- Canada

- /

- Metals and Mining

- /

- TSX:ERO

Does Analyst Uncertainty Ahead of Earnings Challenge Ero Copper’s Revenue Momentum Story (TSX:ERO)?

Reviewed by Sasha Jovanovic

- Ero Copper Corp. is set to release its quarterly earnings report for September 2025 on November 4, with expectations for a year-over-year earnings increase driven by higher revenues.

- Recent shifts in analyst sentiment, including a negative Earnings ESP of 15.84%, have introduced uncertainty about the company's ability to meet or exceed these expectations despite a positive sales outlook.

- We'll explore how analyst caution ahead of the upcoming earnings release could shape the current investment narrative for Ero Copper.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ero Copper Investment Narrative Recap

To be a shareholder in Ero Copper, you need to believe in the company’s ability to drive consistent production growth and improve operational efficiency across its Brazilian assets, capitalizing on the rising demand for copper. The upcoming earnings, with analyst caution reflected in a negative Earnings ESP, are a short-term catalyst, but the prevailing risk remains management’s track record of revising production guidance downward, an area this latest news does not appear to materially change.

The completion of Phase 1 drilling at the Furnas Copper-Gold Project, announced in September 2025, stands out for its relevance: strong assay results and the forthcoming new mineral resource estimate could refresh confidence in Ero’s organic growth pipeline. This could become especially important if production targets prove challenging to sustain or if market sentiment over earnings guidance doesn’t improve.

Yet, contrasting recent optimism, investors should be aware of the ongoing risk around production guidance revisions and what this means for...

Read the full narrative on Ero Copper (it's free!)

Ero Copper is expected to reach $996.0 million in revenue and $298.7 million in earnings by 2028. This outlook is based on a projected annual revenue growth rate of 22.9% and an earnings increase of $156 million from the current $142.7 million.

Uncover how Ero Copper's forecasts yield a CA$31.67 fair value, a 6% upside to its current price.

Exploring Other Perspectives

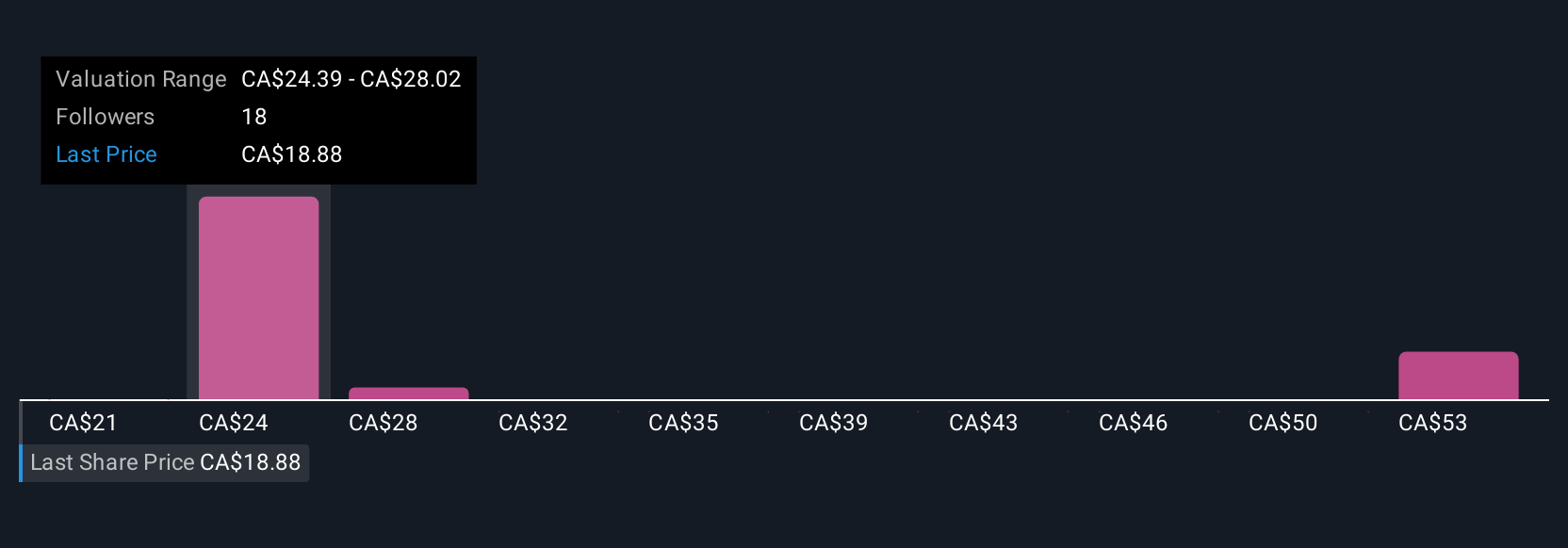

Six Simply Wall St Community contributors estimate Ero Copper’s fair value between CA$20.76 and CA$78.53 per share, highlighting a broad range of opinions. While many see upside tied to improved cost control and production, the risk of unmet guidance remains front of mind for those watching future earnings.

Explore 6 other fair value estimates on Ero Copper - why the stock might be worth over 2x more than the current price!

Build Your Own Ero Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ero Copper research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ero Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ero Copper's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ero Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERO

Ero Copper

Engages in the exploration, development, and production of mining projects in Brazil.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives