- Canada

- /

- Metals and Mining

- /

- TSX:ETG

Entrée Resources Shareholders Booked A 40% Gain In The Last Three Years

One simple way to benefit from the stock market is to buy an index fund. But many of us dare to dream of bigger returns, and build a portfolio ourselves. Just take a look at Entrée Resources Ltd. (TSE:ETG), which is up 40%, over three years, soundly beating the market return of 17% (not including dividends).

See our latest analysis for Entrée Resources

With zero revenue generated over twelve months, we Entrée Resources has proved its business plan yet. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, investors may be hoping that Entrée Resources finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized).

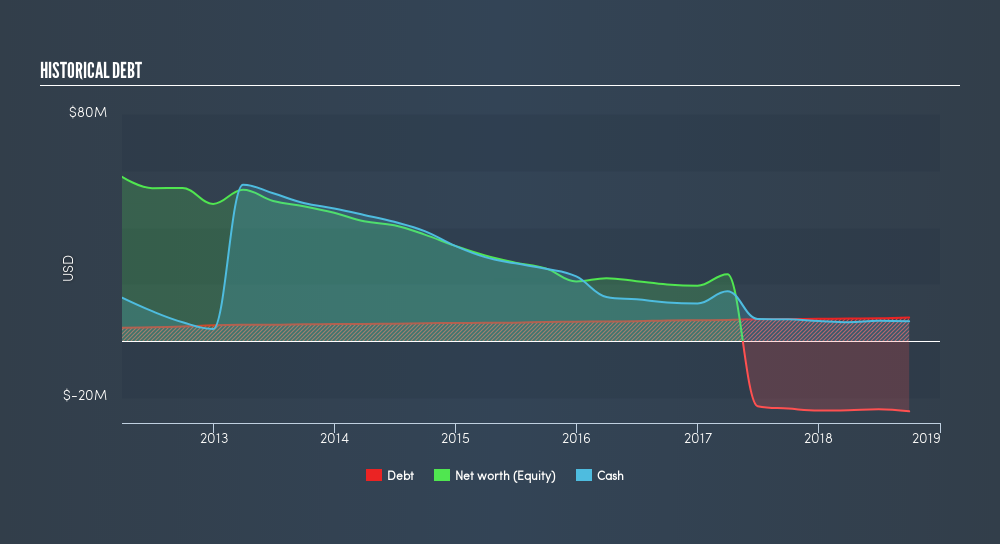

Our data indicates that Entrée Resources had net debt of US$25,342,000 when it last reported in September 2018. That makes it extremely high risk, in our view. So the fact that the stock is up 12% per year, over 3 years shows that high risks can lead to high rewards, sometimes. Investors must really like its potential. You can see in the image below, how Entrée Resources's cash and debt levels have changed over time (click to see the values).

Of course, the truth is that it is hard to value companies without much revenue or profit. One thing you can do is check if company insiders are buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this freechart of insider buying (and selling).

A Different Perspective

Investors in Entrée Resources had a tough year, with a total loss of 5.6%, against a market gain of about 4.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 1.2% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:ETG

Entrée Resources

A mining company, engages in the development and exploration of mineral properties in Canada.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026