- Canada

- /

- Metals and Mining

- /

- TSX:ERO

Is Ero Copper Still an Opportunity After Climbing 46.5% in 2025?

Reviewed by Bailey Pemberton

If you have Ero Copper in your portfolio or have been eyeing it for a while, you are probably wondering what comes next. The stock has powered up an impressive 46.5% so far this year, shaking off dips and outperforming broad market benchmarks. Just in the past month, it climbed another 11.4%, despite a small pullback of 0.2% over the last week. While copper prices and broader commodity trends often dominate the headlines, it is actually some recent company-specific developments that are steering Ero Copper’s story right now.

For starters, strategic expansion projects and ongoing operational improvements have caught the market’s attention. Investors are clearly growing more bullish on the company's long-term production outlook, and there is a sense that Ero Copper is positioning itself as a low-cost leader in the sector. Positive updates around mine development and favorable commentary on project timelines have contributed to shifting risk perceptions, making the stock look less speculative and more like a solid growth story.

But what does all this mean for valuation? Is the market getting ahead of itself, or could there be even more upside? Ero Copper currently boasts a value score of 5 out of 6. By most widely used valuation checks, it still appears undervalued. Next, let’s break down which valuation methods make Ero Copper stand out and dig into those numbers. And if you want to know whether these models really tell the whole story, stick around. The best perspective on valuation might surprise you at the end of this article.

Why Ero Copper is lagging behind its peers

Approach 1: Ero Copper Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future free cash flows and discounting them back to today’s dollars. In Ero Copper’s case, recent numbers show last-twelve-months free cash flow was negative, at $-159.7 Million. However, analysts anticipate a strong turnaround, with free cash flow growing every year. By 2029, projections expect Ero Copper to generate $302.8 Million in annual free cash flow. Long-term growth is confirmed by a ten-year outlook, which relies on analyst estimates for the first few years and then extends the trend with more conservative assumptions.

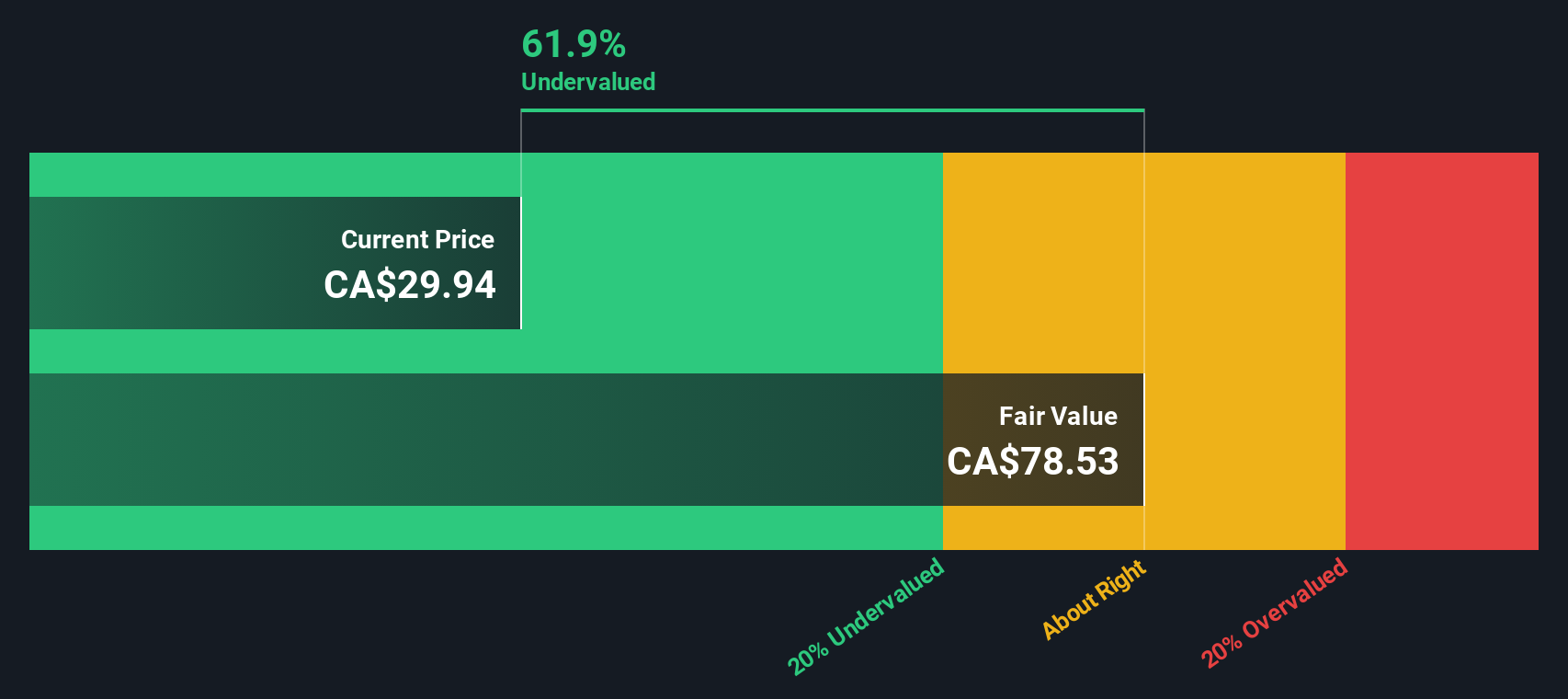

Using these projections, the model calculates an intrinsic value per share of $78.49. This suggests the shares are trading at a significant discount; current pricing implies the stock is 63.1% undervalued versus its DCF-based fair value. The numbers paint a picture of a company with robust potential for cash generation, making its current share price look especially attractive on a long-term basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Ero Copper is undervalued by 63.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Ero Copper Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies, as it directly connects a company’s stock price to its earnings performance. Since Ero Copper is now consistently generating positive profits, using the PE ratio provides a clear snapshot of whether the market is optimistic or cautious about its future growth prospects.

It is important to remember that what counts as a “fair” PE ratio depends on a mix of expectations and risk. A higher PE usually reflects greater confidence in future earnings growth and business stability. Lower numbers can suggest market skepticism or higher perceived risks in the outlook.

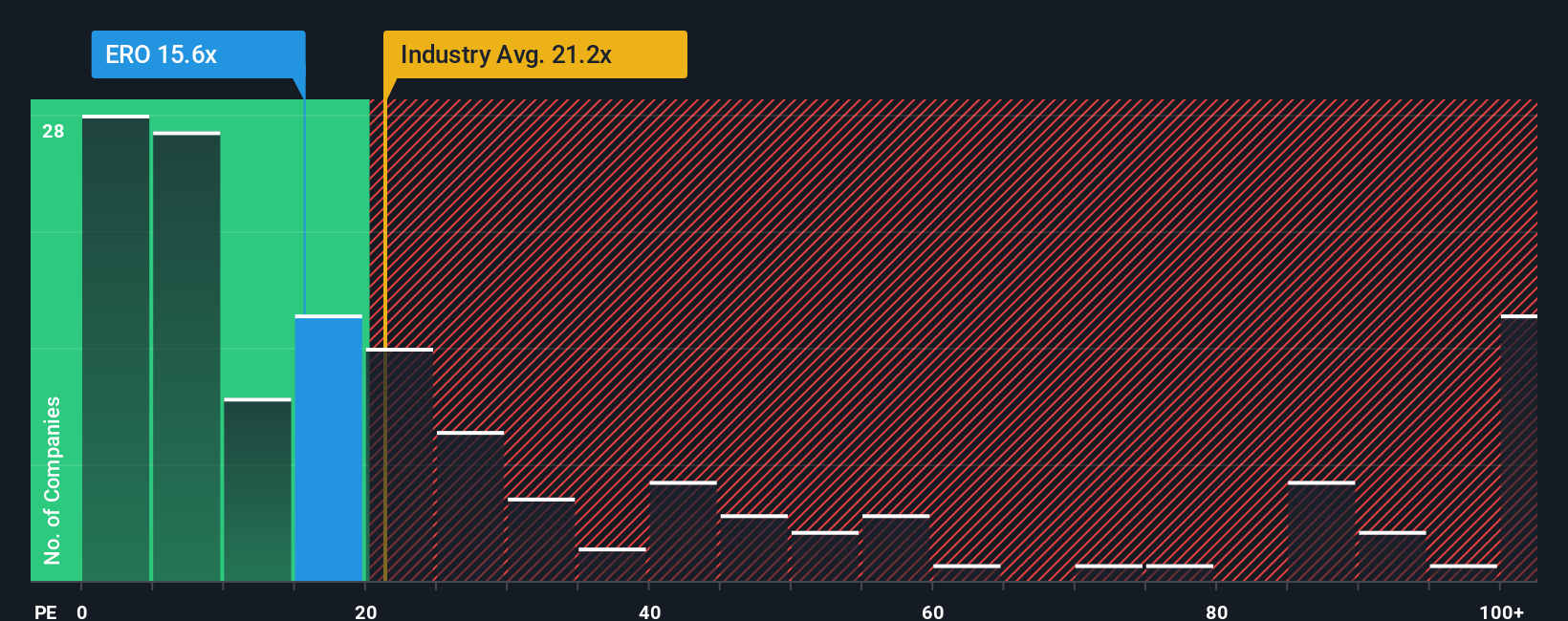

Ero Copper is currently trading at 15.1x earnings. For context, the average metals and mining company in the industry commands a PE of 21.2x, while the average for its direct peers stands even higher at 67.9x. This puts Ero Copper well below both of these benchmarks, potentially pointing to some market caution about its risks or growth relative to competitors.

To provide a more tailored perspective, Simply Wall St calculates a “Fair Ratio” for each company. For Ero Copper, the Fair Ratio comes in at 46.0x. This proprietary metric factors in company-specific details such as growth prospects, profit margins, risk level, industry trends, and market cap, making it a more precise yardstick than simply comparing with industry averages or peers.

With Ero Copper trading significantly below its Fair Ratio, the numbers suggest that the stock is undervalued on a PE basis, even after considering company and industry-specific factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Ero Copper Narrative

Earlier, we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives, a powerful, accessible tool that lets you connect your story about Ero Copper with the numbers behind your investment decisions.

Put simply, a Narrative is your “big picture” perspective, built from your interpretation of Ero Copper’s potential and risks, which you then tie to your estimates for future revenue, profit margins, and a fair value target.

This approach bridges your view of the company’s real-world progress, such as operational upgrades or commodity cycles, to a grounded financial forecast, helping you judge whether the stock is attractively priced right now.

Narratives on Simply Wall St (found on the Community page used by millions of investors) are dynamic and update as soon as new earnings, news, or company events are reported. This means your story and your numbers always reflect the latest information.

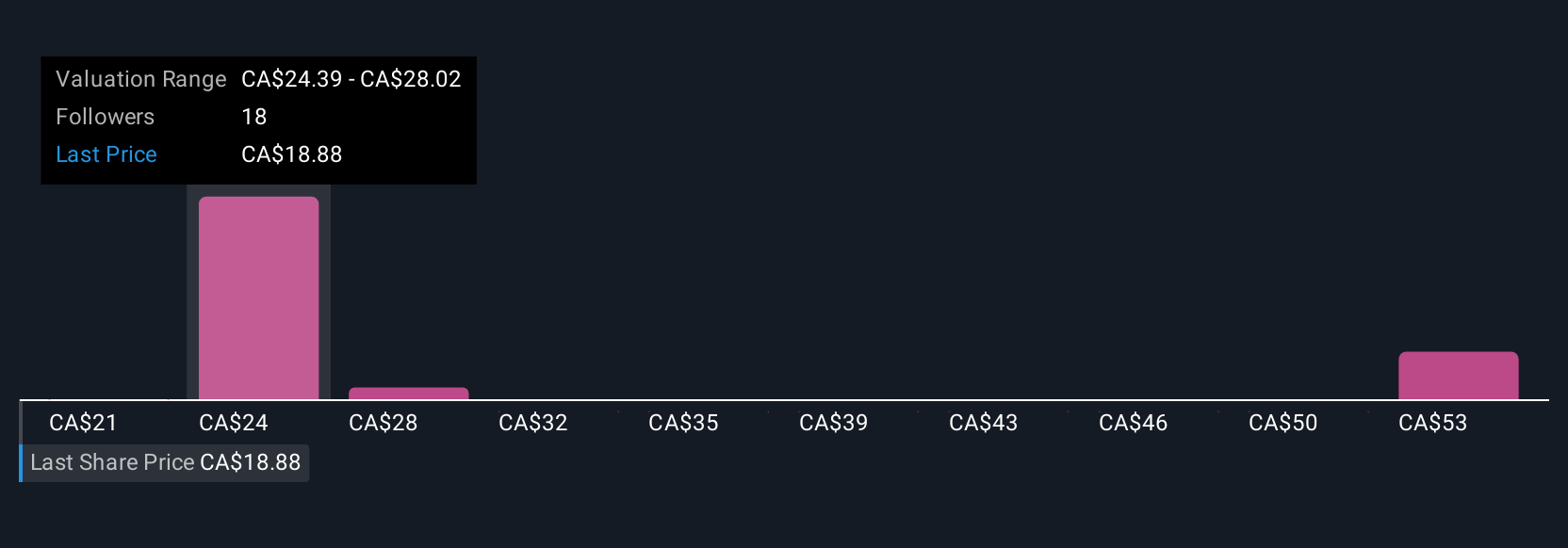

Suppose one investor thinks Ero’s modernization will drive rapid earnings growth and assigns a bullish fair value near C$39, while another sees ongoing risks and estimates just C$22.5. Both viewpoints become Narratives, making it easy for users like you to compare them and decide for yourself when the current share price looks like a buy or a sell.

Do you think there's more to the story for Ero Copper? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ero Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERO

Ero Copper

Engages in the exploration, development, and production of mining projects in Brazil.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives