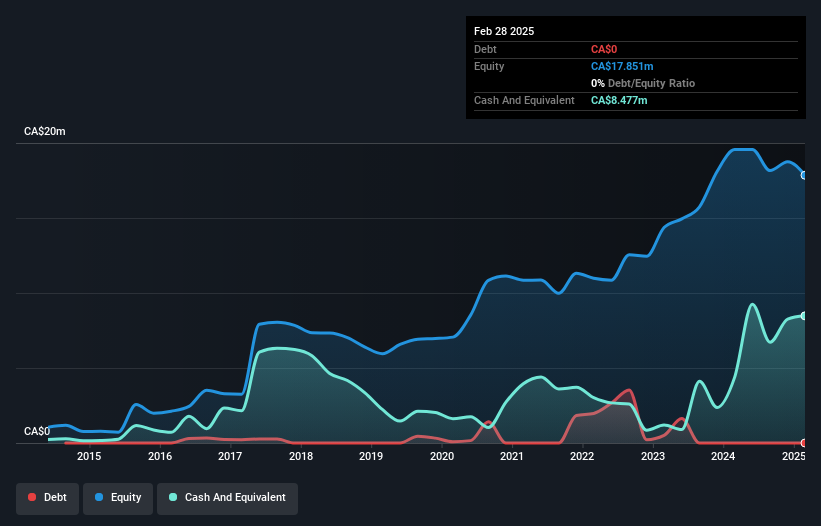

Gatekeeper Systems Inc., with a market cap of CA$44.16 million, has faced financial challenges recently, reporting a net loss of CA$1.06 million for Q2 2025 compared to a net income the previous year. Despite being unprofitable, the company remains debt-free and has not significantly diluted shareholders over the past year. Recent contracts in Ontario and Nova Scotia for supplying mobile data collectors and video systems indicate potential growth opportunities. The company also supports new Transport Canada regulations requiring perimeter visibility systems on school buses, potentially expanding its market presence in safety solutions for transportation environments.

- Click here and access our complete financial health analysis report to understand the dynamics of Gatekeeper Systems.

- Understand Gatekeeper Systems' track record by examining our performance history report.

Tornado Infrastructure Equipment (TSXV:TGH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tornado Infrastructure Equipment Ltd. designs, fabricates, manufactures, and sells hydrovac trucks in North America and China, with a market cap of CA$231.86 million.

Operations: The company generates revenue from two geographical segments, with CA$36.36 million from Canada and CA$100.53 million from the United States.

Market Cap: CA$231.86M

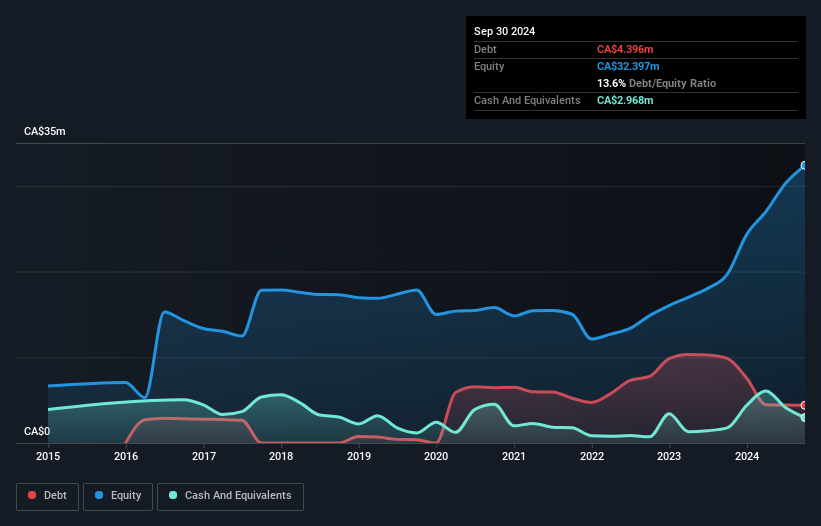

Tornado Infrastructure Equipment Ltd. has shown robust financial performance, with sales reaching CA$136.89 million for the year ending December 2024, up from CA$105.01 million the previous year. The company’s net income increased to CA$10.3 million, reflecting improved profitability and operational efficiency under its seasoned management team and board of directors. Tornado's strategic focus on innovation is evident in its recent product launches, including the EF4 Tornado Hydrovac and Coring Machine, which could enhance market competitiveness. Additionally, strong financial health is supported by well-covered debt obligations and a high return on equity of 28.4%.

- Click to explore a detailed breakdown of our findings in Tornado Infrastructure Equipment's financial health report.

- Review our growth performance report to gain insights into Tornado Infrastructure Equipment's future.

Summing It All Up

- Explore the 909 names from our TSX Penny Stocks screener here.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 22 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GSI

Gatekeeper Systems

Designs, manufactures, markets, and sells video security solutions for mobile and transportation environment for children, passengers, and public safety in Canada and the United States.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives