- Canada

- /

- Metals and Mining

- /

- TSX:ERO

Why Ero Copper (TSX:ERO) Is Up 15.1% After Upgraded 2025 Guidance and Analyst Optimism

Reviewed by Sasha Jovanovic

- Ero Copper recently updated its 2025 production guidance and saw heightened analyst optimism ahead of its latest earnings release, which was anticipated to report an EPS of $0.57, a very large increase from the prior year.

- Rising analyst consensus estimates, enhanced Relative Strength Rating, and strengthened buy sentiment reflect increased market confidence fostered by management’s operational updates and focus on realistic objectives.

- We’ll examine how rising analyst optimism and the company’s updated production guidance may influence Ero Copper’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Ero Copper Investment Narrative Recap

For those considering Ero Copper, the underlying conviction is in the company’s ability to execute a ramp-up of copper production and improved operational consistency across its Brazilian mining assets. While the impressive analyst optimism and EPS estimate upgrades signal growing confidence, the updated 2025 production guidance remains the most important near-term catalyst; its credibility is crucial, as repeated downward revisions in previous years make flexibility and delivery on these targets the biggest watchpoint. These latest updates reinforce management’s focus, but do not materially change the central production execution risk facing the business right now.

The July 2025 announcement revising production guidance for Caraíba, Tucumã, and Xavantina is the key reference point. This guidance update aligns with heightened analyst sentiment and underscores management’s efforts to provide more realistic and achievable operational forecasts, supporting confidence in the copper production ramp as a direct near-term business driver.

In contrast, uncertainties remain around how dilution from lower-grade sources at Caraíba might weaken earnings if cost improvements and copper prices do not compensate, which is information investors should be aware of…

Read the full narrative on Ero Copper (it's free!)

Ero Copper's narrative projects $996.0 million in revenue and $298.7 million in earnings by 2028. This requires 22.9% yearly revenue growth and a $156 million earnings increase from $142.7 million today.

Uncover how Ero Copper's forecasts yield a CA$27.71 fair value, a 7% downside to its current price.

Exploring Other Perspectives

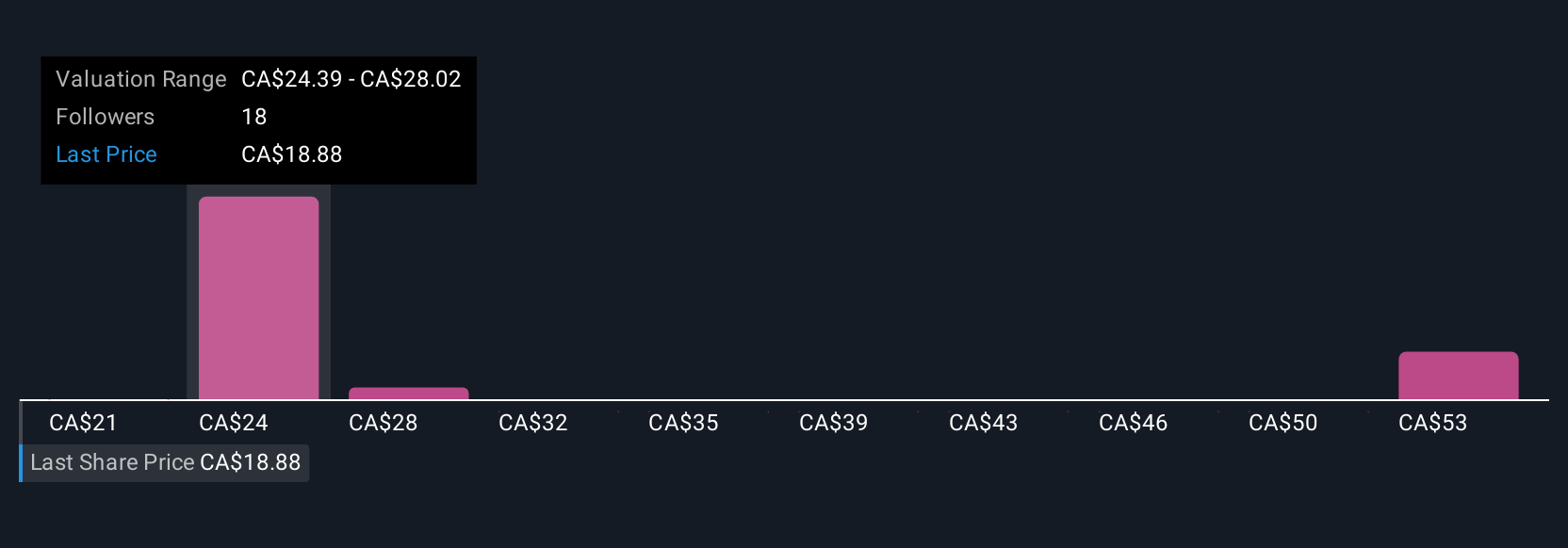

Six private investors in the Simply Wall St Community valued Ero Copper between CA$20.76 and CA$65.98 per share, highlighting wide differences in outlook. Execution on the updated production guidance remains central to the company’s financial progress, so reviewing the reasoning behind these varied assessments may help clarify your own expectations.

Explore 6 other fair value estimates on Ero Copper - why the stock might be worth 31% less than the current price!

Build Your Own Ero Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ero Copper research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ero Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ero Copper's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ero Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERO

Ero Copper

Engages in the exploration, development, and production of mining projects in Brazil.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives